Archives of “November 23, 2020” day

rssWith the market suddenly tuned into economic data, here’s what’s coming up the rest of the week

A look at the calendar

Tuesday:

- Consumer confidence

- Richmond Fed

Wednesday:

- Weekly jobless claims

- Advance trade balance

- Q3 GDP (second look)

- PCE report

- Durable goods orders

- New home sales

- FOMC meeting minutes

Thursday is US Thanksgiving and Friday is also a de facto holiday as well as Black Friday.

Canada leads in net debt creation b/c the fiscal deficit will balance itself.

Janet Yellen Now Favored To Become Treasury Secretary

President-elect Biden is expected to name some of Cabinet picks on Tuesday,

President-elect Joseph R. Biden Jr.’s transition team will officially announce its first cabinet appointments on Tuesday, said Ron Klain, Mr. Biden’s incoming White House chief of staff, although he declined to say which ones.

The names of at least three expected cabinet appointments were released on Sunday night by people close to the decision process, including Anthony J. Blinken for secretary of state, Jake Sullivan as national security adviser and Linda Thomas-Greenfield as ambassador to the United Nations. – NY Times

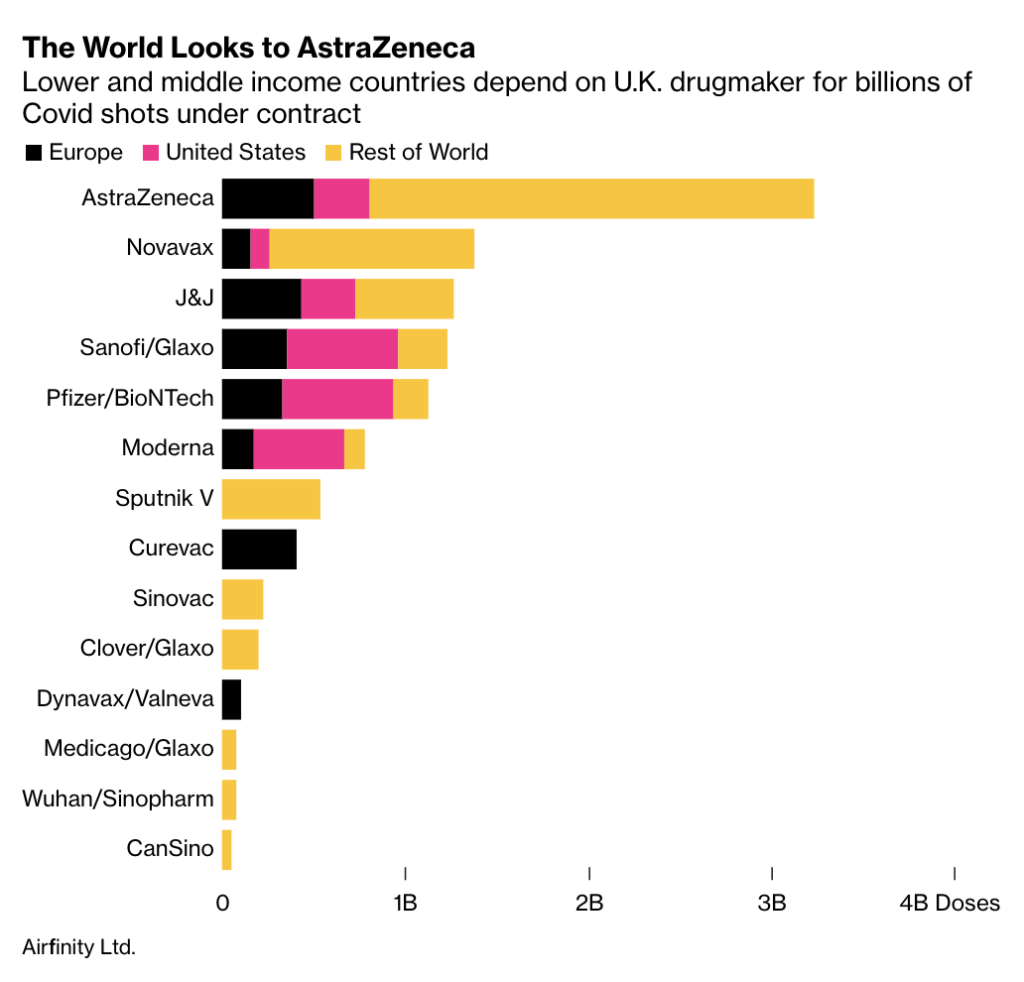

Astra-Oxford Shot Is Key to Escaping Pandemic for Many Nations

Brexit: Rumours of a “temporary deal” in the works to be agreed this week

Tweet by Dave Keating, Brussels correspondent for France 24

