Oil down 1.5%

UK-EU trade deal talks have, at long last, entered the mythical tunnel. Michel Barnier has stopped internal debriefs to the wider EU, his last was on Friday. Hopes (on both sides) of a deal by the end of this week – but could still yet all fall apart

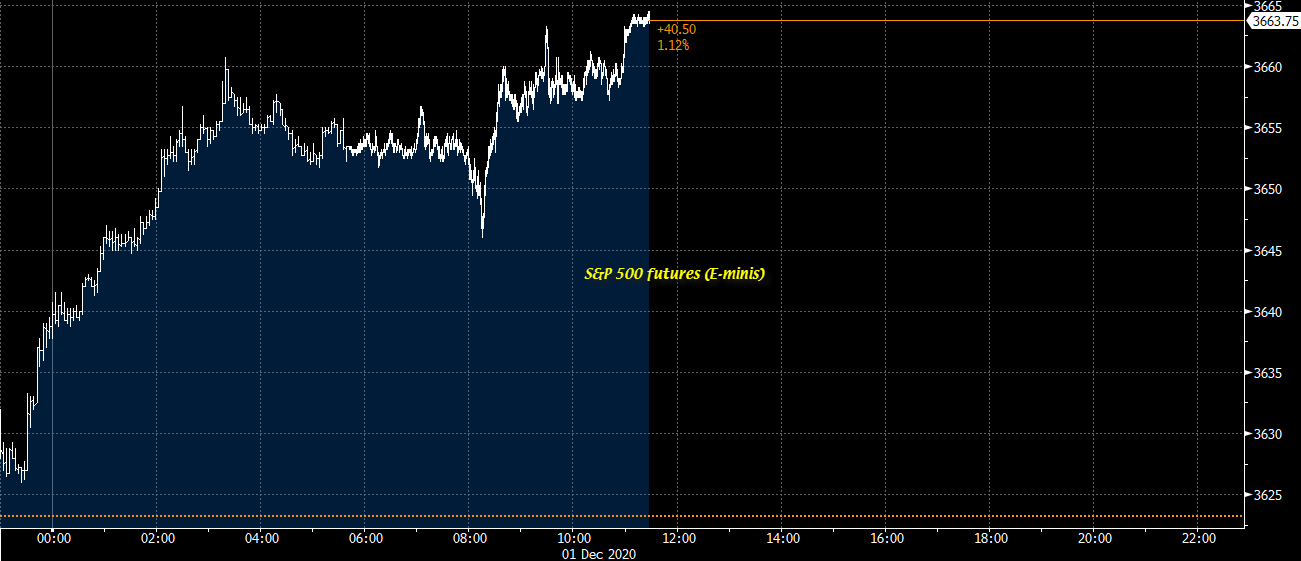

It is risk-on to start December trading and equities are looking poised for a solid day of gains after a bit of a pause amid month-end trading yesterday.

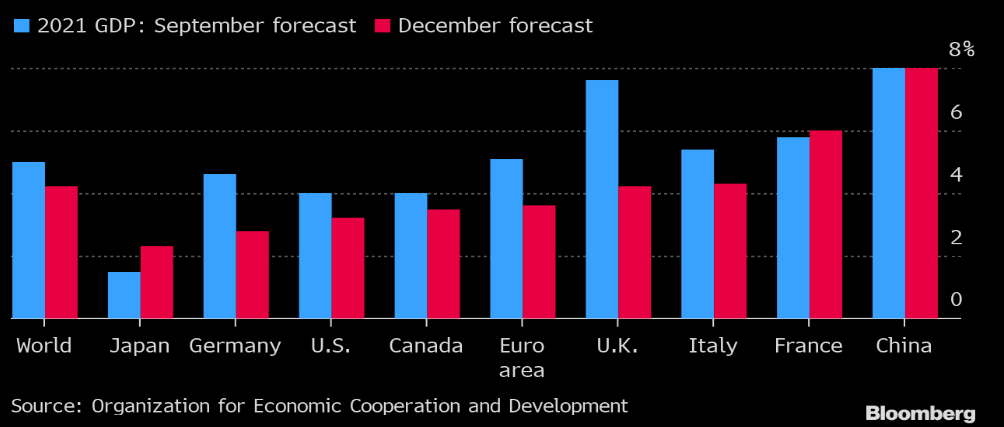

OECD chief economist, Laurence Boone, comments on the report:

“Policy still has a lot to do. If public health or fiscal policy falter then we would see a loss of confidence and a much more depressing outlook.”

