German Dax down for the second consecutive day

The European shares are closing mostly lower. the one exception is the UK FTSE 100 which is closing up marginally.

The provisional closes are showing:

- German DAX, -0.1%

- France’s CAC, -0.3%

- UK’s FTSE 100, +0.3%

- Spain’s Ibex, -0.65%

- Italy’s FTSE MIB, -0.8%

Looking at other markets as London/European traders look to exit:

- Spot gold is trading down five dollars or -0.28% at $1782.

- Spot silver is trading down $0.20 or -0.86% at $23.63

- WTI crude oil is trading up $0.19 or 0.28% at $67.58

- The price of bitcoin is trading down 100 dollars at $45,830

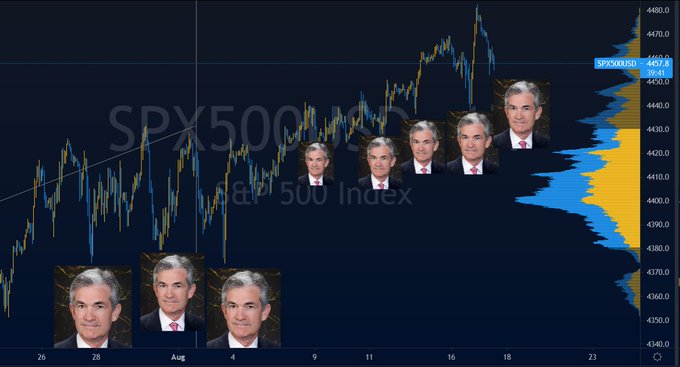

In the US stock market, the major indices are all trading lower with the NASDAQ index had the hardest:

- Dow -261 points or -0.73% at 35363

- S&P index -28.63 points or -0.64% at 4451.24

- NASDAQ index -140 points or -0.95% at 14652.94

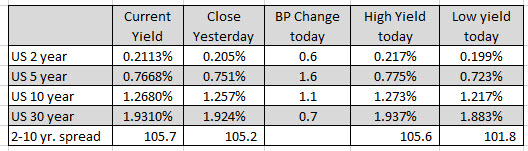

In the US debt market, yields are higher after starting the New York session negative. The 10 year yield is currently trading at 1.268% (up 1.1 basis point).