I’m hearing rumours we may see an emergency “temporary #Brexit deal” agreed this week to avoid #NoDeal happening in midst of #COVID19.

If this is true, it’s important to point out that this will *not* be a “deal”.

It’s essentially an extension. The problem doesn’t go away.

Just something to take note. This could be what all the murmurs and whispers were referring to since the weekend.

It seems like this may allude to an agreement on the supposed 95% of the deal, with any agreement on the remaining 5% i.e. fisheries, governance, level playing field is likely to be postponed/extended pending further negotiations.

That brings us back to what I was referring to earlier in the day here:

Otherwise, we are likely to see the can kicked down the road again and I firmly believe that at the end of the day, both sides will fall back on some technicality to sell a compromise.

A skinny deal excluding the three key outstanding issues (instead postponing them) will allow Boris Johnson to “technically” stick with a Brexit on 1 January 2021 while the EU doesn’t have to move its red lines and be made to look worse off from any deal.

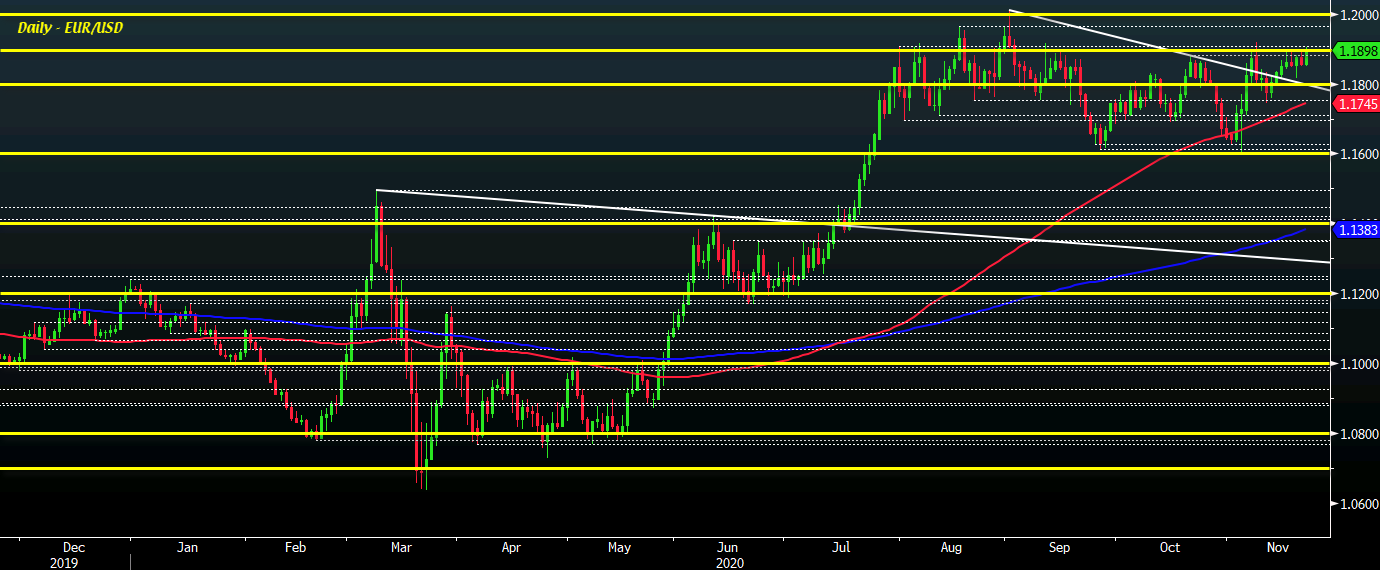

EUR/USD touches 1.1900 as dollar eases lower on the session

The dollar is keeping weaker across the board so far today

EUR/USD is once again testing the 1.1900 handle, reaching a high of 1.1906, as the dollar is seen weaker so far in European trading today.

