UK FTSE 100 rises. German DAX, France’s CAC near unchanged

The major European indices are ending the session mixed.

They snapshot of the provisional closes shows:

- German DAX, unchanged

- France’s CAC, +0.1%

- UK’s FTSE 100, +0.3%

- Spain’s Ibex, -0.1%

- Italy’s FTSE MIB, -0.1%

in other markets as European traders look to exit:

- Spot gold is surging by about $30 a 1.67% and is back above the $1800 level at $1816.70

- SPot silver is up $0.95 for 3.59% at $27.44

- WTI crude futures are down $0.48 a -0.73% at $65.15

- Bitcoin is up $200 or 0.38% at $57100

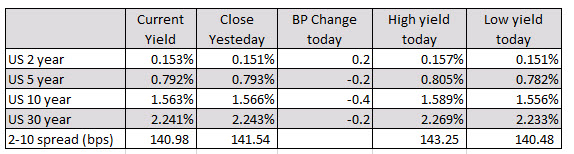

In the US debt market, yields are fluctuating above and below unchanged. The current yields are marginally lower on the day:

The price action in the forex market has seen mixed price action.

The CAD is now the strongest of the majors as the USDCAD continues its move to the downside and traded to the the lowest level since September 2017 (broke the 2018 low at 1.2245 today). The GBP is now the weakest of the majors. The USD is still mostly lower with the controversial the major currencies with the exception of the GBP now.