Archives of “February 18, 2021” day

rssEuropean traders look to head for the exits

Major indices in the red today

As European traders look to head for the exits, the major indices all moved lower in trading today.

- German DAX, -0.16%

- France’s CAC, -0.65%

- UK’s FTSE 100, -1.4%

- Spain’s Ibex, -0.8%

- Italy’s FTSE MIB, -1.11%

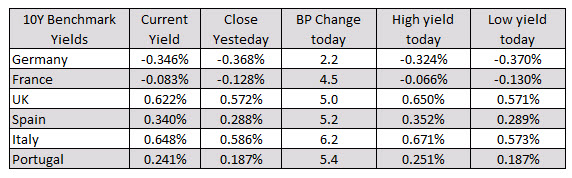

In the European debt market, the benchmark 10 year yields moved higher.

France’s yield moved up to a high of -0.066% as it climbed its way back toward the 0.0% level.

In other markets:

- Spot gold is trading up $0.44 or 0.02% $1776.57. That is well off the high price of $1789.67.

- Spot silver is trading down $0.31 or -1.15% $27.06

- bitcoin is down $462 or -0.8% of $51,937

- WTI crude oil futures are trading down $0.13 or -0.21% at $61.01 for the March contract. For the April contract the price is down $0.17 or -0.28% at $60.99

In the US stock market, the NASDAQ and Russell 2000 index remain the weakest as investors get out of the high flyers. However all indices are lower.

- S&P index -38.30 points or -0.97% at 3893.24

- NASDAQ index -194 points or -1.4% at 13769.63

- Dow -274 points or -0.87% at 31337

- Russell 200 is down the most at -1.7%

US dollar finds a footing as Treasury yields pop

Dollar off the lows

Bonds are slumping and that’s given the dollar some new life.

US 10-year yields are up 4 bps to 1.31%. The high yesterday was 1.33%.

Similarly, long bonds are up 5.8 bps and about 2 bps from yesterday’s high. 30s have broken above a channel and are having a look at the Feb 2020 levels.

There is a push-and-pull ongoing with the dollar, the risk trade and stocks that’s struggling to find a solid base.

The market doesn’t seem to mind higher yields until we get +5 bps daily moves and then it starts to look a bit panicky.

With the latest pop in yields AUD/USD has given back most of its gains, falling to 0.7763 from a high of 0.7790 a short time ago.

Come on, do something…

US January housing starts 1580K vs 1660K expected

US housing starts data for January 2021:

- Prior was 1669K

- Building permits 1881K vs 1680K exp

- Starts -6.0% m/m vs -0.5% exp

- Prior starts +5.8%

The headline is a miss but January is a tough time to start building so I wouldn’t read much into it, especially after a string of good numbers. I take the signal from permits, which rose 10.4% and builders look to have a very busy spring/summer.

Details:

