Thought For A Day

Societe Generale discusses its outlook for EUR/USD for the coming year.

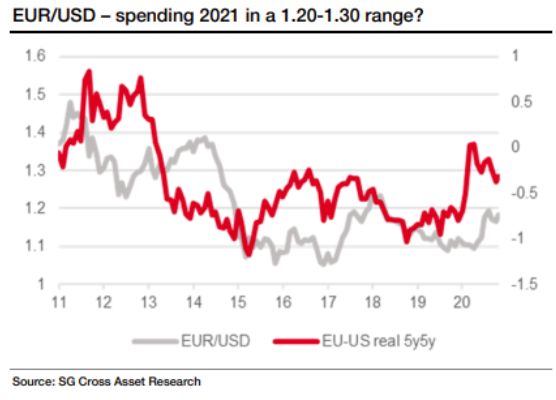

“Relative real rates started to turn less negative for the EUR/USD in 2019, but the Fed has accelerated that development with its dramatic policy moves this year,” SocGen notes.

“That should take EUR/USD into a 1.20-1.30 range during 2021, and eventually to a 1.25-1.35 range centred on where we see fair value – though fair value for EUR/USD will be predicated on the dollar losing ground against a lot more currencies than just the euro, and may have to wait for a broad-based rally in EMFX, which isn’t something we see happening just yet,” SocGen adds.

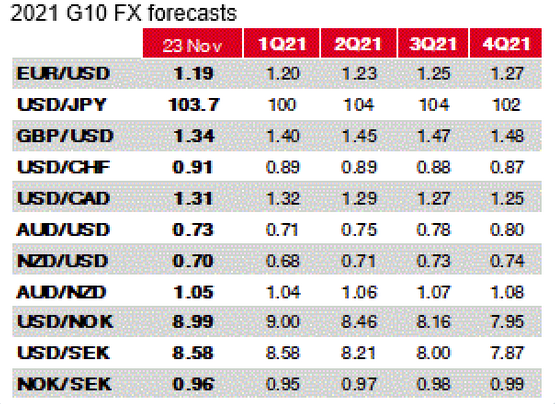

Here are the latest SocGen FX forecasts, note the escalation in cable as well:

Meanwhile, Reuters is also reporting that Italy is to get 16 million shots of AstraZeneca’s coronvirus vaccine some time in early 2021. I reckon the combination of the news is helping to keep the push higher in BTPs, as 10-year yields hit a record low of 0.604%.