Copper vulnerable in the short term

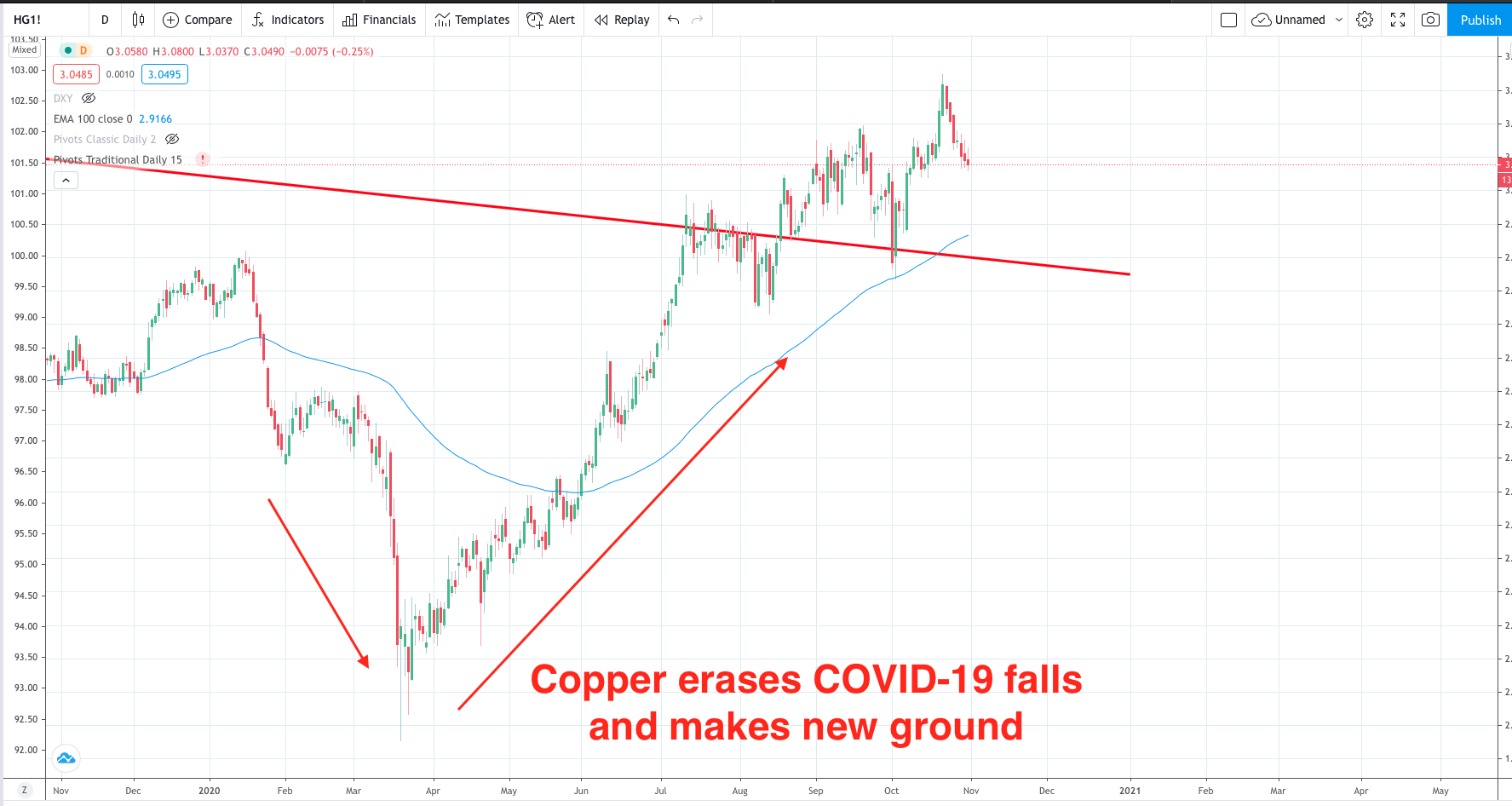

The return to national lockdowns has been the catalyst for the recent stock sell off in Europe and beyond. This does leave Copper looking vulnerable to a correction in the near term as industrial demand should take a hit and reduce the demand for copper. The recent bull run in copper has been very strong and managed to easily brush off its original COVID-19 falls and make new ground:

The long term picture for copper remains good

The move to electric vehicles is now well under way. Copper stands to gain from the green tech, so it is hard to see copper prices keep falling without seeing dip buyers step back in.

Where and when might they return?

Well the first catalyst for a Copper dip buyer could come next week. One of the key differences between Republican President Trump and Democrat Joe Biden is their differing proposals around Green investments plan. While President Trump advocates more spending on roads, bridges, and airports he has signalled very little interest in ‘green’ investments. However, Joe Biden on the other hand has said that he will spend $2 trillion over four years to improve infrastructure, create zero-emissions, public transport and create clean energy jobs. Green investments stand to gain big with a Biden Presidency. So, one key area to be looking out for is if Democrats win both the House and the Senate races. This could mean a strong move from green investments likely to benefit from Biden’s plans. With both houses under Democrat control it will be easier for Biden’s policies to pass. Biden is ahead in the polls, so buying copper the day before could be a shrewd move. However, it could equally go horribly wrong if Trump does another surprise (highly unlikely) or is the US election is contested and ends up getting dragged out over weeks.