Thought For A Day

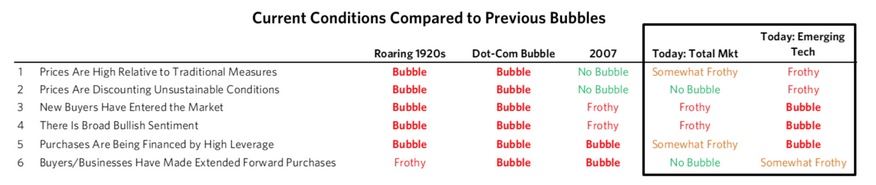

“What one chooses to do with this is a tactical decision. Even if this gauge is perfectly accurate (which it is not) timing tops and bottoms based on it is precarious because while it shows what neighborhood these stocks are in, there is nothing precise about it. So it is tough to pick the levels and timing of tops and bottoms based on it. Having said that, we have found that it is a pretty good predictor of relative performance of stocks over the subsequent three to five years. As a result, while it contributes to our increasingly favoring non-bubble stocks, we need to combine it with timing indicators.”

I expect Dalio is looking at markets outside the US where valuations are much cheaper or within the value space in the US.

Italian stocks bought the Draghi rumour but are selling the fact.