Archives of “February 3, 2021” day

rssUS EIA weekly oil inventories -994K vs -2300K expected

Weekly oil inventories

- Prior was -9910K

- Gasoline +4467K vs +1500K exp

- Distillates -9K vs -500K exp

- Refinery utilization +0.6% vs +0.2% exp

- Production 10.9 mbpd vs 10.9 mbpd prior

Oil is quickly down to $55.67 from $55.90 before the report.

API numbers from late yesterday:

- Crude -4261K

- Cushing -1885K

- Gasoline -240K

The Trader and the Trading System Must Meet

- Systems don’t need to be changed. The trick is for a trader to develop a system with which he is compatible.

- My original system was very simple with hard-and-fast rules that didn’t allow for any deviations. I found it

difficult to stay with the system while disregarding my own feelings. I kept jumping on and off—often at just the wrong time. I thought I knew better than the system. - Also, it seemed a waste of my intellect and MIT education to just sit there and not try to figure out the markets.

- Eventually, as I became more confident of trading with the trend, and more able to ignore the news, I became more comfortable with the approach. Also, as I continued to incorporate more “expert trader rules,” my system became more compatible with my trading style.

- As I keep trading and learning, my system (that is the mechanical computer version of what I do) keeps evolving.

- Over time, I have become more mechanical, since (1) I have become more trusting of trend trading, and (2)

my mechanical programs have factored in more and more “tricks of the trade.” I still go through periods of thinking I can outperform my own system, but such excursions are often self-correcting through the process of losing money. - I don’t think traders can follow rules for very long unless they reflect their own trading style. Eventually, a breaking point is reached and the trader has to quit or change, or find a new set of rules he can follow. This seems to be part of the process of evolution and growth of a trader.

- A trading system is an agreement you make between yourself and the markets.

Basic Factors in Evaluating a Trading System

Statistics

- Win rate

- Average winner / Average loser

- Profit factor (gross winnings / gross losses)

- Number of consecutive losers (needs to match with your psychological ability to handle)

- Expectancy (i.e. P/L of an average trade)

- Maximum drawdown

- Annual return

- t-statistic > 2

Robustness

- Markets: The system should be tested across all market environments, e.g. bull, bear, choppy, etc. Performance should preferably be consistent across all environments.

- Outliers: Is a significant chunk of the performance attributable to a just few trades or a particular market? or is the P/L across trades fairly consistent?

- Costs: Slippage and commission deducted?

- Logic: Are all signals immediately executable? e.g. limit moves might not allow execution

System Details

- How many rules and variables are there in the system? Beware of over-optimization.

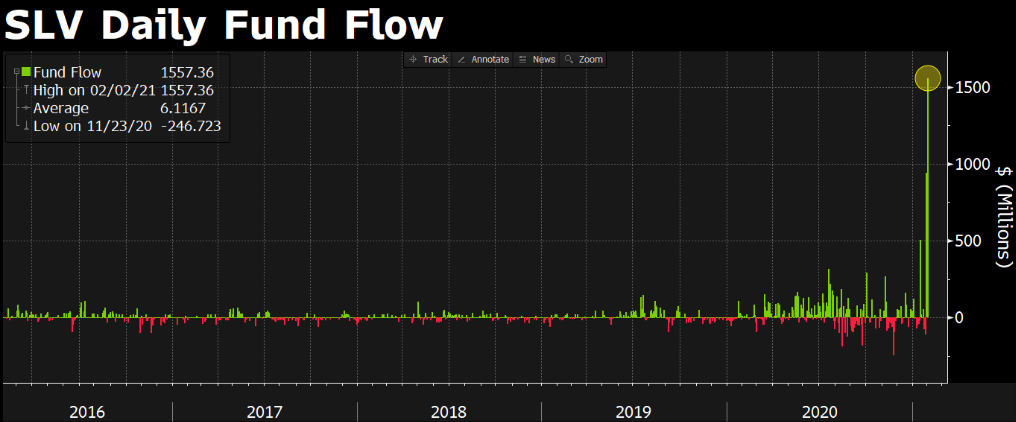

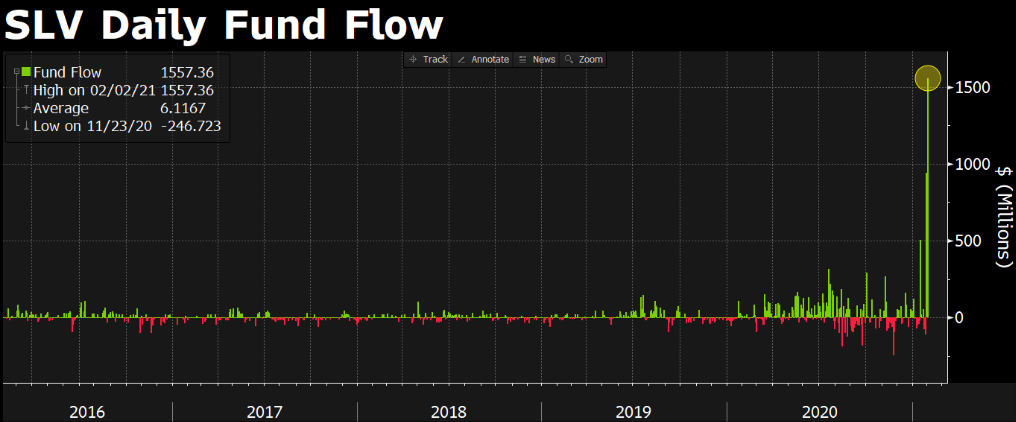

Silver ETF surges despite price drop yesterday

Is the silver trade looking to switch back up again?

SLV saw a record amount of daily inflows worth nearly $1.6 billion yesterday (h/t @ daniburgz) despite the 9% drop in silver prices yesterday. That might be a sign that there is still strong appetite for silver despite the retreat after hitting $30 earlier in the week.

For some context, this is how silver prices have matched with SLV holdings in recent years:

Just something to be aware of when factoring in the fundamental landscape to the current technical picture, as buyers are still hanging on at key near-term levels.

Oil climbs to a fresh one-year high as OPEC committee meets

The extension continues

The break of the oil range has continued today with WTI at the highs of the day and up 62-cents to $55.39.

The measured target of the range break is $56.

The JMMC is meeting has just begun and if they were being honest, I could see them starting to reverse policy on a better demand outlook. However I don’t see any incentive for them to change it up with the climb in oil prices far outpacing whatever they’re losing by holding back production. The consensus is that they won’t recommend any adjustments to policy.

The other thing to watch in oil will be the US weekly report at 1530 GMT (10:30 am ET). The consensus is a -2300K reading on oil but the API numbers late yesterday were bullish:

- Crude -4261K

- Cushing -1885K

- Gasoline -240K

- Distillates -1622K

Silver ETF surges despite price drop yesterday

Is the silver trade looking to switch back up again?

SLV saw a record amount of daily inflows worth nearly $1.6 billion yesterday (h/t @ daniburgz) despite the 9% drop in silver prices yesterday. That might be a sign that there is still strong appetite for silver despite the retreat after hitting $30 earlier in the week.

For some context, this is how silver prices have matched with SLV holdings in recent years:

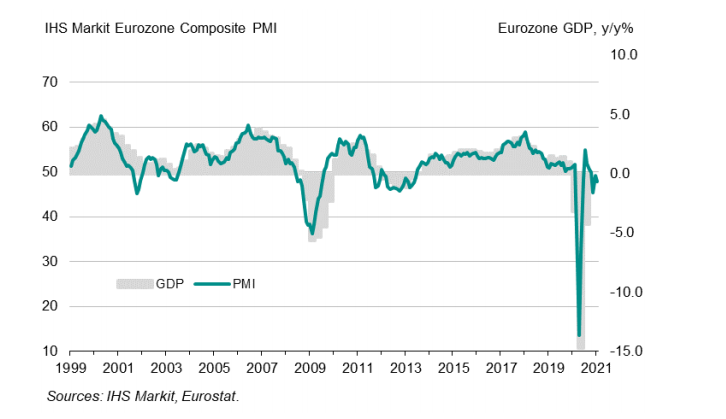

Eurozone January final services PMI 45.4 vs 45.0 prelim

Latest data released by Markit – 3 February 2021

- Composite PMI 47.8 vs 47.5 prelim

The preliminary report can be found here. A slight upward revision to the initial estimates but this still reaffirms a contraction in overall business activity to start the year, with tighter virus restrictions weighing on economic conditions.

That points to risks of a potential double-dip recession after having seen Q4 2020 GDP fall by 0.7% q/q as reported yesterday here. Markit notes that:

“The eurozone economy endured a predictably tough start to 2021 as ongoing efforts to contain the spread of COVID-19 continued to hit business activity, especially in the service sector. Manufacturing growth continued to help offset some of the weakness in the service sector, though even here factories saw output growth slow amid subdued demand and supply delays, often linked to the pandemic.

“A contraction of GDP therefore looks likely in the first quarter, though on current trends this should be modest in comparison to the falls seen in the first half of 2020.

“However, with virus containment measures likely to constrain euro area economies in the coming months, and potentially well into the second quarter given the slow vaccine roll-out, the focus will be on the need to sustain supportive fiscal and monetary policymaking for some time to come, notably to prevent further intensifying job losses in the hardest hit sectors, such as hospitality, tourism, travel and retail.

“Rising costs have dealt a further blow to many companies, with input prices rising at the steepest rate for two years to squeeze margins. However, in many cases this reflects a short-term lack of capacity and shipping delays, which should ease in coming months, helping alleviate these price pressures.”