Markets:

- EUR leads, USD lags on the day

- European equities higher; E-minis up 1.8%

- US 10-year yields down 1 bps to 0.753%

- Gold up 1.2% to $1,926.20

- WTI down 0.8% to $38.88

- Bitcoin up 6.4% to $14,899

The market continues to be fixated on the US election where there is still no winner called yet between Trump and Biden as the vote count continues into the week.

Biden continues to look like he may very well pip it in the end but the race is tight in the likes of Arizona and Nevada as well, so it may very well come down to Trump’s lead in Pennsylvania if the tables start turning in the other states.

The bond market stuck with the stimulus narrative, being that there isn’t going to be any massive spending coming, as yields fall but not as dramatic as yesterday.

Meanwhile, equities continued to rally further with European indices on the hunt for a fifth straight day of gains after the meltdown seen at the beginning of last week.

US futures also soared higher with S&P 500 futures jumping up by 1.8% while Nasdaq futures are holding near 3% gains going into North American trading.

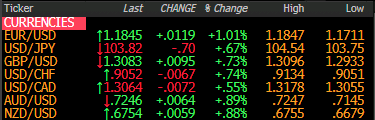

In the FX market, the dollar sank heavily across the board with EUR/USD rising by nearly 1% from 1.1730 to near 1.1847 and is keeping near the highs still now.

The pound got a slight lift as the BOE introduced more QE, while refraining from any negative rates talk, seeing cable rise from 1.2940 to 1.3000 before surging to 1.3096.

USD/JPY also dropped to a fresh low since March below 104.00 with AUD/USD surging from 0.7170 to 0.7247 as price trades at its highest level in nearly a month.

There’s still plenty of question marks up in the air as we digest the market moves but it seems like investors are somehow cherry-picking what they want from the election i.e. all the benefits from a Biden win without wanting to deal with the flip side of the story.

That said, all of this could also be a function of election finally getting out of the way – take a look at the drop in VIX. In other words, a sigh of relief being let out by the market.

The technicals are starting to break down for the dollar now but with the election narrative still not over yet, we could be in store for more twists and turns before the week ends.