Risk remains in a better spot with European equities posting a modest advance of around 0.5% to 0.7% currently while S&P 500 futures are also higher by 0.6%.

But the movement out of the dollar looks more flow-based than any reaction to risk, with the greenback sitting as the weakest performer among the major currencies.

Even with 10-year Treasury yields up 2.5 bps to 0.849%, USD/JPY is down to 103.70.

Looking back to EUR/USD, buyers will have a key test ahead of the close today in trying to keep above the 1.1900 handle. The 9 November pop on the vaccine news saw the high touch 1.1920 and a push above that will start to bring 1.2000 back into the picture again.

Otherwise, a failure to hold another break above 1.1900 may lead to some exhaustion as the pair continues to consolidate just below that.

Elsewhere, AUD/USD is still settling around 0.7320-30 levels with short-term resistance at 0.7340 still holding. GBP/USD is off earlier highs of 1.3380 to sit around 1.3350-60 levels while NZD/USD is still flirting with a retest of the December 2018 high of 0.6969.

Fake Zoom invite steals $8m from Australian hedge fund

The cyberattack on the fund was initiated after a fake Zoom invitation was clicked, which triggering a malicious software program to be planted on the company’s network.

This allowed control of its email system, the sending of bogus invoices and approvals.

The fund, Levitas Capital, was forced to close due to its largest institutional client withdrawing its money after the cyber attack.

Info via the Australian Financial Review, here is the link for much more (may be gated) .

China warns that relations with the US will not automatically get better under Biden

China says that the good old days are over

Chinese government adviser, Zheng Yongnian, is reported as to saying that Beijing must not assume that the US-China relationship will get better under a Biden presidency, and should instead be prepared for a tougher stance from Washington.

“The good old days are over… the cold war hawks in the US have been in a highly mobilised state for several years, and they will not disappear overnight.”

Much like you would expect, Zheng also reaffirmed the continued divide between the US and China in saying that:

“American society is torn apart. I don’t think Biden can do anything about it. He is certainly a very weak president, if he can’t sort out domestic issues, then he will do something on the diplomatic front, do something against China. If we say Trump is not interested in promoting democracy and freedom, Biden is. Trump is not interested in war… but a Democratic president could start wars.”

Adding that the difference between Trump and Biden is that Trump is unpredictable or in his words, “irrationally tough” on China, whereas Biden would be “rationally tough”.

The full report can be found here via the SCMP.

All of this pretty much reaffirms the narrative that regardless of who is in charge in the White House, there is only one direction that US-China relations are headed towards. The next decade could well end up being a defining one as these two powerhouses of the world continue down the path of decoupling – in some sense or another.

Singapore data: Q3 GDP +9.2% q/q, still down y/y

Third quarter economic growth in Singapore rebounded q/q, ahead of Q2 but missed expectations:

- Q3 GDP +9.2% q/q (seasonally adjusted rate) vs. expected 9.5%, prior 7.9%

- Q3 GDP -5.8% y/y vs. expected -5.5%, prior -7.0%

More:

The Ministry of Trade and Industry has revised their 2020 GDP growth forecast to -6.5% to -6% (previous forecast -7% to -5%)

- forecasts 2021 GDP growth of +4% to +6%

- says 2020 sales volumes in consumer-facing sectors likely to remain below last year’s levels

- says economic activity in consumer-facing sectors not likely to return to pre-covid levels even by end-2021

- 2020 NODX forecast adjusted upwards to +4% to +4.5%

- 2021 NODX forecast 0% to +2%

- 2020 trade merchandise forecast adjusted upwards to -7.5% to -7%

- 2021 trade merchandise forecast +1% to +3%

The forecasts are being bumped up a little as officials see an end in sight for COVID-19 outbreaks.