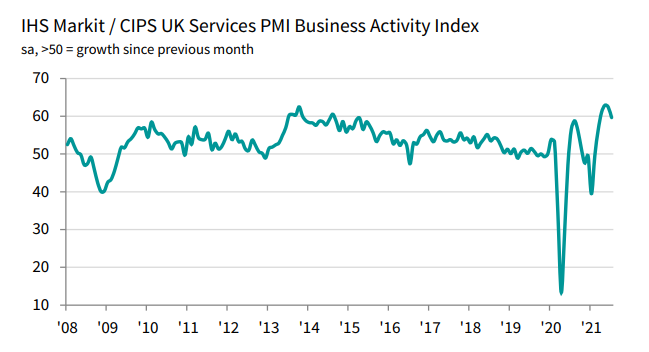

Latest data released by Markit/CIPS – 4 August 2021

- Composite PMI 59.2 vs 57.7 prelim

“July data illustrates that recovery speed across the UK economy has slowed in comparison to the second quarter of 2021. More businesses are experiencing growth constraints from supply shortages of labour and materials, while on the demand side we’ve already seen the peak phase of pent up consumer spending.

“The full easing of pandemic restrictions appears to have helped limit the overall loss of momentum towards the end of July. At 59.6, the PMI reading for services output was much stronger than our earlier ‘flash’ figure of 57.8 in July, largely due to the final index covering an extra five working days since ‘freedom day’.

“Any re-acceleration of growth in August looks unlikely, however, as new orders increased at a much-reduced pace at the start of the third quarter. Moreover, business expectations softened again during July, with UK firms the least optimistic about the growth outlook since January. Survey respondents cited worries about recruiting staff to meet business expansion plans and some suggested that escalating costs would hinder the recovery.”