Archives of “November 2020” month

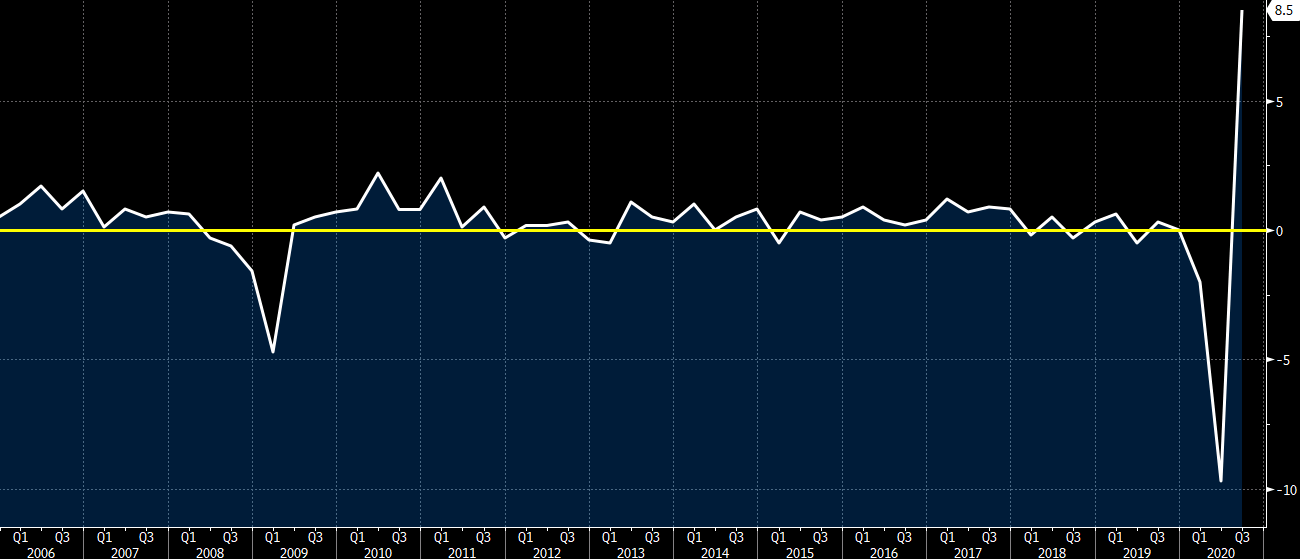

rssGermany Q3 final GDP +8.5% vs +8.2% q/q prelim

Latest data released by Destatios – 24 November 2020

- GDP (non-seasonally adjusted) -3.9% vs -4.1% y/y prelim

- GDP (working day adjusted) -4.0% vs -4.3% y/y prelim

- Private consumption +10.8% vs +9.0% q/q expected

- Prior -10.9%; revised to -11.1%

- Capital investment +3.6% vs +6.0% q/q expected

- Prior -7.9%; revised to -6.6%

The preliminary release can be found here. The final reading sees a slightly more positive revision but it does little to change the current market focus, amid the more gloomy backdrop in Q4 as tighter restrictions look set to extend into December.

Nikkei 225 closes higher by 2.50% at 26,165.59

Japanese stocks return from the long weekend with a bang

The Nikkei climbs by over 2% to close near the highs for the day, as Asian equities trade more mixed during the session. The Hang Seng is up 0.1% but the Shanghai Composite is down 0.5%, though that belies the overall market mood.

Risk is keeping in a more positive spot after a stronger finish by Wall Street overnight, with S&P 500 futures being up by 0.7% ahead of European trading.

The transition to the Biden administration has begun and the market is also feeling good about the likely return of Janet Yellen as Treasury secretary.

In the currencies space, the dollar is slightly weaker to start the day with risk currencies leading the way. The kiwi also got an additional boost from a potential addition of house prices to the RBNZ mandate, seeing NZD/USD jump to its highest level since June 2018.

