Archives of “November 25, 2020” day

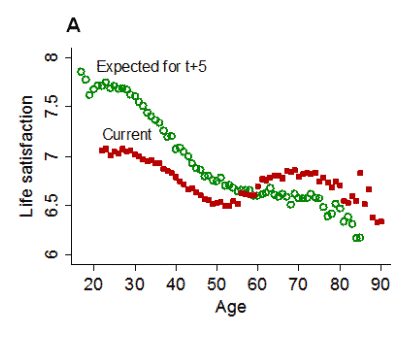

rss“Young people constantly overestimate their satisfaction with future life. They make a huge forecast error.”

Analysts tipping a further rise for the Dow

Via Reuters polling, analysts looking for more gains on the back of the release of a COVID-19 vaccine driving an economic and corporate earnings recovery from the pandemic

Forecasts:

- S&P 500 will finish 2020 at 3,600

- S&P 500 will finish 2021 at 3,900

- Dow Jones industrial average will finish 2021 at 32,500

Reuters poll of 40 strategists over the last two weeks.

More:

- S&P 500 earnings to jump 23% in 2021

- expectations the Fed will remain accommodative

- “The Fed has said they intend to keep short rates grounded at zero through at least 2023. With ultra low rates, stocks have little competition”

—-

On the Fed and 2023 … I would not be banking on this, if there is a sniff of better data (there already is) and higher inflation (not yet) the Fed will find an excuse to hike.

Although, for now:

Bank of England warn of a disastrous no-deal Brexit, worse than the virus – UK car industry expect a huge slump also

An ICYMI heads up to comments from Bank of England Governor Bailey:

- failing to secure a new trade deal with the European Union would do more damage to the UK economy over the long run than the coronavirus pandemic

- “I think the long-term effects … would be larger than the long-term effects of Covid,”

- “It takes a much longer period of time for what I call the real side of the economy to adjust to the change in openness and to the change in profile in trade”

Bailey was speaking in testimony before parliament’s Treasury committee.

Meanwhile the UK motor industry is warning of production losses of £55bn over the next five years if no Brexit deal is agreed. That is the number from the Society of Motor Manufacturers and Traders. SMMT is urging the government to get a deal that avoids resorting to tariffs under World Trade Organization rules.

—-

Meanwhile the clock is ticking, the UK will leave the EU transition period on January 1 . Just over 37 days away.

Bank of America like oil higher on coronavirus vaccine driven rebound in global economy

Forecast for Brent crude is it could hit as high as $60 a barrel in the next (northern hemisphere) summer

- easing travel restrictions to boost demand

- BoA expect the oil market to drop into a 1.6m barrels a day deficit in 2021 (compared with a surplus of 3m this year)

Dow and S&P close at record highs. Dow 30,000.

Russell 2000 closes at a record high as well

The Dow, S&P and Russell 2000 all closed at record levels for the day. Moreover, the Dow 30 close above the 30K level for the first time ever.

The S&P had the best day in 3 weeks.

The final numbers are showing:

- S&P index up 57.84 points or 1.62% to 3635.42

- Nasdaq up 156.15 points or 1.31% to 12036.78

- Dow rose 454.97 points or 1.54% to 30046.24

Winners today included energy, financials and transportation. Some of the biggest winners include:

- United Airlines, +9.87%

- American Airlines, +9.29%

- Wells Fargo, plus a .78%

- Exxon Mobil, +7.51%

- Citigroup, +7.04%

- Tesla, +6.52%

- Delta Air Lines, +6.37%

- Bank of America, +5.82%

- Morgan Stanley, +5.51%

- PNC financial, +4.83%

- J.P. Morgan, +4.63%

- Walt Disney, +3.78%

Some losers today included:

- Chew -2.71%

- Goodrx, -2.59%

- Rackspace, -2.4%

- Square, -2.21%

- Nvidia, -1.39%

- Chipotle, -1.39%

- Slack, -1.2%

- Amgen, -0.87%

- General Mills, -0.74%

- Zoom, -0.6%

- Micron, -0.34%

- Procter & Gamble, -0.32%

- AMD, -0.29%

You’ve been warned.

Thought For A Day