Archives of “February 2021” month

rssWhere is the US dollar heading?

What is the dollar outlook at the moment?

The US dollar made a good start in 2021 after a sharp fall in 2020, but January’s bounce, driven by profit-taking and optimism of faster economic recovery, was short-lived.

The Dollar Index which measures the performance of the dollar against six major currencies – was in a steep downtrend during most of 2020, falling around 7% during the year and hitting the lowest in nearly three years.

The greenback spiked during the March crisis as investors rushed into the traditional safe-haven asset due to high uncertainty, but massive Central Bank support and prospects of coronavirus vaccine reversed the trend and sent the dollar sharply lower.

In comparison to the 2007/2009 recession when the dollar made wild gyrations, the action in 2020 was milder, due to the global crisis caused by the pandemic and similar policies of Central Banks and governments that include massive fiscal supports and ultra-low interest rates.

The main factors that influence US dollar performance

Interest rates

The US Federal Reserve is expected to keep interest rates at record lows and continue asset purchases as the Central Bank made a shift in its policy in 2020, signaling that the interest rates will start to rise only when inflation makes a significant move and rises to a 2% target zone and until labor market conditions return to levels consistent with the Fed’s assessment of maximum employment.

According to the Central Bank’s forward guidance, the downward pressure on longer-term rates is expected to persist and ultra-loose policy to stay in place until at least early 2023 that keeps grim outlook for the dollar. (more…)

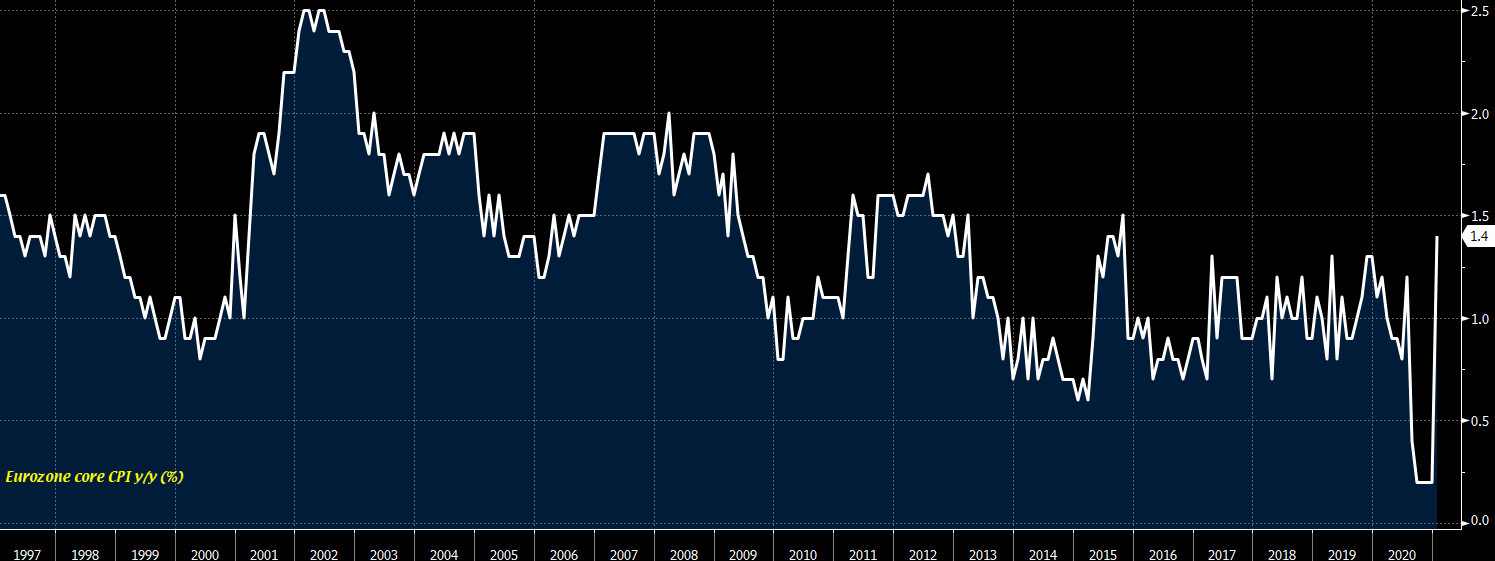

Eurozone January final core CPI +1.4% vs +1.4% y/y prelim

Latest data released by Eurostat – 23 February 2021

- CPI +0.9% vs +0.9% y/y prelim

The preliminary report can be found here. No change to initial estimates as this reaffirms a bounce in inflation figures to start the year.

