Thought For A Day

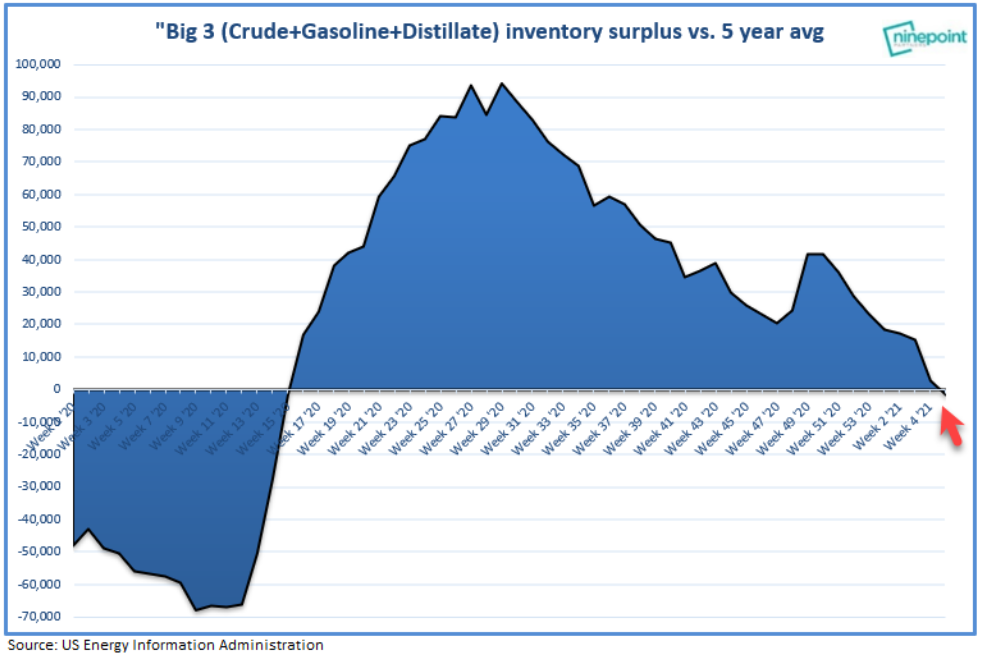

“I want to be long oil and hang on for the ride,” Goldman’s Jeff Currie said in an interview with S&P Global Platts on Feb. 5, warning “there is a lot of upside here.”

“Is it back to $150/b? I don’t know… as it is a macro repricing we are talking about and everything needs to reprice.”

How does that sound? While oil itself and CAD, RUB or NOK would be good bets on crude, oil company shares remain extremely depressed.

The greenback is higher across the board in European morning trade and is starting to run against some key levels on the charts today.