Dalio writes about equity markets

Bridgewater founder Ray Dalio writes about equity markets today and looks at whether stock markets are in a bubble.

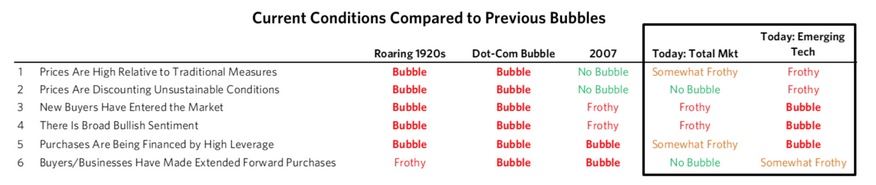

He measures them in size ways including leverage and sentiment. He says that emerging tech is close to bubble territory but that the overall market isn’t.

His overall bubble meter scores at 77%, which is elevated by has been exceeded at least 14 times since 1920. It peaked at 100% in the 1920s and late-1990s.

Right now, he says that about 5% of the largest US companies are in a bubble, mostly emerging tech stocks.

He writes:

“What one chooses to do with this is a tactical decision. Even if this gauge is perfectly accurate (which it is not) timing tops and bottoms based on it is precarious because while it shows what neighborhood these stocks are in, there is nothing precise about it. So it is tough to pick the levels and timing of tops and bottoms based on it. Having said that, we have found that it is a pretty good predictor of relative performance of stocks over the subsequent three to five years. As a result, while it contributes to our increasingly favoring non-bubble stocks, we need to combine it with timing indicators.”

I expect Dalio is looking at markets outside the US where valuations are much cheaper or within the value space in the US.