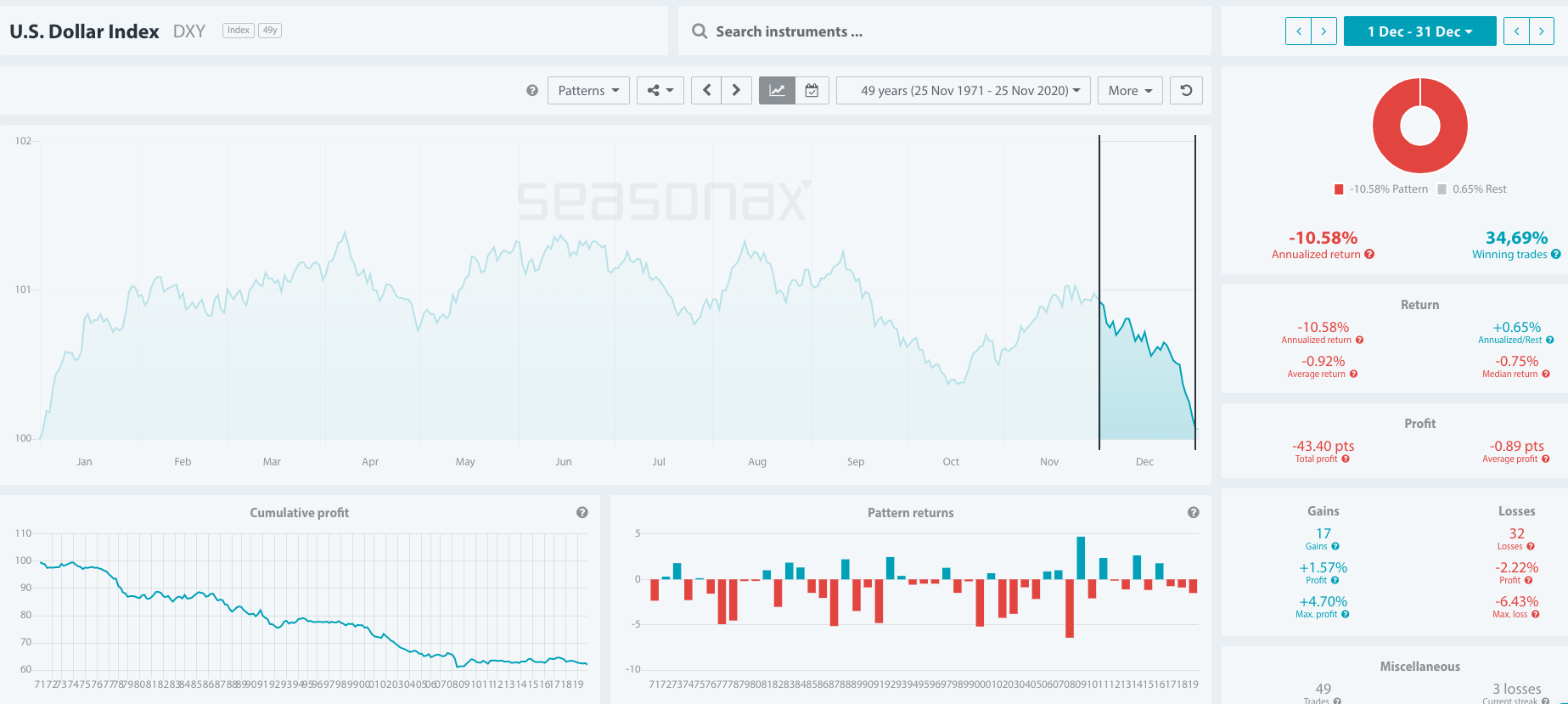

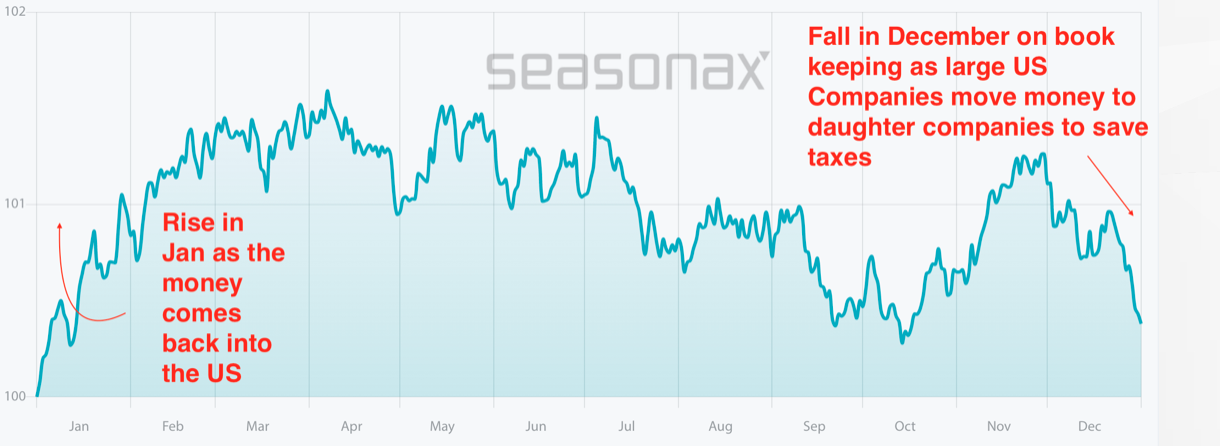

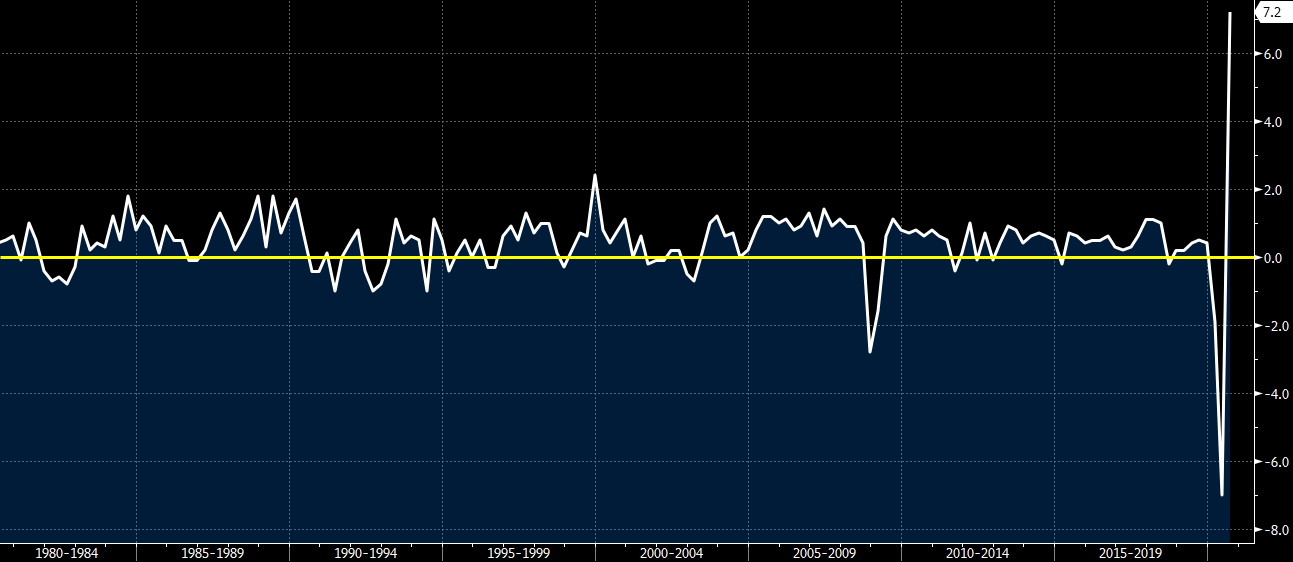

The USD has strong reasons for USD weakness heading into year end.The USD tends to see outflows in December and inflows in January due to taxation issues. It is a pattern that has repeated itself over the last 50 years and you can see the outflows here in December below.

In December large US companies move money to daughter companies to save taxes.In January the money comes back into the US. This pattern is solid and here is the seasonal outline over the last 25 years. So this would favour further falls in the DXY heading into year end.

The good news is that the Swiss economy bounced back more than estimated in Q3 but that is more than offset by the virus resurgence and its impact on the economy in Q4, which is the market focus at the moment (alongside Q1 2021 and vaccine optimism).