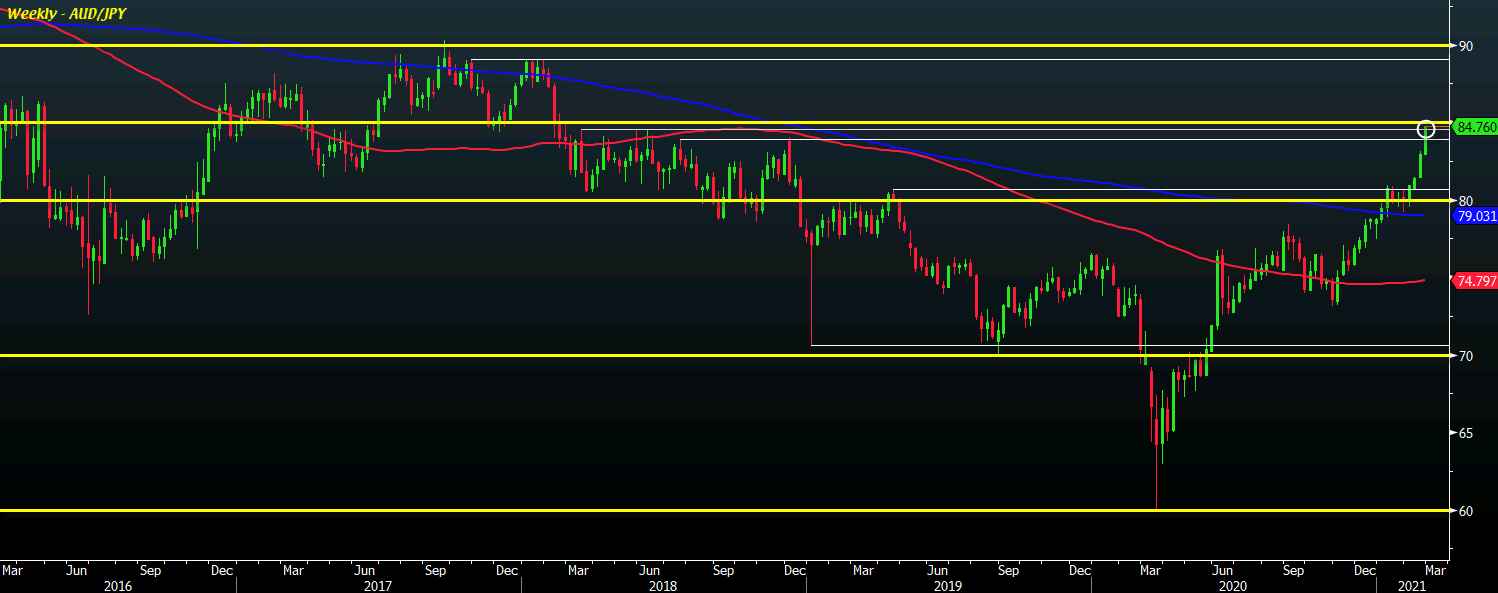

The aussie has hit the key milestone, what’s next?

AUD/USD is extending gains on the day as the dollar remains pressured, with the pair now touching above 0.8000 for the first time since 2 February 2018.

This is one that has been coming since the latter stages of last year but I would argue that it is playing out in a much quicker timeframe than I would have anticipated.

Granted, the commodities rally and latest round of dollar weakness is part and parcel contributing to the surge higher since the end of last week but this has been a truly remarkable recovery in AUD/USD from the depths of the pandemic lows last year.

As price hits the key milestone, it puts into focus the 2017 and 2018 highs around 0.8125-36 – at least from a technical perspective.

However, now that we’re here, I would argue that the RBA will be more actively watching price levels and verbally intervening moving forward.

That said, I’m quite doubtful of their abilities to pin down the currency so long as the market landscape and fundamentals continue to play out as they have in recent months.

Adding to that is the fact that the Fed put will continue to keep the dollar pressured to the downside in the bigger picture.

Despite already reaching such levels early on in the year, it is tough to fight the market momentum if the focus continues to be on reflation (bolstering commodities) and a global economic reopening (better for riskier currencies).

As such, gains may be more bumpy from hereon if the RBA decides to make known their dissatisfaction with price levels but if equities carry on with the party and the global economic outlook continues to improve, we may be targeting 0.8500 next.

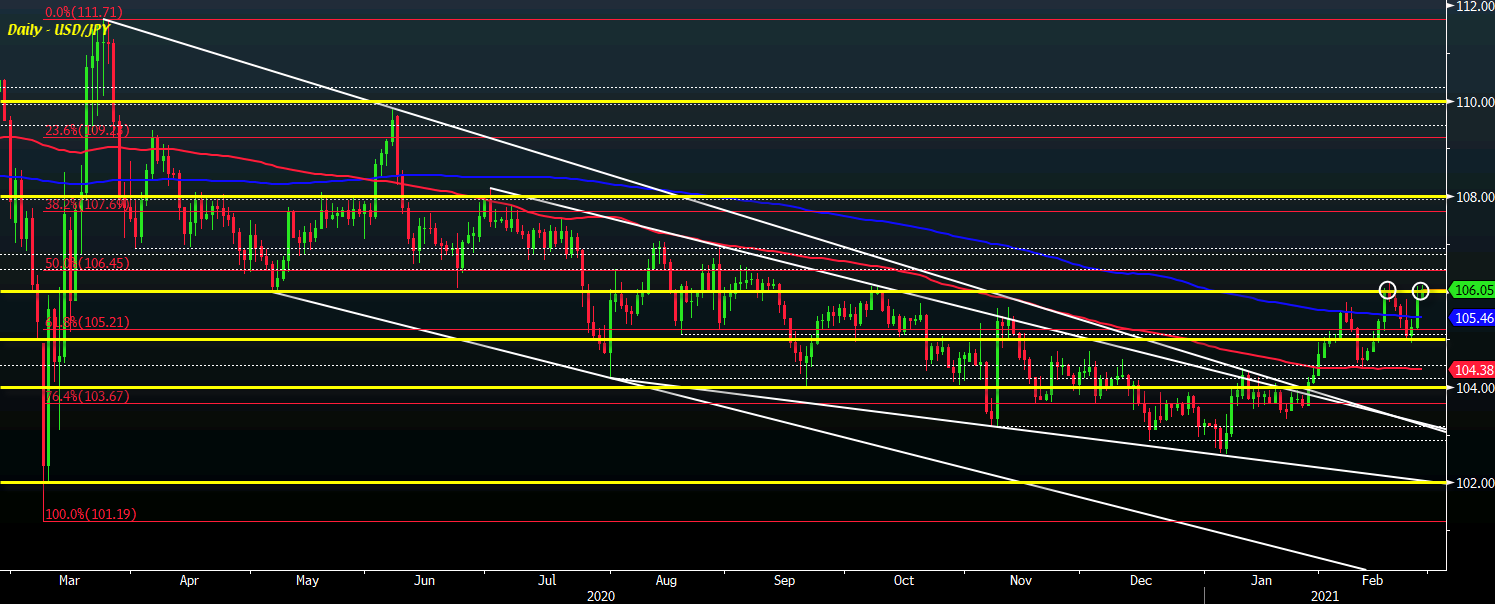

Going back to the technicals, just take note that the 200-month moving average sits @ 0.8256 as well. But price looks set for a first monthly close above the 100-month moving average – which sits @ 0.7860 – since August 2014.