Archives of “November 2020” month

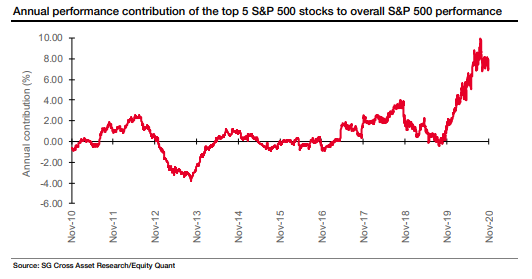

rssContribution of the 5 largest companies to the annual profitability of the S&P 500.

The influence of compounding on the performance of the S&P 500.

EU, UK likely to miss mid-November deadline to finalise Brexit deal – report

Reuters reports, citing sources familiar with the matter

The report says that ongoing negotiations in London are expected to last until the end of the week but EU envoys do not expect updates this week with Brexit tentatively being on the agenda for the 18 November meeting between EU ambassadors.

Adding that they now expect negotiators to present some semblance of a deal some time next week, unless talks yield a breakthrough or collapse before that happens.

The source adds that the real deadline is late next week. In other words, they are going to miss the soft deadline at the end of this week and push it to next week instead – where we are likely to experience the same kind of episode as per Brexit tradition.

Have US stocks topped for the year?

Via Bloomberg

I came across a Bloomberg piece making a case for vaccine euphorias being overdone. The heart of the thinking was as follows:

- Traders are not immunologists and have not driven down into the detail. Initial results show that protection is achieved 7 days after the second dose, which must come three weeks after the first dose. The whole process takes 28 days. So in order to be effectively vaccinated by year end you need to start the process by December 03.

- A 90% base effectiveness rate is a good sign for other vaccines which suggests there may be a range of other options in the first half of 2021

- The vaccine needs to be stored and transported at -70C which makes for logistical challenges. Pfizer hopes to apply to the FDA to start distributing later in November and has around 50 million doses prepared this year (enough to treat 25 million). This means that the best case scenario is for 25 million people vaccinated by year end.

- Now consider that 3.9 million people got the virus last week. So that means that if you assume this number of people get the virus each week it will mean that by year end there will be 29 million new cases, but only 25 million vaccinated. A net growth of 4 million cases.

All of the above points mean that the vaccine process will take time and that a correction lower in US stocks would make sense heading into year end.

Eurostoxx futures -0.2% in early European trading

Tepid tones observed in early trades

- German DAX futures -0.1%

- UK FTSE futures +0.1%

- Spanish IBEX futures +0.2%

European futures are little changed as we get the session underway with the market keeping more quiet after the manic start on Monday. Besides the kiwi, major currencies aren’t doing a whole lot so far, with US futures leaning towards slight gains for now.

S&P 500 futures are up 0.4% while Nasdaq futures are up 0.5% but trading has been a little choppy since the Asia Pacific session.

Nikkei 225 closes higher by 1.78% at 25,349.60

The Nikkei continues to push forward with gains on the week

Asian equities are mostly continuing the trend of investor rotation with tech stocks easing while financials, energy and travel stocks are posting modest gains on the day. Japanese stocks continue to stay buoyed with the Nikkei at its highest levels since 1991.

Elsewhere, the Hang Seng is up by 0.2% while the Shanghai Composite is down 0.2%.

US futures are keeping little changed but in a calmer mood as we look towards the session ahead. That is leaving major currencies little to work with as we observe minor changes for now, except for the kiwi which jumped on the RBNZ policy decision.

New York Times contacted election officials in all 50 US states – none reported any major voting issues

The New York Times contacted the offices of the top election officials in every state on Monday and Tuesday to ask whether they suspected or had evidence of illegal voting.

Officials in 45 states responded directly to The Times. For four of the remaining states, The Times spoke to other statewide officials or found public comments from secretaries of state; none reported any major voting issues.

Probably one of the most important charts in markets right now.

China’s real rates have climbed to among the highest globally right now.

(… and some still wondering why CNY is on tear lelz)

Hedge fund manager Ackman says markets too complacent about the coronavirus

Founder of Pershing Square, hedge fund manager Bill Ackman speaking on Tuesday at the Financial Times’ Dealmakers conference

- markets once again have become too complacent about the coronavirus.

- is hedging his equity exposure with insurance against corporate defaults

- “We’re in a treacherous time generally and what’s fascinating is the same bet we put on eight months ago is available on the same terms as if there had never been a fire and on the probability that the world is going to be fine.”

(Ackman referring to his similar trade earlier in the year that paid off big time).

FT link is here for mote (may be gated)

(This pic for a while back)