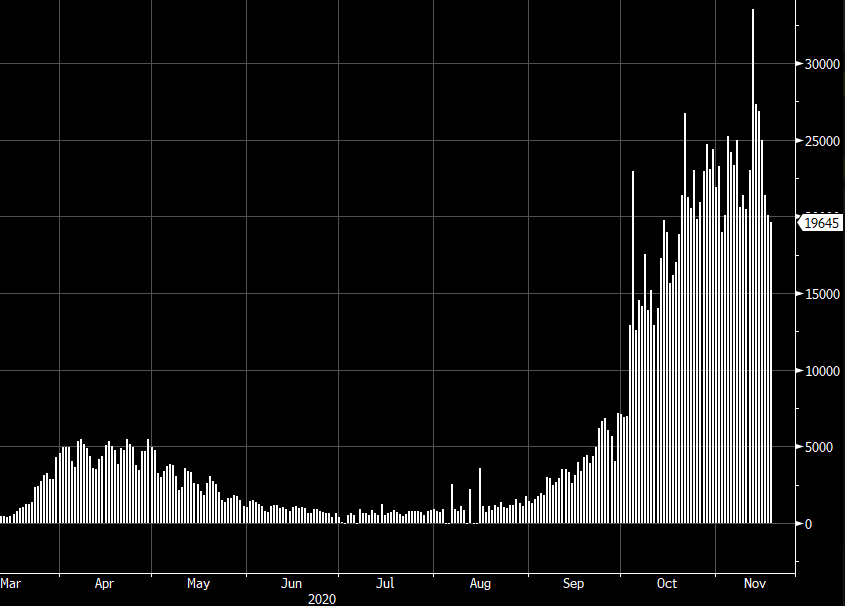

Reuters tallying up Thursday’s results, the highest single-day increase since the pandemic started.

Hospitals are already under severe strain, some at capacity. healthcare workers are overwhelmed. Adding in 185k new cases a day only stuffs the pipeline of admissions (and deaths) further and further. Its going to be a cold and bitter winter coming up in the US.