- Single family starts -6.0% vs +12.0% prior

- Multifamily +17.1% vs -15.0% prior

- Single family permits +3.8% vs +7.8% prior

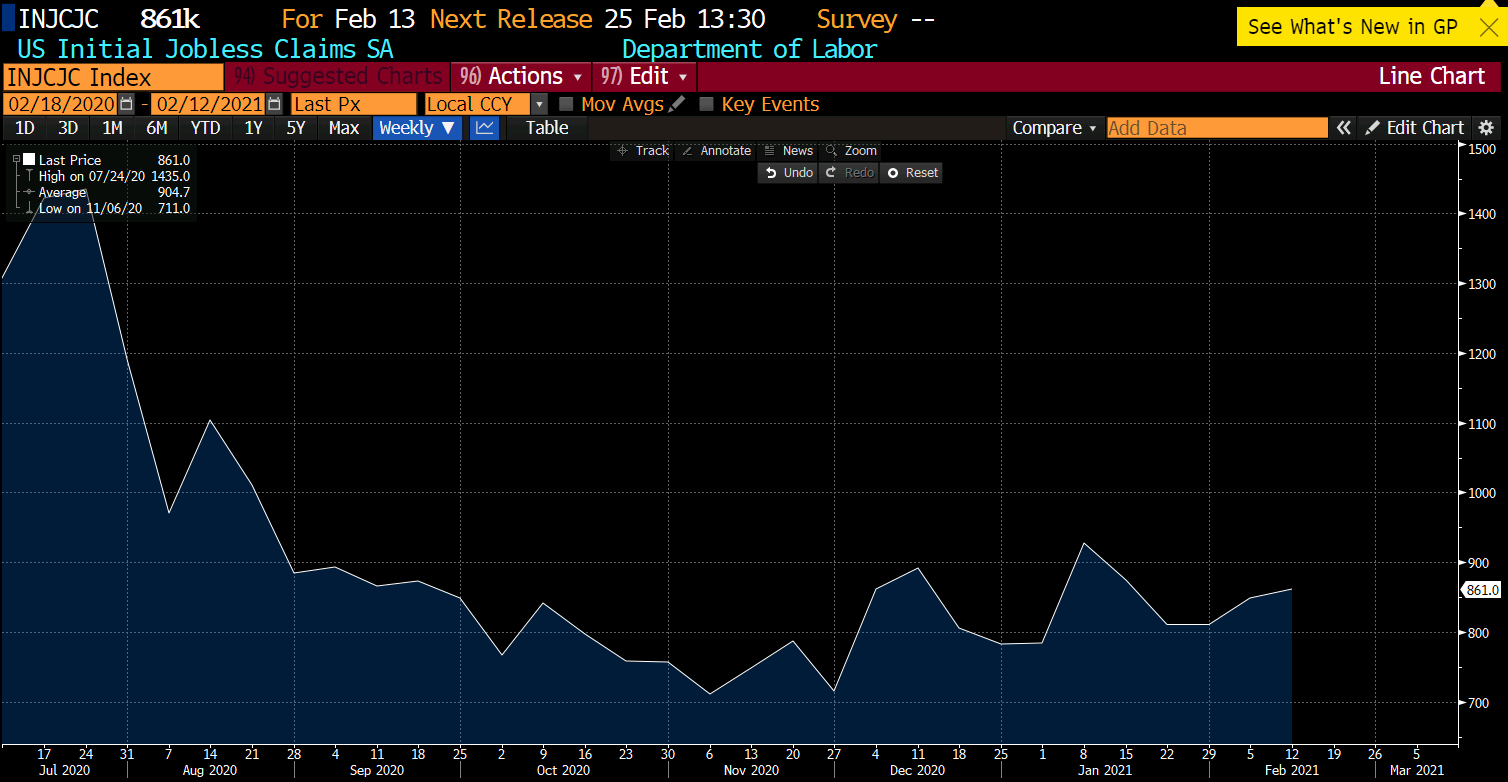

US initial jobless claims 861K vs. 773K estimate

US weekly initial jobless claims and continuing claims

- prior week

- Initial jobless claims 861K vs 773K estimate. Prior week revised to 848K vs 793K previously reported

- 4 week moving average of initial claims 833.25K vs 836.75K last week (revised)

- Continuing claims 4494K vs. 4425K estimate. Prior week revised to 4558K vs 4545K initially reported

- 4 week moving average of continuing claims 4632K vs last week 4752.25K

- The largest increases in initial claims for the week ending February 6 were in Ohio (+92,667), California (+28,688), Georgia (+5,171), Mississippi (+3,796), and Colorado (+3,045),

- The largest decreases were in Florida (-47,430), New York (-17,407), Maryland (-16,585), Kansas (-12,376), and Arizona (-7,478).

- During the week ending January 30, 51 states reported 7,685,389 continued weekly claims for Pandemic Unemployment Assistance benefits and 51 states reported 4,061,305 continued claims for Pandemic Emergency Unemployment Compensation benefits

The employment data is going the wrong way. This weeks data corresponds with the survey week for the BLS employment report released in the 1st week of March.

Housing, jobless claims and oil inventories on the schedule

What’s coming up on the economic calendar

The data slate at the bottom of the hour is a busy one today:

- US housing starts

- Philly Fed

- Initial jobless claims

- US import/export price index

- Canadian Teranet house price index

It’s tough to rank the top three on that list but the market has been consistently perking up around jobless claims.

Later at 1500 GMT we get eurozone consumer confidence and comments from the Fed’s Bostic. The topic is educational inequality though so I don’t expect anything noteworthy for markets.

One to watch will be the US weekly EIA petroleum inventories report. This one is for up to Feb 12 so it won’t cover the bulk of this week’s cold-maggedon but with WTI touching $62 earlier, it’s going to be a market mover.

On the US Treasury auction schedule we get 30 year TIPS.

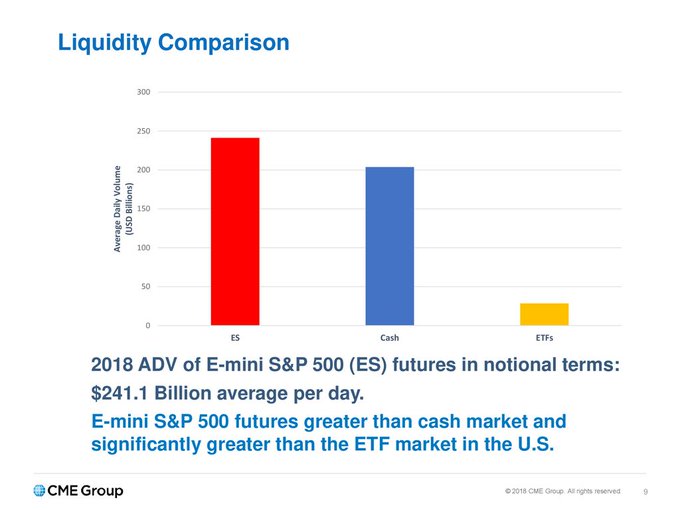

Retail investors represent less than 4% of the daily volume of the futures market.

The daily volume of S&P 500 futures is greater than the volume of the stocks that make up that index.

White House says actively engaged in addressing chip shortage impacting vehicle makers

A spokesperson for the US administration says has asked US embassies to identify how foreign govmts, companies can assist

- officials have met with automakers and suppliers to identify chokepoints

- urging companies to work cooperatively to address the current shoirtage

- reviewing critical supply chains to identify vulnerabilities, take steps including increased US domestic production of chips

- have thanked Taiwan for its efforts to resolve the shortage of automotive chips

—

Many firms are producing flat out, there is no easy short term fix to this. Can’t blame the WH for trying, and maybe they’ll manage to hasten new production, but the fix will be time.