What is the dollar outlook at the moment?

The US dollar made a good start in 2021 after a sharp fall in 2020, but January’s bounce, driven by profit-taking and optimism of faster economic recovery, was short-lived.

The Dollar Index which measures the performance of the dollar against six major currencies – was in a steep downtrend during most of 2020, falling around 7% during the year and hitting the lowest in nearly three years.

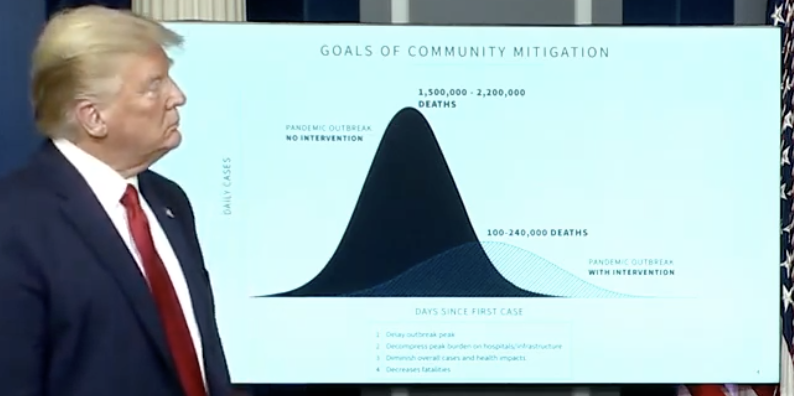

The greenback spiked during the March crisis as investors rushed into the traditional safe-haven asset due to high uncertainty, but massive Central Bank support and prospects of coronavirus vaccine reversed the trend and sent the dollar sharply lower.

In comparison to the 2007/2009 recession when the dollar made wild gyrations, the action in 2020 was milder, due to the global crisis caused by the pandemic and similar policies of Central Banks and governments that include massive fiscal supports and ultra-low interest rates.

The main factors that influence US dollar performance

Interest rates

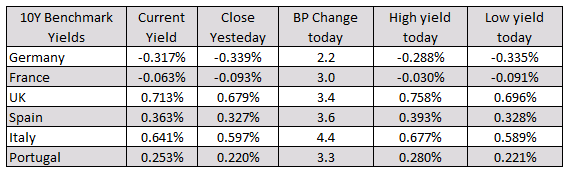

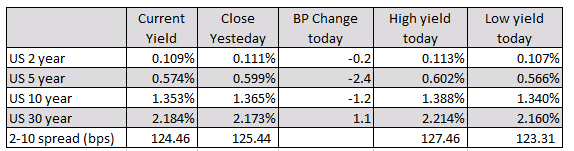

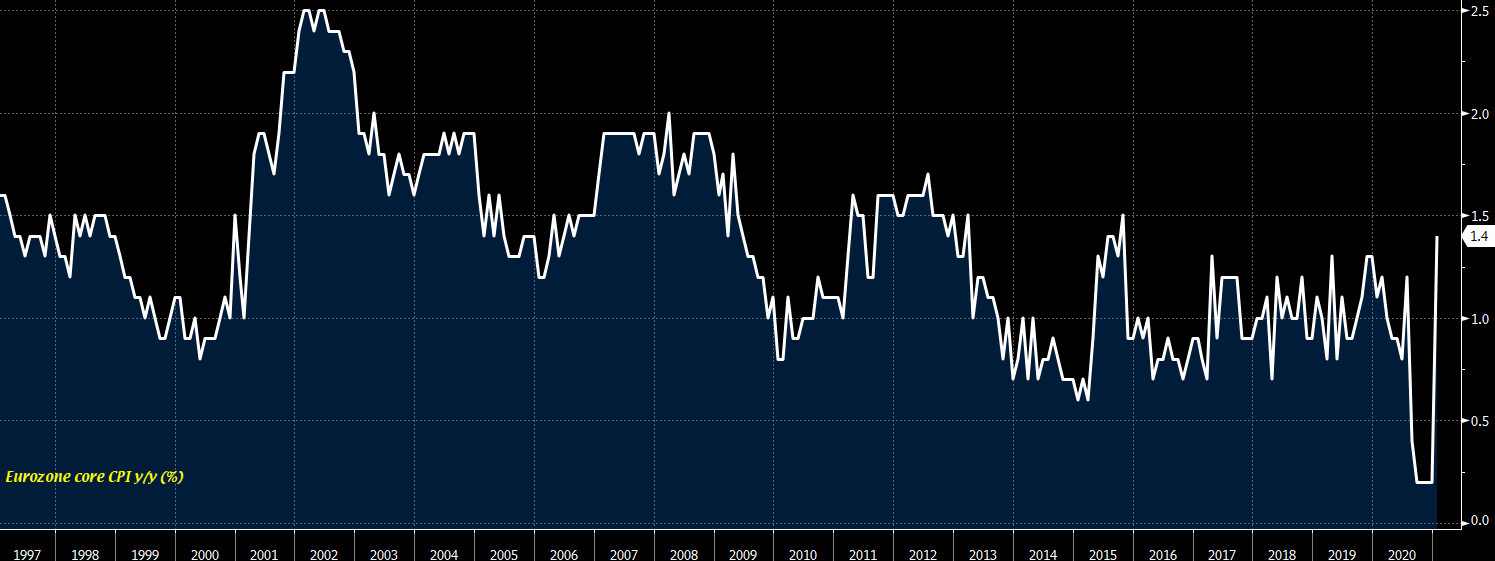

The US Federal Reserve is expected to keep interest rates at record lows and continue asset purchases as the Central Bank made a shift in its policy in 2020, signaling that the interest rates will start to rise only when inflation makes a significant move and rises to a 2% target zone and until labor market conditions return to levels consistent with the Fed’s assessment of maximum employment.

According to the Central Bank’s forward guidance, the downward pressure on longer-term rates is expected to persist and ultra-loose policy to stay in place until at least early 2023 that keeps grim outlook for the dollar. (more…)