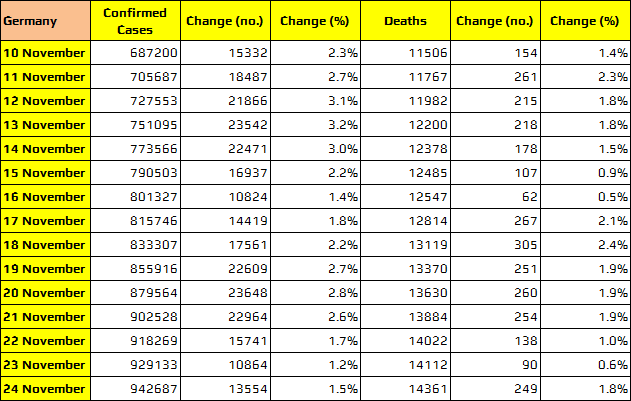

Germany reports 13,554 new coronavirus cases in latest update today

Another 249 deaths reported in the latest update

The virus cases have sort of reached a plateau over the past two weeks but they haven’t exactly shown much signs of abating just yet. The count typically picks up as we move towards the second-half of the week so we’ll see if there is a change.

But for now, this will continue to reaffirm that tighter restrictions may be needed for longer to curb the spread of the virus and ease the burden on healthcare capacity.

As of yesterday, there were 3,742 (+33) coronavirus patients needing intensive care with there still being 6,616 (24%) intensive care beds available across the country.

Morgan Stanley on the US dollar – lower in 2021

Looking for USD weakness next year, especially against commodity currencies

- See EUR/USD to 1.25 when the distribution of a COVID-19 vaccine or vaccines begins

- Cable to 1.36 as Brexit resolved but then falling away

- USD/JPY declining in 2021 but firming towards the end of next year as expectations of a Fed lift-off (in 2023) solidfy

- AUD/USD to 0.77

- NZD/USD to 0.74

- USD/CAD to 1.23

Barclays 2021 oil price forecasts for Brent, WTI ($53 and $50 /bbl respectively)

Barclays looking at the roll-out of vaccines as a turning point to boost demand

- could lead to a sustainable recovery for the economy

The note also adds, on the supply side, that the Bank expects OPEC+ to delay the increase in of production targets by three months.

(OPEC meet later in November, the 30th and also on December 1)

Barclays info via Reuters

Bezos on experimental vs operational failure. Simple and elegant comparison.

The world’s largest asset manager has upgraded US equities to “overweight”

BlackRock is the world’s largest asset manager, have turned bullish on quality large cap technology companies as well as small cap firms that tend to perform well during a cyclical upswing.

Reuters carry the report:

- BlackRock said it prefers the United States – has a higher share of “quality” companies with strong balance sheets and free cash flow generation in the high-flying tech and healthcare sectors

- resurgence in virus cases in Europe and the United States could led to further outperformance of large cap tech and healthcare companies

- BlackRock turned bearish on Europe.

Monthly SPX back to 2006 or so. Ok then.

Analyst who questioned AstraZeneca vaccine lays out his case

SVB Leerink’s Geoffrey Porges speaks on Bloomberg TV

Porges was in the news today because he questioned AstraZeneca’s vaccine news today, saying that the company embellished the data and that it will never be approved in the US.

“It wasn’t particularly clear what the efficacy was… then they changed the dose, partway through because of a manufacturing problem and serendipitously that created a much better outcome in a small sample.”

He said you can’t draw too many conclusions from 2700 test patients, it’s a small sample.

He highlighted how the spike protein via a primate vector and that could be

“I’m going to be signing up for the 90%, not the one that’s 70%, maybe 60%, maybe 90%,” he said.

Executives said they will publish the full data set later in the week.

Porges said he wants to see the full safety database, data on showing whether there are adverse events and whether it helps prevent severe cases.

His report hurt the shares of AstraZeneca earlier today and still remain about 2% lower.