Archives of “May 2021” month

rssCoronavirus- Japan to extend state of emergency and add further prefectures

The current state of emergency in effect for Tokyo, Osaka, Kyoto and Hyogo will be extended to May 31

Aichi and Fukuoka prefectures will be added to state of emergency declarations

Japan’s economy minister Nishimura says the government will seek the extension and additions. He is trying to soften the blow of further restrictions in Japan.

- He will continue with the request that bars, karaoke venues serving alcohol, will stay closed.

- Ask people to continue to avoid unnecessary trips outside

The vaccination rollout in Japan is one of the developed world’s slowest.

Futures – The CME has lowered margins for gold, silver, platinum

Chicago Mercantile Exchange Group has lowered initial and maintenance Performance Bonds (margins) for

- COMEX 100 GOLD FUTURES (GC)

- E-MINI GOLD FUTURES (QO)

- COMEX 5000 SILVER FUTURES (SI)

- COMEX MINY SILVER FUTURES (QI)

- PLATINUM FUTURES NYMEX (PL)

and other contracts but highlighting those above here.

New bond requirements will be effective after the close of business on Friday, May 7, 2021.

ICYMI – Australian government backs down from its 5 year jail threat for arrivals from India

Due to the exponential surge in COVID-19 cases in India the Australian government placed a temporary ban on flights from the country.

A defensible public health precaation that was unfortunately accompanied by a disgusting and disgraceful threat to jail anyone arriving from the country for 5 years, along with a heavy monetary fine. The jail threat applied to anyone arriving from India, including Australian citizens wanting to return home.

Overnight the Australian government backed down on this act of malice, removing the threats.

Flights from India will reopen from May 15 and passengers will not be thrown into the slammer.

The Australian Prime Minister Scott Morrison:

ICYMI – Goldman Sachs offers bitcoin derivatives to investors

Bitcoin price dependent derivatives according to Reuters with the news (citing Bloomberg)

- A bitcoin price-linked non-deliverable forward (ie. cash settled)

GS to hedge/trade the exposures it has with its customers for the product with Bitcoin futures in block trades. BTC futures trading on the CME.

BTC update:

The Dow industrial average closes at another record high

NASDAQ snaps four days losing streak.

The US stocks rallied into the close with the Dow ending the session at a new record and at the highs of the day. The index is closing up 315.76 points for the fourth higher close in as many days. The NASDAQ index is also closing higher for the first time in five trading days.

A snapshot of the final numbers are showing:

- Dow industrial average rose 318.19 points or 0.93% at 34548.53. The high reached 34561.29

- S&P index rose 33.51 points or 0.8% at 4201.10. The high reached 4202.80

- Nasdaq index closed up 50.42 points or 0.37% at 13632.84. The high reached 13635.74

The Russell index eked out a tiny gain by closing up 0.05 points or 0.002% at 2241.42.

At the lows:

- Dow was down -45.28 points or -0.13%

- S&P was down -20.09 points or -0.48%

- Nasdaq was down -143.03 points or -1.05%

- Russell 2000 index traded down -42.37 points or -1.89%

The major indices snatch victory from the jaws of defeat today. Tomorrow the nonfarm payroll report (and other employment statistics) will be released at 8:30 AM ET.

Thought For A Day

European shares ending the session mixed

UK FTSE 100 rises. German DAX, France’s CAC near unchanged

The major European indices are ending the session mixed.

They snapshot of the provisional closes shows:

- German DAX, unchanged

- France’s CAC, +0.1%

- UK’s FTSE 100, +0.3%

- Spain’s Ibex, -0.1%

- Italy’s FTSE MIB, -0.1%

in other markets as European traders look to exit:

- Spot gold is surging by about $30 a 1.67% and is back above the $1800 level at $1816.70

- SPot silver is up $0.95 for 3.59% at $27.44

- WTI crude futures are down $0.48 a -0.73% at $65.15

- Bitcoin is up $200 or 0.38% at $57100

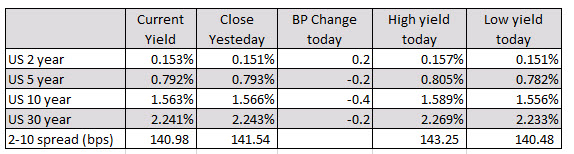

In the US debt market, yields are fluctuating above and below unchanged. The current yields are marginally lower on the day:

The price action in the forex market has seen mixed price action.

The CAD is now the strongest of the majors as the USDCAD continues its move to the downside and traded to the the lowest level since September 2017 (broke the 2018 low at 1.2245 today). The GBP is now the weakest of the majors. The USD is still mostly lower with the controversial the major currencies with the exception of the GBP now.

When earnings week goes from something you look forward to, to something you don’t

A couple of takeaways from the BOE May monetary policy meeting

The BOE starts off with a bit of a technical taper, if you want to call it that

You can call it algos. You can call it a bit of a messy release with some separation between the statement and the monetary policy minutes/report. But at the end of it, the pound looks destined for a brighter outlook when all is said and done.

The pound went for a bit of a messy ride on the BOE decision earlier but has now held steady and is keeping a little higher than before the announcement.

Here are some key takeaways from the decision:

BOE slows down QE purchases

This was the key passage that helped to reverse most of the downside action in the pound: