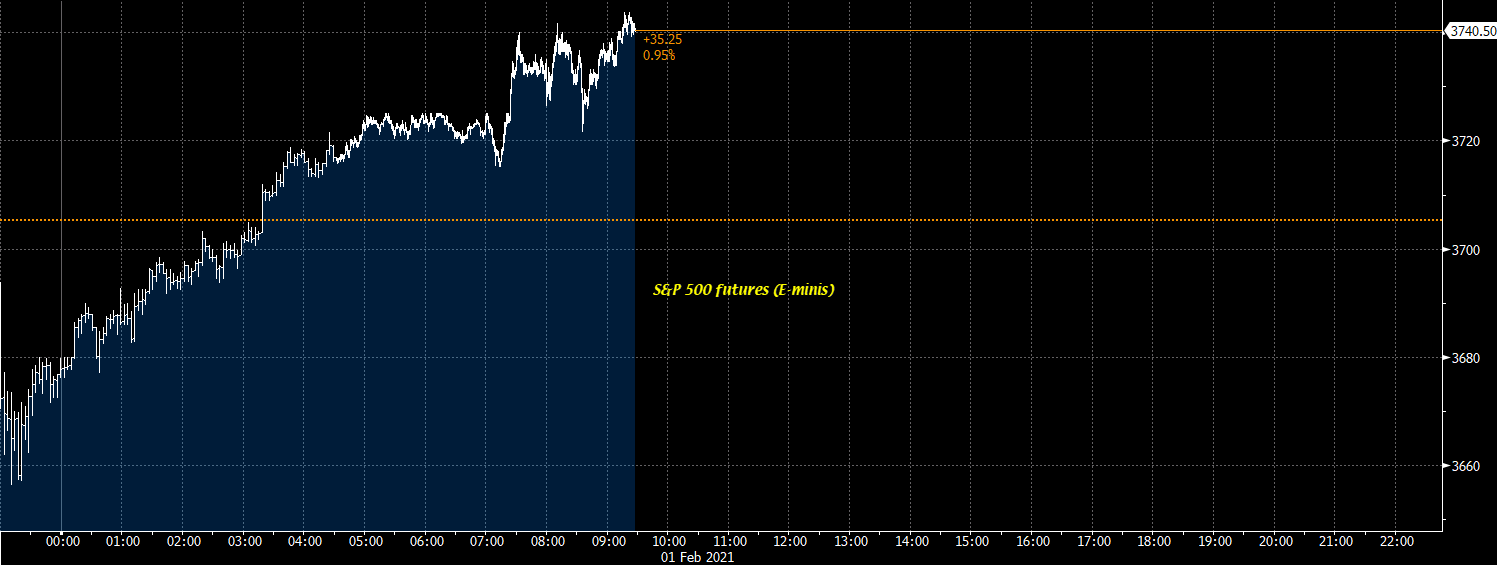

GOP proposal includes $1000

- $160B for direct pandemic response, $132B for UI

- $20B for child care, $20B for schools

- $50B for small businesses

- $220B for direct payments ($1,000)

- $12B for nutrition

- $4B for mental health service

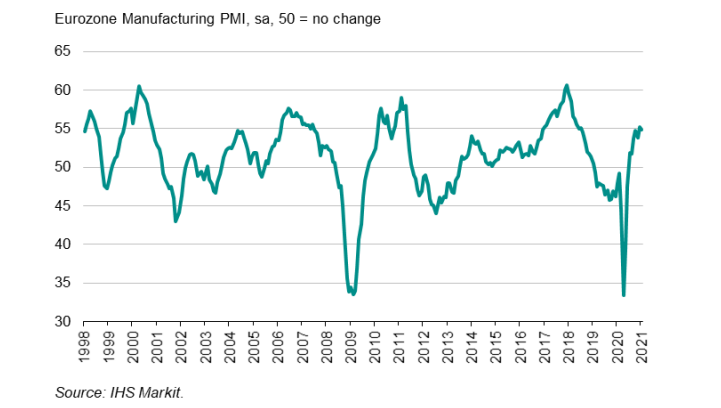

“Eurozone manufacturing output continued to expand at a solid pace at the start of 2021, though growth has weakened to the lowest since the recovery began as new lockdown measures and supply shortages pose further challenges to producers across the region.

“Supply chain delays worsened during the month to a degree only exceeded once – during the global lockdowns early last year – in more than two decades of survey history.

“At the moment, manufacturing is providing an important support to the economy as the service sector is hit by COVID-19 restrictions, but this support is waning. Consumer goods producers in particular are struggling. While future prospects brightened, with manufacturers’ optimism striking a three-year high in January to sound a reassuring note of confidence at the start of the year, any potential delays to the vaccine roll-outs will add an additional layer of uncertainty to the outlook.

“Supply shortages have meanwhile put pricing power in the hands of suppliers, pushing raw material prices sharply higher. Increased shipping costs are adding to the burden. These price pressures should ease once more supply capacity comes online, although there remains some uncertainty about how much pent-up demand exists and how sticky these higher prices may prove to be.”

Meanwhile the yuan is moving a little lower on the session also. HigherUSD/CNH shows a weakening offshore yuan:

more to come