Archives of “February 9, 2021” day

rssEIA crude oil output and demand forecasts being released

For what it is worth. Crude oil is currently trading up $0.27 and $58.25

- US crude output to rise 510K BPD to 11.53M BPD in 2022 (vs risk of 390K BPD forecast last month)

- US crude output to fall 290K to 11.02M BPD in 2021 (vs fall of 190 K BPD forecast last month)

- US petroleum demand to rise 1.35 million BPD to 19.43 million BPD in 2021 (vs. rise of 1.45 million BPD previously forecasted)

- US petroleum demand to rise 1 million BPD to 20.43 million BPD and 2022 (vs. rise of 990K BPD previously forecasted)

European shares end mostly lower

France’s CAC unchanged. UK’s FTSE up marginally

The European shares are ending the session lower. The exceptions are France’s CAC which is closing near unchanged levels for the day. The UK’s FTSE 100 is up marginally by 0.13%. The provisional closes are showing

- German DAX, -0.38%

- France’s CAC, unchanged

- UK’s FTSE 100, up 0.13%

- Spain’s Ibex, -1.2%

- Italy’s FTSE MIB, -0.5%

in other markets as London/European traders look to exit:

- spot gold is trading up around $7 or 0.39% of $1838

- spot silver is trading up $0.05 or 0.18% at $27.32

- WTI crude oil futures are trading up $0.08 or 0.14% $58.05

- The price of bitcoin is now up $2200 or 4.9% of $46,889. The high price reached $48,200. The low price extended to $44,300

in the US stock market, the NASDAQ has been trading above and below the 0 level (mostly higher though). The S&P index and Dow industrial average have remained negative for the day.

- S&P -5 points or -0.13% 3910.58

- NASDAQ index +28.5 points or 0.2% at 14016.7

- Dow -24.7 points or is -0.08% the 31360

US yields remain on the downside today.