That said, it needs to be put into context as the German VAT changes and CO2 tax introduction has played a key role in inflating the numbers to start the new year.

10-year German bond yields erase Lagarde drop

The bond market remains unperturbed for the time being

10-year bund yields are up by over 5 bps to -0.30% today and that pretty much cancels out the drop from yesterday after Lagarde’s remarks here.

This is going to be one long and drawn out battle between central banksters and the market in the next year or so and we are only at the beginning.

I would argue that policymakers also don’t see much need to really step in with sterner intervention, as they have reaffirmed that any talk of inflation – or at least sustained inflation – is still a long ways to go.

So, the market will do what it wants to do for now. But we’ll see how much is too much if it risks upsetting the status quo.

Who made this? #Bitcoin

OPEC+ meet next week -oil market chatter is of a potential Saudi / Russia clash on output curbs

OPEC+ meets next on March 4. The two questions occupying the oil market are:

- whether Saudi Arabia scales back its 1 million bbl/d voluntary cut (which is due to end next month)

- and whether there will be an additional increase in supply from the whole group

Recently, Russian Deputy PM Novak expressed support for a gradual increase in oil output, which comes as demand is seen improving as COVID-19 vaccines are rolled out.

Saudi Arabia is said to want to maintain output pretty much around the current level.

Any agreement to boost supply would take effect from the following month, April, most likely.

Morgan Stanley bumps its oil price forecast higher, Q2 WTI now projected at US$62.50 (from 52.50)

Morgan Stanley have revised higher their forecasts for WTI oil prices:

- Q2 2021 to USD 62.50/bbl from USD 52.50

- Q3 to USD 67.50/bbl from USD 57.50

- Q4 to USD 62.50/bbl from USD 57.50

Brent:

- Q2 2021 to USD 65/bbl from USD 55

- Q3 to USD 70/bbl from USD 60

- Q4 to USD 65/bbl from USD 60

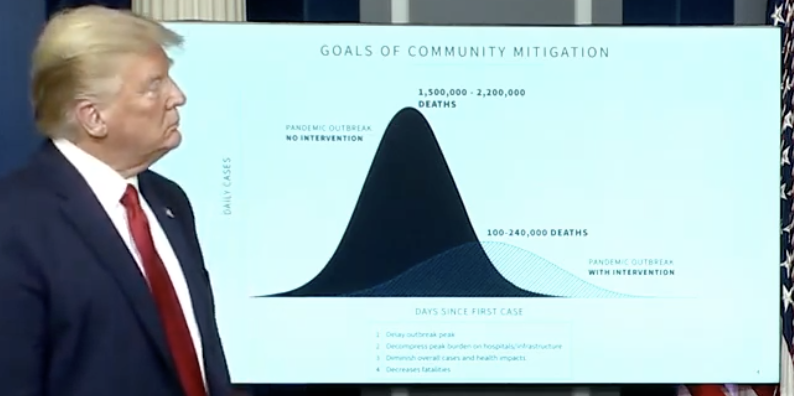

Another grim milestone passed, US COVID-19 deaths climb above half a million

Johns Hopkins data

US President Biden warned weeks ago the toll would eventually rise to 600K

Previous US President Trump outlined other, even worse, scenarios:

Oil gains nearly 4%. A look at spec positioning

Crude prices sizzle again

Two days of oil selling late last week on OPEC+ and Iran worries were met with a wave of buying today on broad commodity buying, a bullish Goldman call and Iran signaling it won’t give up ground in the nuclear deal.

The chart itself has overrun but the recent consolidations around $47 and $53 show the buying appetite and today’s quick rebound is impressive. My read is that enthusiasm also isn’t high because there’s so much fear and skepticism around the future of oil.

Specs in the CFTC report are long but if you look at it historically, it’s not a red flag and argues that there’s plenty of more room for buying on that side.

US equities claw back loses but tech continues to lag

S&P 500 pares loses

It’s increasingly difficult to talk about ‘the US equity market’ without splitting up the parts.

Today we have:

- DJIA +0.4%

- Russell 200 +0.3%

- S&P 500 -0.2%

- Nasdaq -1.4%

Those are four very different stories and reflect a tech sector that looks like a leveraged bond bet.

It also reflects a market that’s struggling to cop with higher yields that aren’t exactly ‘high’ by any historical measure.

I generally look to the S&P 500 as ‘the US market’ and that’s always over-simplified but moreso now than any time I can remember.