Archives of “February 2021” month

rssHere’s one for your wall – just change that year (the original referenced 1917) to any year that you scored big profits – the rules never change!

Nikkei 225 closes higher by 0.97% at 28,362.17

A positive day for Asian equities

Broader market sentiment is continuing to exude more calm as the retail trading frenzy starts to show signs of settling down, with the VIX receding as well.

The Hang Seng is up 1.5% while the Shanghai Composite is up 0.6% on the day, with S&P 500 futures seen up by 0.5% as we look towards European trading.

The mood is pinning the dollar slightly on the softer side but nothing that stands out too much for the time being. NZD/USD is up 0.3% as buyers push above its 100-hour moving average @ 0.7173 and look towards its 200-hour moving average @ 0.7188.

RBA leaves policy unchanged, as expected.

Reserve Bank of Australia February 2021 monetary policy announcement and Governor Lowe’s statement

- The Board decided to maintain the targets of 10 basis points for the cash rate and the yield on the 3-year Australian Government bond,

- as well as the parameters of the Term Funding Facility.

- It also decided to purchase an additional $100 billion of bonds

More QE from the RBA but policy rates left untouched (as expected). More QE is significant, the Bank had been expected to announce this, but perhaps at a later date. The extra purchasing will begin in April.

CME futures exchange has raised the margin on silver futures by 18%

The Chicago Mercantile Exchange has ramped up the Comex XAG margin

In response to the spike in volatility.

SI futures maintenance margins raised by 17.8%

- to $16,500 per contract (from $14,000)

US CFTC is “closely monitoring recent activity in the silver markets”

Commodity Futures Trading Commission statement

- Commission is “communicating with fellow regulators, the exchanges, and stakeholders to address any potential threats to the integrity of the derivatives markets for silver, and remains vigilant in surveilling these markets for fraud and manipulation.”

In response to the price spike over recent days:

The rise in price has been driven by chatter the WSB folks are lining up a run on silver shorts similar to that on GME. Hmmmm …. good luck with that.

US broad market indices close with big gains

S&P and NASDAQ close near session highs

The US broader market indices are closing with big gains led by the NASDAQ index.

- Both the S&P and NASDAQ close near highs for the day

- Russell 2000 broke a 5 day losing streak

- All sectors of the S&P closed higher today

a look at the final numbers shows:

- S&P index rose 59.61 points or 1.6% at 3773.83. The high price reached 3784.32. The low was at 3725.62

- NASDAQ index rose 332.70 points or 2.55% to 13403.39. The high price reached 13431.45. The low extended to 13132.47

- Dow rose 229.75 points or 0.77% to 30212.37. The high price reached 30335.91. The low extended to 30014.97

Some big winners today include:

- Novavax, +21.34%

- GoodRx, +7.21%

- Tesla, +5.89%

- Tencent, +4.89%

- Alcoa, +4.39%

- Alibaba, +4.31%

- Amazon, +4.21%

- Blackberry, +3.69%

- Alphabet, +3.61%

- Broadcom, +3.60%

- Hoover +3.53%

- Charles Schwab, +3.49%

- Qualcomm +3.44%

- Intuit, +3.3%

- Microsoft, +3.29%

The meme stocks did not do well today and led the declines:

- Koss, -45.47%

- Gamestop, -30.77%

- Express, -16.67%

- Bed Bath and Beyond, -14.12%

Other losers:

- Rite Aid, -10.5%

- DuPont, -7.95%

- Rackspace, -7.05%

- Palantir, -3.55%

- Walgreens, -2.83%

- American airlines -1.92%

- Airnbnb, -1.72%

- Corsair, -1.51%

Thought For A Day

You can pencil in at least $1000 for direct checks in US stimulus package

GOP proposal includes $1000

10 US Republicans Senators are out with an alternative proposal to Biden’s $1.9 trillion stimulus. The price tag is $618B and includes:

- $160B for direct pandemic response, $132B for UI

- $20B for child care, $20B for schools

- $50B for small businesses

- $220B for direct payments ($1,000)

- $12B for nutrition

- $4B for mental health service

One thing that isn’t included is $15/h minimum wage, which isn’t a surprise.

