Archives of “November 2020” month

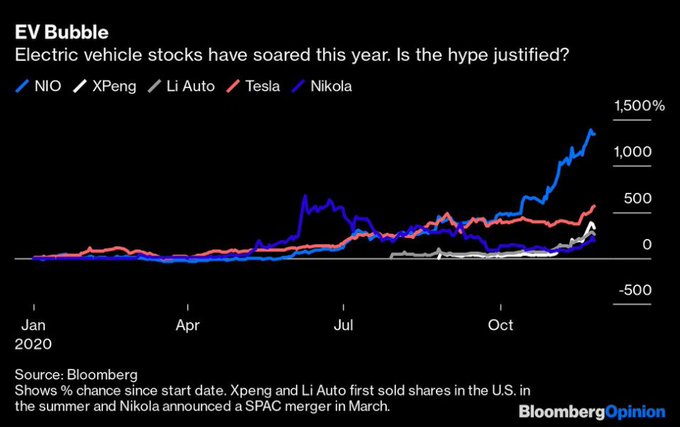

rssHerbert Diess (Volkswagen CEO): “In 5 to 10 years, the most valuable company in the world will be an automobile manufacturer.”

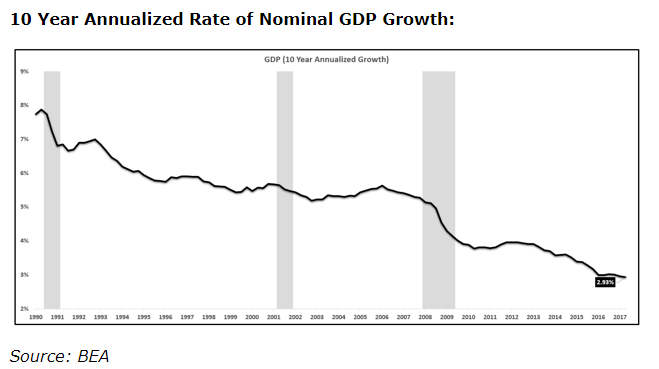

US GDP is growing less and less.

Inflation in the US is decreasing.

UK poised to become the first western country to approve a Covid-19 vaccine

So report the Financial Times, saying the drug regulator in the country is set to grant approval within days. (FT may be gated.)

- Deliveries of the vaccine developed by BioNTech and Pfizer would begin within hours of the authorisation

- first injections could take place from December 7.

- UK has ordered 40m doses of the two-shot product, which preliminary data found to be more than 95 per cent effective in preventing disease

The UK’s Medicines and Healthcare Products Regulatory Agency has the power to temporarily authorise products, in cases of urgent public need, thus bypassing the normal approval required from the European Medicines Agency (what this means is that while the UK is bound by the European agency until the end of the Brexit transition on December 31 the country still has the power to approve apart from the EU approval, with our without Brexit).

I posted an early leak of approval soon back on Friday, but that was re the Oxford-Astra product.

