Archives of “August 18, 2021” day

rssALERT. EURUSD breaks to new 2021 low and bounces

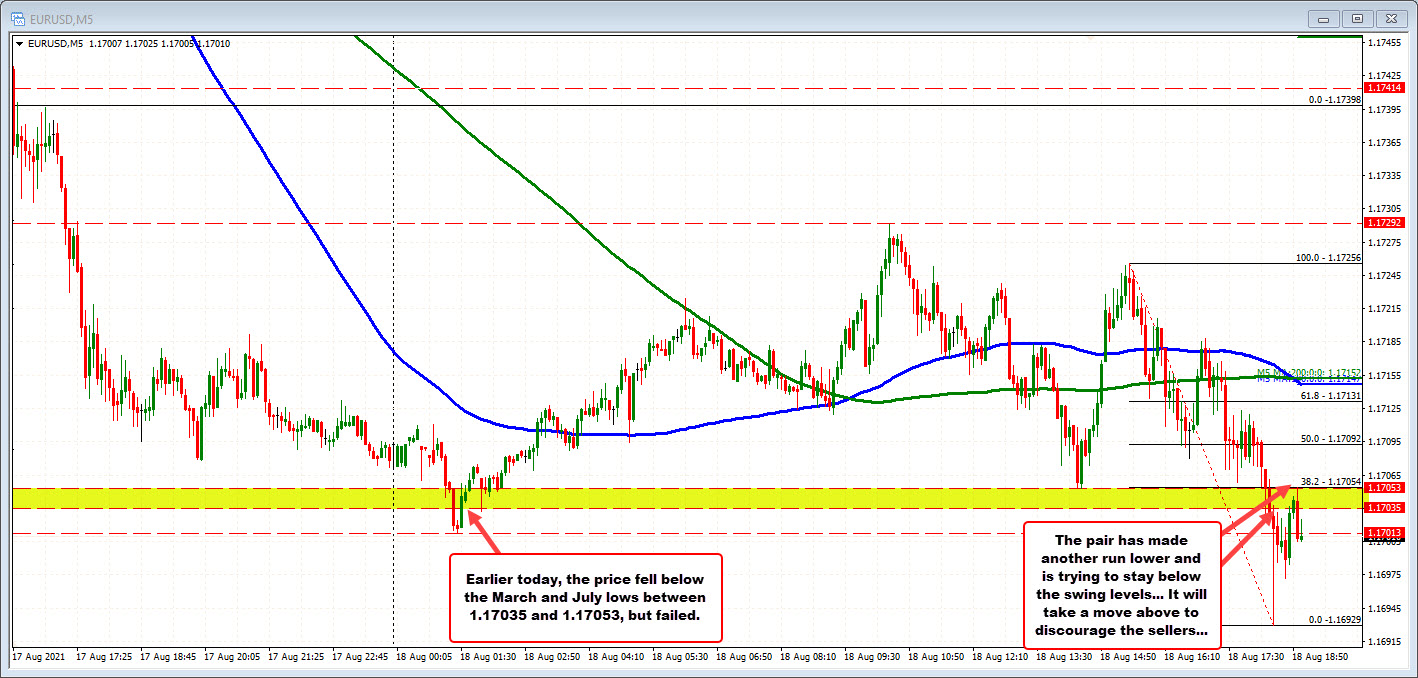

The lows between 1.17013 to 1.17053 was broken and the price scoots to 1.16929

The EURUSD broke below the old lows from March 31 and July between 1.17035 and 1.17053 earlier today, but only to 1.17013 before bouncing higher.

The price then traded between the 1.17054 level and 1.17292 until the last hour or so of trading. The price broke below the swing levels, cracked 1.1700 and moved to a low at 1.16929.

Looking at the five minute chart below, the price has bounced back up to retest the 1.17053 level. The 38.2% retracement of the move down in the New York session was also tested near that level.

We currently trade at 1.1702. The pair sits on an edge.

If the price can stay below 1.17053, the sellers remain in full control intraday. If the price move above that level, there could be more disappointment on the failed break (for the 2nd time today).

European major indices close the day with mixed results

UK’s FTSE 100 and France’s CAC move lower

The major European indices are closing the day with mixed results. The UK FTSE 100 and the France’s CAC moved lower while the German, Italian and Spanish indices all closed higher:

- German DAX, +0.3%

- France’s CAC, -0.7%

- UK’s FTSE 100, -0.3%

- Spain’s Ibex +1.1%

- Italy’s FTSE MIB +0.5%

in other markets as European traders look to exit:

- Spot gold is trading down $4.64 or -0.26% at $1781.25

- Spot Silver is trading down $0.25 or -1.05% at $23.39

- WTI crude oil futures are down $0.28 or -0.42% at $66.27

- Bitcoin is trading up $700 and $45,393

in the US debt market, the yields are higher ahead of the 20 year auction at 1 PM ET. The 10 yield is up 2.2 basis point on the day while the 30 year is up 1.1 basis point.

