Archives of “November 10, 2020” day

rssNikkei 225 tops 25000. It’s time for a big collective “genki desu” — altogether now!

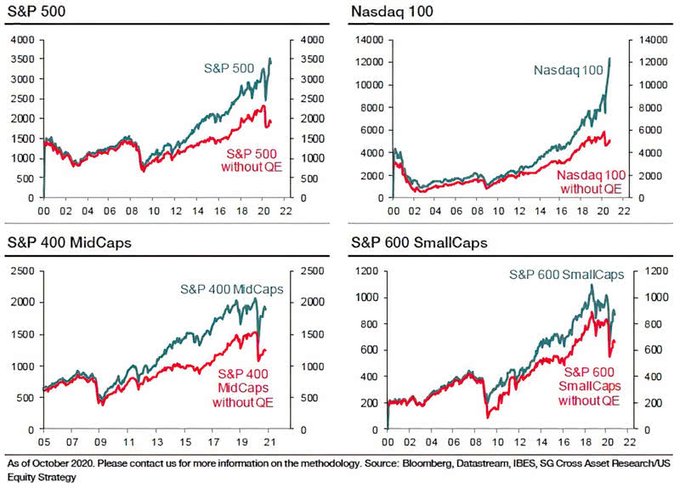

Influence of monetary stimuli on the stock market.

JP Morgan forecast S&P500 to 4000 in early 2021 and higher still after that

An ICYMI from a note from JPM (via Reuters)

- S&P 500 index to hit 4,000 by early 2021

- Pfizer COVID-19 vaccine update “one of the best backdrops for sustained gains in years.”

- index to hit about 4,500 by the end of 2021

Federal Reserve says assets may have a large decline if coronavirus is not contained

Major points from the report (Headlines via Reuters):

- business debt has risen sharply; reduction in economic activity has weakened ability to service debt

- household loan defaults may rise

- banks continue to be well-capitalized, though challenging conditions remain

- strains in household, business sectors mitigated by government lending, relief and low interest rates

- protracted slowdown could harm finances of even households with high credit scores, leading to defaults

- sources of vulnerability in household, business sectors unevenly distributed

- Fed includes climate change risks in financial stability report for first time

- climate risks could result in more frequent, severe financial shocks

- disruptions in global dollar funding markets are ‘important risk’ to financial system

- fiscal stimulus, lower interest rates, emergency lending facilities and asset purchases supported stronger-than-expected economic recovery

- uncertainty remains high and investor risk sentiment could shift quickly if recovery proves less promising or efforts to contain coronavirus disappoint

- most banks’ common equity tier 1 (cet1) ratio recovered to pre-pandemic levels in the second quarter as demand for bank credit waned and earlier drawdowns were repaid

- yields on corporate bonds dropped to historically low levels but remain elevated for airlines, energy and leisure industries heavily affected by pandemic

- true status of bank loan credit quality is not reflected in loan delinquencies because of loss-mitigation programs, government stimulus payments, and ppp loans

- delinquency rates on commercial mortgage-backed securities have spiked

- as programs expire, some accounts in loss mitigation could result in higher bank delinquency rates later this year and early next year, followed by higher charge-off rates and losses

- all told, a great deal of uncertainty about the future path of these losses remains

- strength in housing sector reflects robust demand from households but downside risks remain, given unusually large number of mortgage loans in forbearance programs

- leverage is at historically low levels at broker-dealers but is at post-2008 highs at life insurance companies

- leverage remains elevated at hedge funds relative to past five years

- funding strains on mortgage servicers eased after policy actions, but uncertainties remain

- money markets have stabilized but would be vulnerable without the emergency facilities in place

- outflows from long-term mutual funds that hold less liquid assets have mostly reversed

- redemption waves had run-like characteristics that highlighted significant structural vulnerabilities in the sector

- collateralized loan obligation fundamentals have improved but are still weak compared with pre-pandemic levels

NASDAQ tumbles into the close. Dow and S&P close higher but near session lows

Dows best day since June 5

The major indices opened sharply higher on the back of the Pfizer news on a vaccine. The gains were led by the Dow industrial average the S&P index. The NASDAQ index went along for the ride early on. However, a late day selling pushed the NASDAQ into negative territory. The Dow industrial average and S&P index also close near session lows but still higher on the day.

- All the major indices reached intraday all time record highs.

- Dow had his best day since June 5

- Covid gainers got hammered today including Zoom, Home Depot, Whirlpool, Amazon and Netflix

A look at the final numbers shows:

- S&P index rose 41.06 points or 1.17% at 3550.50. The high price reached 3645.99. The low price extended to 3547.48

- NASDAQ index fell -181.448 points or -1.53% at 11713.78. It’s high price reached 12108.06. The low price reached 11703.49

- Dow industrial average rose 834.57 points or 2.95% at 29157.97. It’s high price reached 29933.83. The low price extended to 29130.66.

Some losers today included:

- Zoom, -17.4%

- Crowdstrike, -10.76%

- Whirlpool, -10.4%

- snowflake, -9.49%

- Netflix, -8.56%

- Square, -7.09%

- Costco, -5.39%

- Amazon, -5.06%

- Facebook, -5.04%

- Home Depot, -5.03%

winners included:

- American Express, +21.43%

- United Airlines, +19.23%

- American Airlines, +15.18%

- Bank of America, +14.27%

- Boeing, +13.71%

- J.P. Morgan, +13.62%

- Walt Disney, +11.87%

- Citigroup, +11.64%

- PNC financial, +11.57%

- Exxon Mobil, +10.34%

- MasterCard, +9.93%

- Southwest Airlines, +9.72%

Thought For A Day