Treasury yields near the highs of the day

I like the valuation of UK stocks but that chart looks like a messy head-and-shoulders and that uptrend from the Nov low looks vulnerable.

The forced sellers are investors in the $7 trillion mortgage-backed bond market. Their problem is that when Treasury yields — which strongly influence home-loan rates — suddenly rise sharply, many Americans lose interest in refinancing their old mortgages. A reduced stream of refinancings means mortgage-bond investors are left waiting for longer to collect payments on their investments. The longer the wait, the more financial pain they feel as they watch market rates climb higher without being able to take advantage of them.

Their answer: unload the Treasury bonds they hold with long maturities or adjust derivatives positions — a phenomenon known as convexity hedging — to compensate for the unexpected jump in duration on their mortgage portfolios. The extra selling just as the market is already weakening has a history of exacerbating upward moves in Treasury yields — including during major “convexity events” in 1994 and 2003.

On top of that, the soft auction and strong (inadvertent) dealer takedown led to some dumping of Treasuries in the belly.

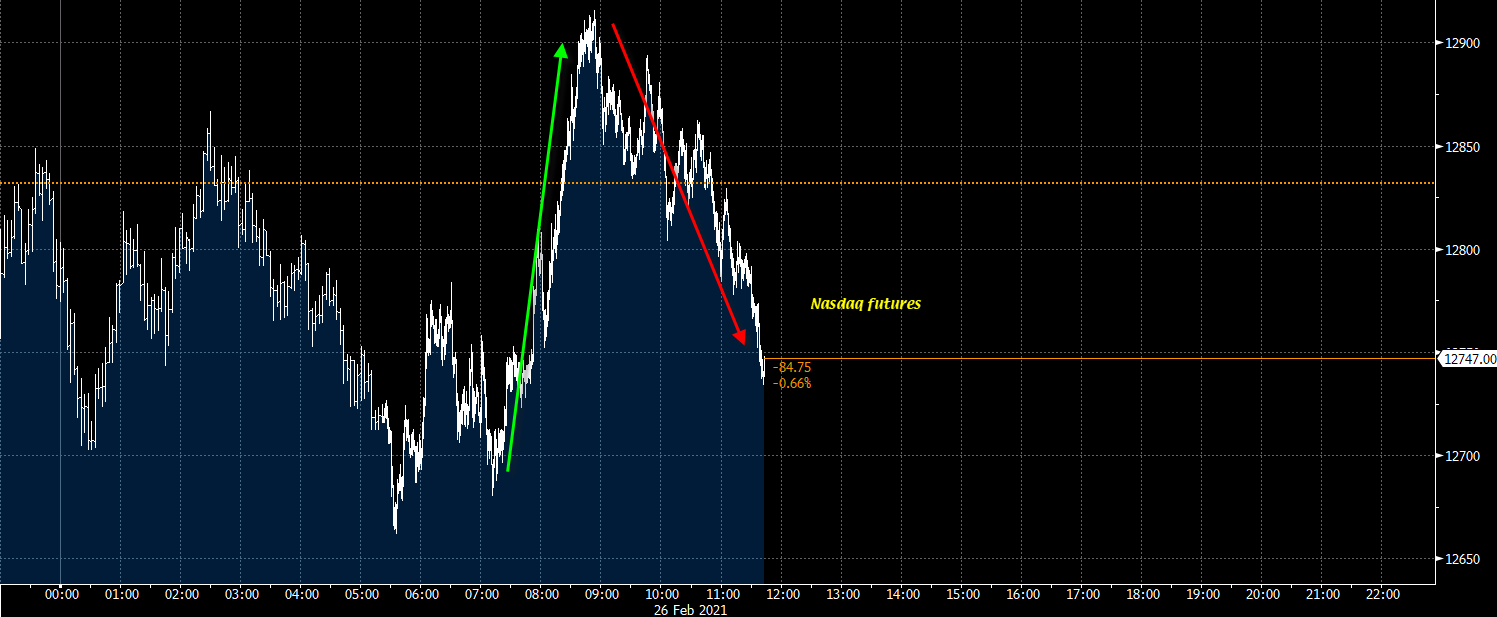

S&P 500 futures have turned lower, down by 0.5%, while Nasdaq futures have also pared its earlier advance (following a turnaround) to be down 0.7%.

The Japanese central bank bought ¥5 million worth of ETFs today amid the 4% drop in the Nikkei, showing some signs that they may be more flexible with ETF purchases.