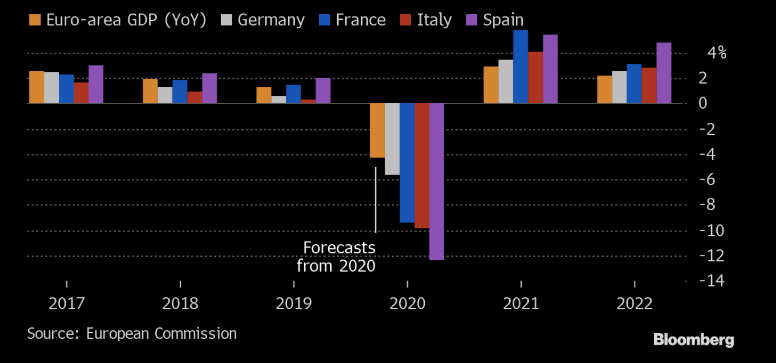

The European Commission publishes its latest forecasts for the euro area economy – 5 November 2020

- Eurozone 2020 GDP forecast -7.8% (previously -8.7%)

- Eurozone 2021 GDP forecast +4.2% (previously +6.1%)

- Eurozone 2022 GDP forecast +3.0

- Expects Eurozone economy to contract by 0.1% q/q in Q4

- Eurozone inflation 0.3% in 2020

- Eurozone inflation 1.1% in 2021

- Eurozone inflation 1.3% in 2022

The commission adds that the technical assumption for the forecasts is that there will be no trade deal between the EU and UK once the Brexit transition period ends on 31 December. Adding that the forecasts are surrounded by ‘exceptional uncertainty’.

Given recent virus developments, the changes to the projections are very much expected but these are still relatively optimistic in my view. I expect far worse projections given the tigther virus restrictions so the forecasts above may well be outdated.

Anyway, this serves as an anecdote that if the virus situation doesn’t get any better in the coming year, we are going to keep rolling back this downgrade update every quarter.