Archives of “November 2020” month

rssChina’s Sinovac coronavirus vaccine candidate – trials show it appears to be safe

COVID-19 China vaccine candidate update via Reuters:

- Sinovac’s covid-19 vaccine appeared to be safe and well-tolerated at all tested doses – phase i/ii trial results

- findings from phase iii will be crucial to determine Coronavac’s immune response – study

- Sinovac’s vaccine Coronavac suitable for emergency use during the pandemic, researchers say

- antibody levels induced by the coronavac vaccine were lower than those seen in people who had recovered from covid-19 – study

more to come

Japan’s government is pondering a 5-year 12tln yen spend on infrastructure

Considering the plan according to local media (Nikkei)

For ‘disaster-proof’ infrastructure.

France has revised down its 2021 GDP forecast from 8% to 6%

Economy and Finance Minister Bruno Le Maire announcing the downward shift in the projections

- blaming the health crisis. weaker rebound, re-introduction of restrictions

Most shorted index nearing 2018 high as vaccine headlines result in parabolic blowoff

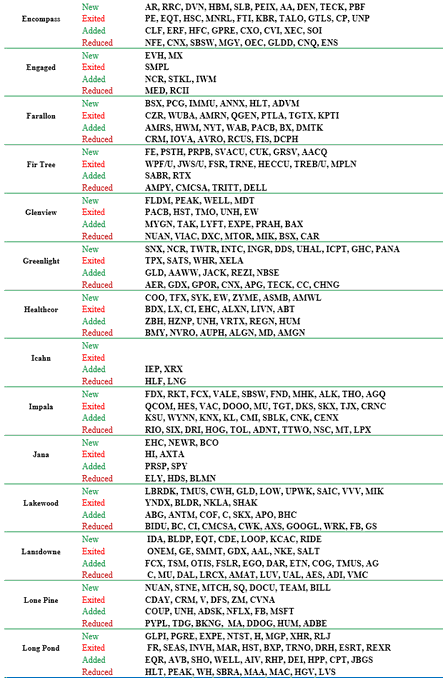

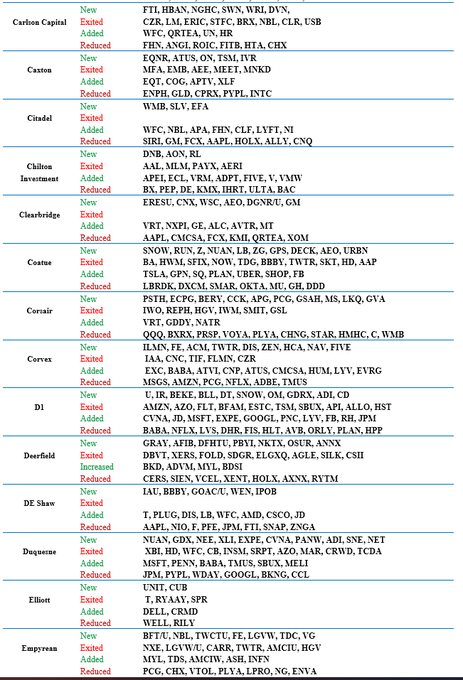

13F Recap of all the most important funds in the world

Russell 2000 closes at record for the 3rd consecutive day

Major indices all closed lower

The good and bad for the stock market day is that the small-cap Russell 2000 closed at record levels for the 3rd consecutive day. The not so great news is that the major indices all closed lower on the day and snapped today winning streaks.

- Dow on track for best month since January 1987

- Dow transports closed at record high

The final numbers are showing:

- S&P index fell -17.38 points or -0.4% to 3609.53. The high price reached 3623.11. The low price extended to 3588.68

- NASDAQ index fell -24.785 points or -0.21% to 11899.34. The high price reached 11950.18. The low price extended to 11852.41

- Dow industrial average fell -167.09 points or -0.56% to 29783.35. The high price reached 29872.42. The low price extended to 29520.29.

- Tesla, +8.19%. It was announced that it would be added to the S&P index

- Square, +4.82%

- Crowdstrike, +4.67%

- Charles Schwab, +4.29%

- Boeing, +3.79%

- Slack, +2.61%

- Snowflake, +2.53%

- Salesforce, +2.53%

- Box, +2.22%

- Pfizer, +1.85%

- FedEx, +1.83%

- Goodrx, -22.54%. Amazon announced today that they would enter the prescription services business

- RiteAid, -16.29% (Amazon competition)

- Walgreen boots, -9.64% (Amazon competition)

- CVS -8.62% (Amazon competition)

- Boston Scientific, -7.86%

- Home Depot, -2.51%. The shares fell down despite beating on revenues and earnings today

- American Express -1.86%

- Stryker, -1.79%

- Cisco, -1.55%

- Intel, -1.41%

- Facebook, -1.39%. Mark Zuckerberg testified on Capitol Hill today

- Corning -1.32%

- Microsoft, -1.26%

Thought For A Day

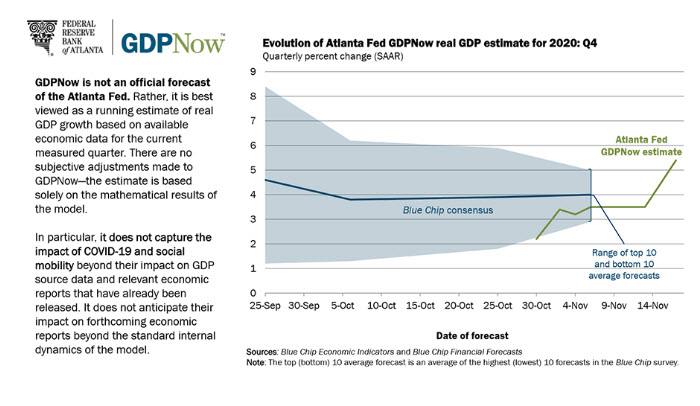

Atlanta Fed GDPNow estimate for 4Q rises to 5.4%

Big jump in Atlanta Fed GDP estimate from 3.5% last

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2020 is 5.4 percent on November 17, up from 3.5 percent on November 6. After recent data releases from the U.S. Bureau of Labor Statistics, the U.S. Census Bureau, the U.S. Department of the Treasury’s Bureau of the Fiscal Service, and the Federal Reserve Board of Governors, an increase in the nowcast of fourth-quarter real personal consumption expenditures growth from -0.4 percent to 2.6 percent was slightly offset by a decrease in the nowcast of real gross private domestic investment growth from 28.8 percent to 27.4 percent.

The next GDPNow update is Wednesday, November 18. Please see the “Release Dates” tab below for a list of upcoming releases.

European major indices close mixed on the day

France’s CAC, Italy’s FTSE MIB close higher

The major European indices are ending the day with mixed results. The provisional closes are showing:

- German DAX, -0.1%

- France’s CAC, +0.2%

- UK’s FTSE 100, -0.9%

- Spain’s Ibex, -0.6%

- Italy’s FTSE MIB, +0.7%

- Spot gold is trading down $2.45 or -0.13% $1886.36.

- Spot silver is trading down $0.19 or -0.78% at $24.57

- WTI crude oil futures are trading down $0.36 or -0.87% at $40.98

- S&P index -12 points or -0.34% at 3614.51

- NASDAQ index -23 points or -0.20% at 11900

- Dow -165 points or -0.54% to 9786