If Democrats want a bi-partisan package, this is basically the starting point so you would expect it to go up.

I get the sense that Democrats are planning on using reconciliation anyway and bypassing Republicans but politics is a tough thing to predict. With this though, you can feel secure that more money is coming (and probably headed straight into call options in meme stocks).

More details:

Risk appetite keeps in a better spot so far in European morning trade

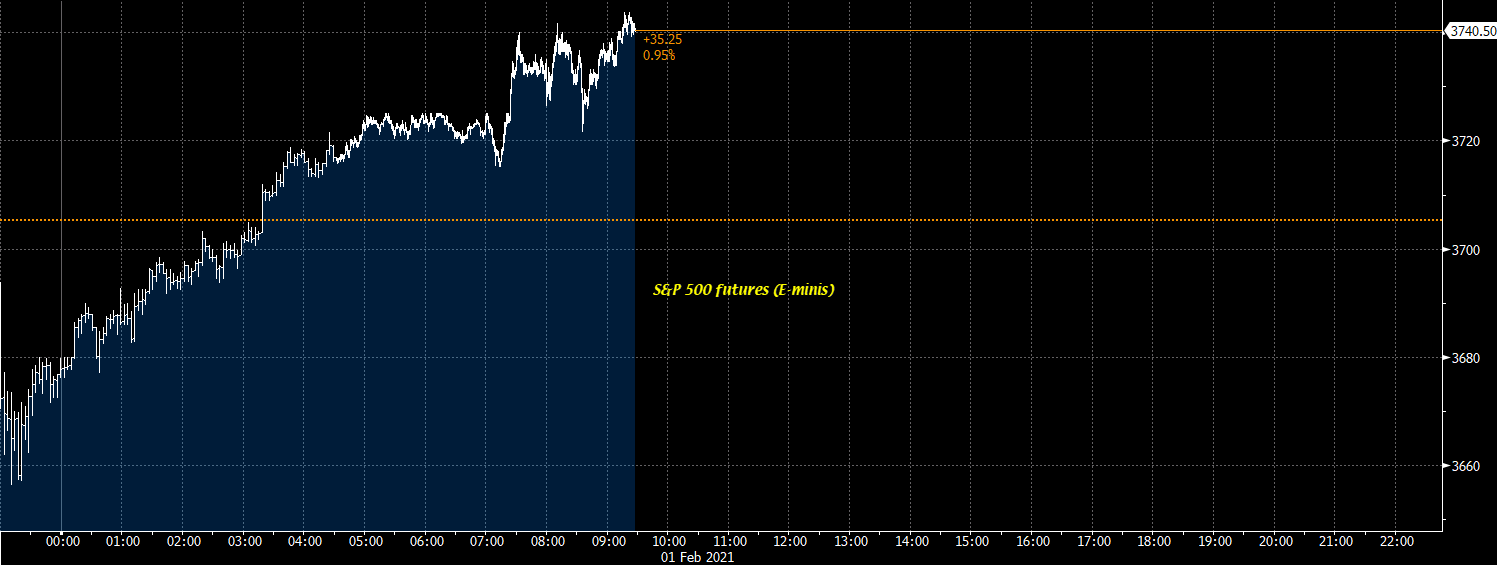

S&P 500 futures are up 1% after being down 1% in the early stages today

Risk appetite continues to show signs of a bounce back after Friday’s rout, with European indices holding around 1% gains – mirroring the mood in US futures.

Things started off poorly early in Asia but S&P 500 futures have gradually advanced and turned around a 1% drop to a 1% gain as of European trading now.

The chaos from the retail trading frenzy played a role in elevating volatility and impacting broader market sentiment but that is calming down a little now as the focus shifts towards silver instead – which is up over 10% at $29.82 currently.

That sets up Wall Street for a modest bounce at the open but we’ll have to wait and see if that will be the case as we get things started on the new week.