- 2 year 0.111%, unchanged

- 5 year 0.467%, -1.1 basis points

- 10 year 1.139%, -3.0 basis points

- 30 year 1.925%, -2.7 basis points

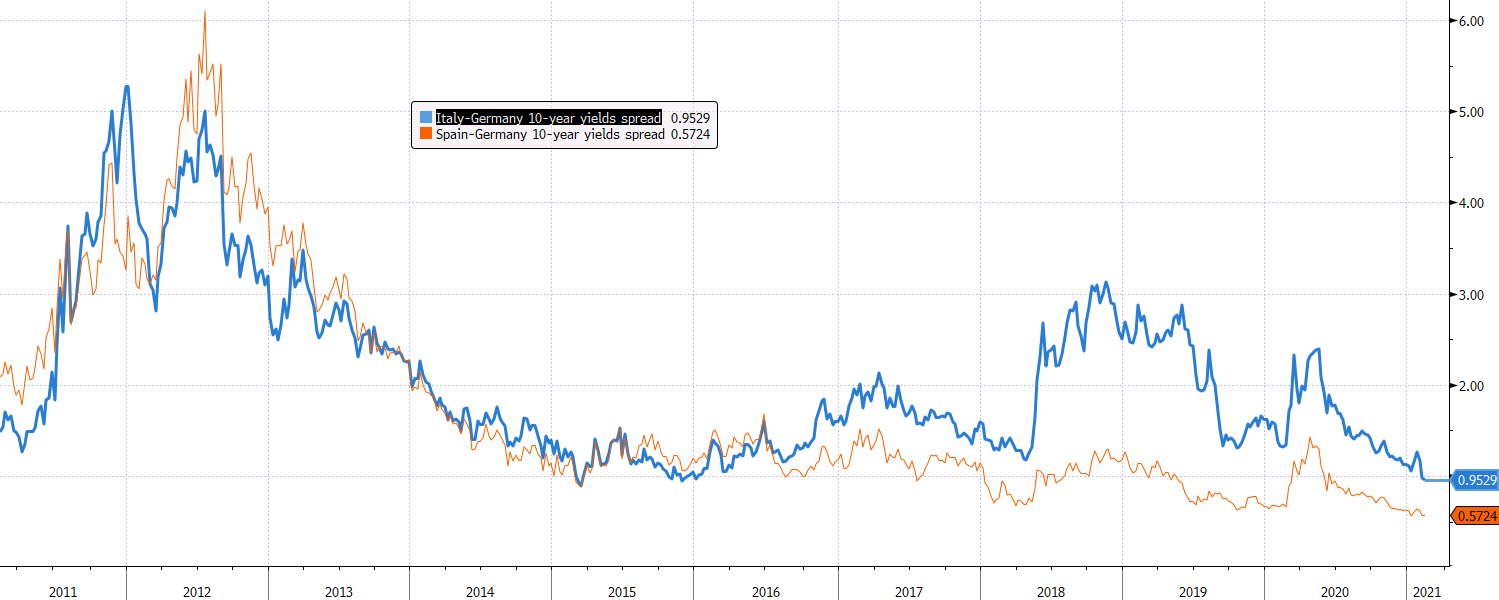

Italian 10-year bond yields fall to record low as Draghi government eyed

10-year Italian bond yields fall to 0.50%

Super Mario is back and the market continues to show a vote of confidence in him as BTPs push higher with yields falling to a record low in the European morning today.

The ECB also has a helping hand in all of this but the market is certainly liking the idea of Italian politics having a familiar figure at the helm.

The transformation of Italian bonds over the past year is quite notable, especially since Lagarde & co. had previously claimed that they were “not here to close the spreads”. That said, there is still some credit risk involved with the spread being ~95 bps.

But as we get accustomed to this whole new market paradigm, would it be too crazy to imagine Italian yields going negative? Now that would be something for the ages.

USD/JPY falls to fresh one-week low as trouble brews for the dollar

USD/JPY falls to a low of 104.78, the lowest level in a week

Things are not looking good for the dollar as we are seeing USD/JPY reverse course after testing its 200-day moving average (blue line) since the latter stages of last week.

The upside momentum appears to have stalled and with yields retreating off the highs over the past few sessions, it is putting a drag on yen pairs in trading today.

Of note, USD/JPY is now down to 104.78 – its lowest level since 1 February.

The push below 105.00 is a significant one for sellers and even more so when you drill down to the near-term chart:

Sellers are now back in control upon a push below the 200-hour moving average (blue line) and are threatening a break below the 38.2 retracement level @ 104.84.

Further support is seen closer towards 104.55-61 but if this is the start of a turning point for the dollar, a return back to 103.50 to 104.00 isn’t out of the picture here.

As we navigate through the week, just keep an eye on the bond market as well in gauging sentiment for USD/JPY and yen pairs in general.

Italy’s Berlusconi: Draghi saved the euro, has great capacity to manage difficult situations

Italian political figureheads talk up Draghi government

Berlusconi also adds that the decision to back Draghi is “an act of wisdom that will also be appreciated in Europe”.

As things stand, Draghi is still in the midst of talks with political parties to shore up support in parliament. But the market has given him a vote of confidence as we see spreads tighten in the euro area. Even if he is not with the ECB, he is still doing their job. *scoffs*

French central bank estimates that economy is operating 5% below pre-crisis levels in February

The estimate is unchanged from its January gauge of economic activity

The central bank also confirms that it sees French GDP growing by 5% for the year.

Nikkei 225 closes higher by 0.40% at 29,505.93

The Nikkei extends its run higher to start the week

After a more tepid start, Japanese stocks are finishing the day on a stronger note with Asian equities taking heart from record closes in Wall Street once again.

The Hang Seng is up 0.4% while the Shanghai Composite is up 1.6%. US futures though, are keeping flatter and little changed as we look towards European trading.

Meanwhile, the selloff in the bond market is meeting a pause as yields slump a little on the day. 10-year Treasury yields are down 1.5 bps to 1.155%.

Record closes across the board with small caps/NASDAQ leading the way

Russell index rises by 2.36%.

The major indices are all closing at record high levels, with today the Dow Industrial Average joining the S&P, Nasdaq and smaller cap Russell 2000 index (they each closed at records on Friday). The indices are also closing near the highs for the day.

Leading the way is the Russell 2000 which is up 2.2%. The NASDAQ rose by 0.95% and closed at the highs.

Of interest is that despite the solid gains, those gains were made without participation materially from Amazon (-0.87%), Netflix (-0.52%), Alphabet (-0.21%), Salesforce (-0.04%),Microsoft (+0.11%) and Apple (+0.11%). Is the market telling us something about big cap tech stocks?

The final numbers are showing:

- S&P index rose 20.76 points or 0.74% to 3915.59. That was just off the high at 3915.77.

- NASDAQ indexrose 131.345 points or 0.95% to 13987.64. The hi for the day reached 13987.73

- Dow industrial average rose 237.52 points or 0.76% to 31385.76. The high for the day reached 31386.10

- Russell 2000 is trading up 52.6 points or 2.36% at 2285.913. It too is just off the high.

Thought For A Day