Thought For A Day

April 20, 2020: A date which will live in infamy

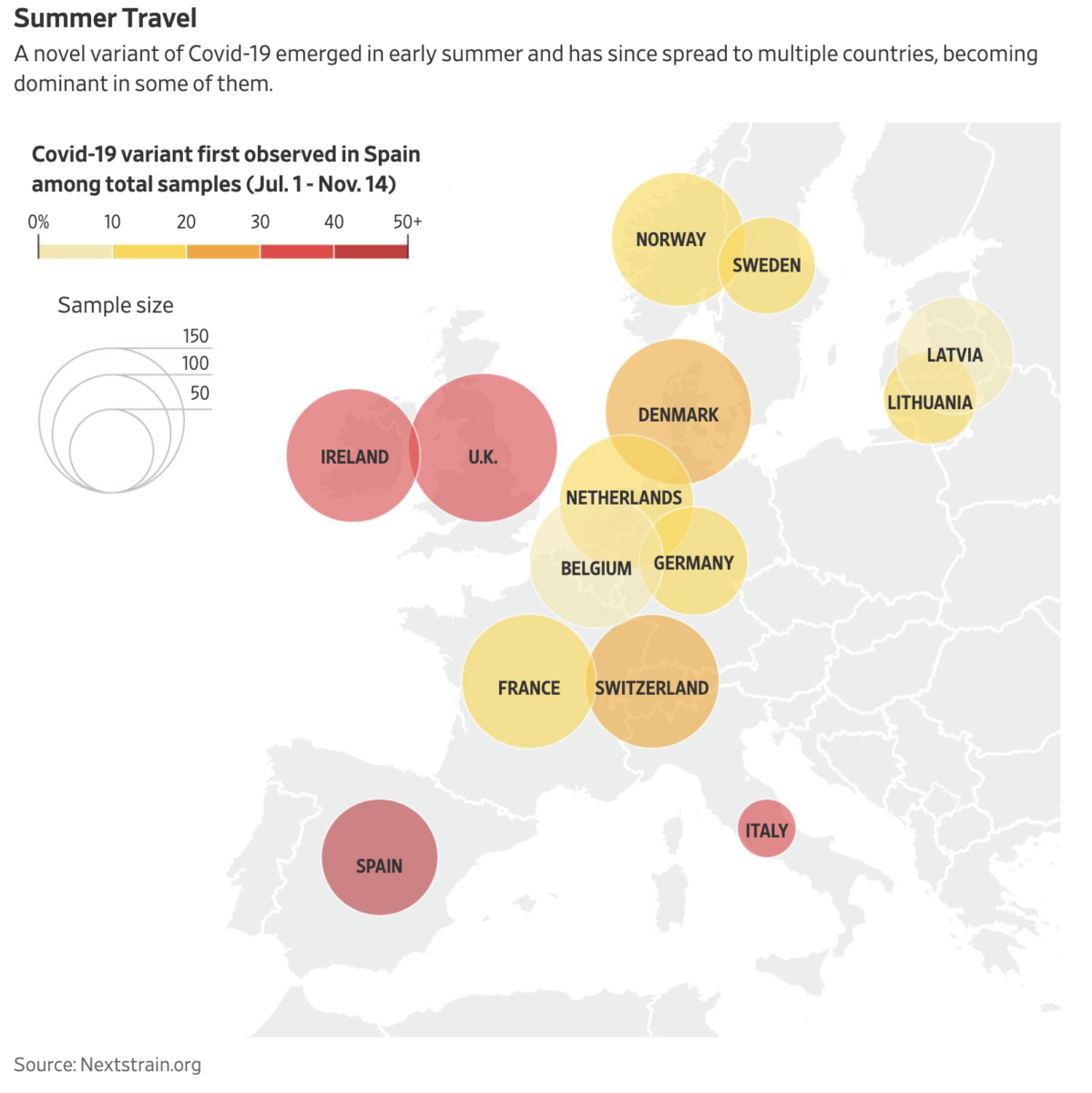

Lessons From Europe’s Covid Surge: Control Is Fragile and Losing It Is Easy

“Reduce options. Increase focus. Multiply results.”

US employment and Fed’s Powell highlight next weeks events and releases

The highlighted events and economic releases for next week’s trading:

The RBA rate decision, Fed’s Powell testimony and the US employment report highlight the events and economic releases in the new trading week.

Monday:

- China Manufacturing PMI. 8 PM ET Sunday/0100 GMT. Estimate 51.7 vs 51.4 last

- OPEC meeting all day

- Chicago PMI. 9:45 AM ET/1445 GMT. Est. 59.0 vs 61.1 last month

- US Pending Home sales. 10 AM ET/1500 GMT. Est 1.5% vs -2.2% last month

Tuesday

- RBA interest rate decision. 10 PM ET Monday/0330 GMT. Est 0.10% unchanged

- UK Final Manufacturing PMI. 4:30 AM ET/0930 GMT. Est 55.2 vs 55.2 preliminary

- Canada GDP month-to-month for September. 8:30 AM ET/1330 GMT. Estimate 0.9% vs. 1.2% last month. Quarterly GDP annualized 47.6% vs. -38.7% in the 2nd quarter. GDP year on year -2.9% vs. -3.8%

- Fed chair Powell testifies on Capitol Hill. 10 AM ET/1500 GMT

- ISM manufacturing PMI for November. 10 AM ET/1500 GMT. Estimate 58.0 vs. 59.3 last.

- ECB’s Lagarde speaks. 12 PM ET/1700 GMT

Wednesday

- RBA Gov. Lowe speaks. 7 PM ET/1200 GMT.

- Australian GDP QoQ. 7:30 PM ET/1230 GMT. Estimate 2.4% vs. -7.0% last month. Year on year -4.5% vs. -6.3%

- ADP employment change for November. 8:15 AM ET/1315 GMT. Estimate 420 K vs. 365K last month

- Fed chair Powell testifies on Capitol Hill. 10 AM ET/1500 GMT

Thursday

- US initial jobless claims. 8:30 AM ET/1330 GMT. 768K vs. 778K

- US ISM services PMI . 10 AM ET/1500 GMT. Estimate 56.0 vs. 56 16 last month

Friday

- Canada employment change. 8:30 AM ET/1330 GMT. Net change in employment 20.0 K vs. 83.6 K last month. Unemployment rate a .9% vs. a .9% last month.

- US employment statistics for November. 8:30 AM ET 1330 GMT. Nonfarm payroll 500 K vs. 638K last month. Unemployment rate 6.8% vs. 6.9% last month. Average hourly earnings 0.1%.