What are Americans spending on tech?

Everlasting skills

How to kill a big idea?

Central bank speakers

Central bank speeches

This post is for those just starting out and getting their heads around central bank speakers. Recently, the USD has been particularly sensitive to changing views by board members, so

Trading, especially intra-day trading, has many different skill sets required to learn. One of those skills is the skill of trading central bank speakers. So, this article will give you a brief outline of how to trade central back speakers

Central banks are in charge of the monetary policy for their country. So, the Federal Reserve is the central bank for the United States. Now a number of people are responsible for ultimately making the decision about whether interest rates are going to rise, fall, or stay the same. Now leading up to central bank meetings it is widely known what each individual central speaker thinks regarding the coming monetary policy decision. For speed of analysis the central bank speakers are given one of three labels. They are either hawkish(looking to hike rates), bearish (looking to cut rates), or neutral (looking to keep rates unchanged). It is the sum of all these individuals

The trade is in the change

Now the market prices in somewhat each of the views of the central bank speakers. So, the opportunity comes from the shift in views. To help you understand this think of this silly example. Imagine that your friend only drinks hot water. Every time you have a meal together they order hot water. At your house, they have hot water. They always have hot water.

Japan July trade surplus 441B vs 202.3B expected

Japanese trade balance data for July 2021:

- Exports y/y 37.0% vs 39.0% expected

- Imports y/y 28.5% vs 35.1% expected

A trade surplus is generally good but when it comes on lower-than-expected exports combined with even-lower than expected imports, then it’s not a sign of underlying strength in the economy.

Seasonally adjusted imports were down 1.6% m/m and exports were flat.

US June machinery orders -1.5% m/m vs -2.8% expected

Japan June 2021 machinery orders:

- Prior was +7.8% m/m

- Machinery orders y/y 18.6% vs 15.8% expected

- Prior y/y machinery orders +12.2%

The previous reading fell well short of expectations despite a jump in exports to China.

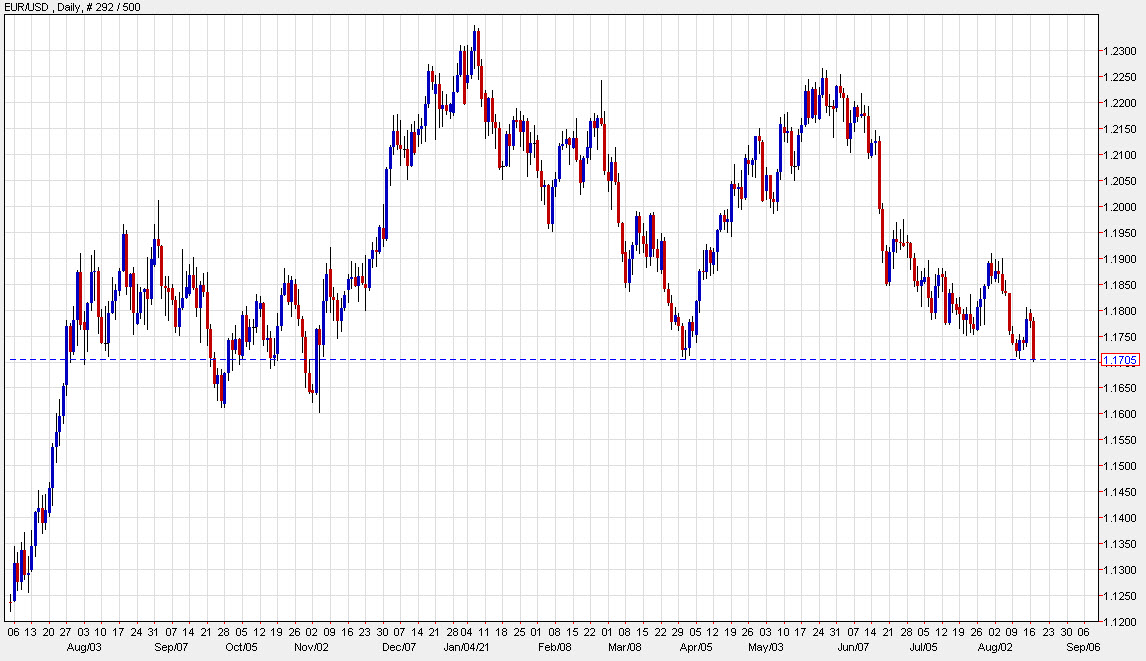

Euro threatens 1.1700 in potential fall to the lowest since November

Big support level broken

EUR/USD is a handful of pips away from the March low of 1.1704 and the key 1.1700 level. That’s a level that’s been defended twice before and is the lowest since just before Biden was elected.