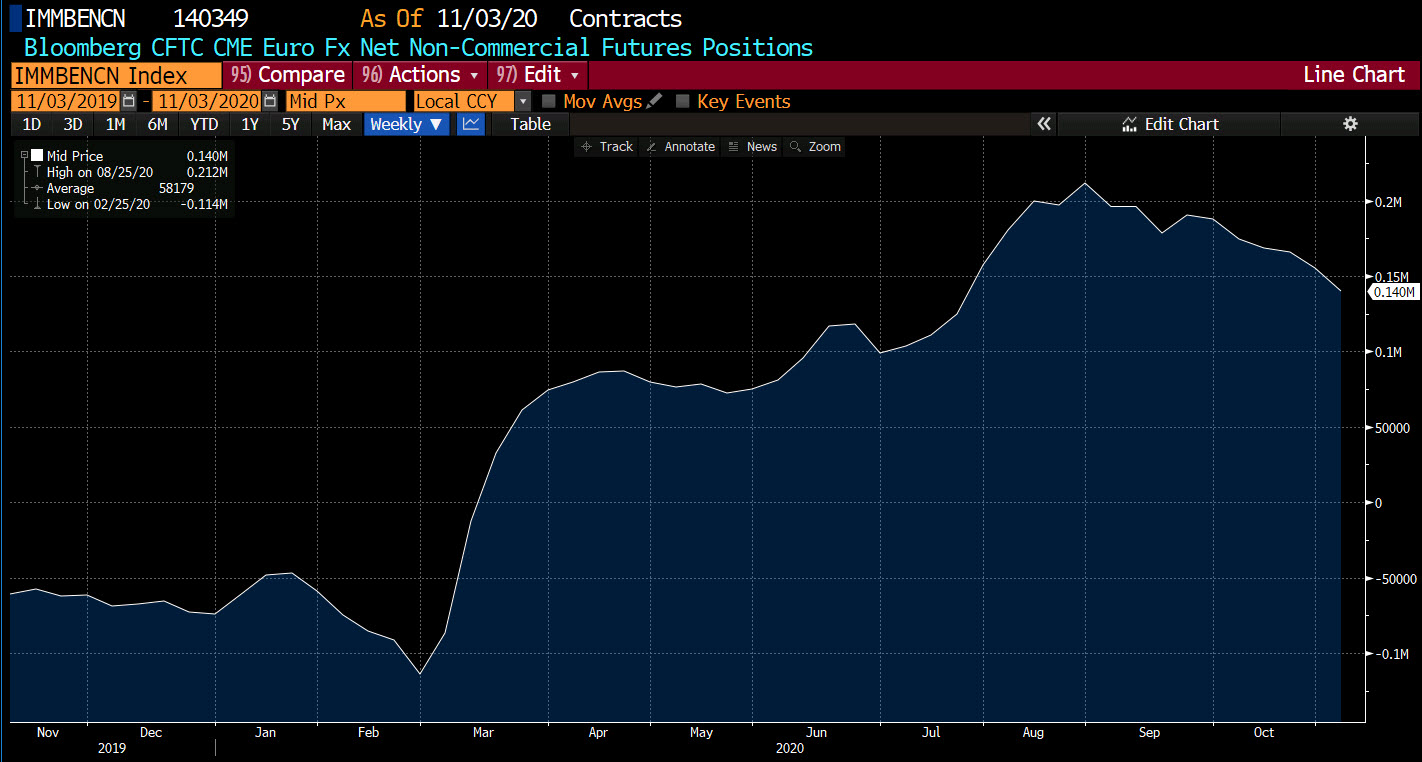

Forex futures positioning for the week ending November 3, 2020.

- EUR long 140K vs 156K long last week. Longs trimmed by 15K

- GBP short 11K vs 7K short last week. Shorts increased by 4K

- JPY long 28K vs 18K long last week. Longs increased by 10K

- CHF long 15K vs 15K long last week. No change in net position

- AUD short 1K vs 9K long last week. Shorts increased by 10K

- NZD long 7K vs 7K long last week. No change in net position

- CAD short 21k vs 18K short last week. Shorts increased by 3K

The EUR long position continues to be trimmed from the high on September 1 week at 212K (was an all time high position as well). It currently is at long 140K. The position has been trimmed for the last 6 weeks. However, it still remains the largest position by far (the next is the JPY at long 28K).

Other highlights:

- AUD this went from long to short but only by 1K

- The CHF and NZD positions remained largely unchanged

- The JPY is the next largest position at 28K.

- The largest short position is the CAD at short 21K.