Archives of “October 2020” month

rssGet ready for negative rates

This is why #amazon is worth trillions!

Alfaazo K Fakir / अल्फ़ाज़ों के फ़क़ीर (Hindi) -#AnirudhSethi

“Love is never outdated, it keeps updating with the time.”

This is all I want to convey through my book “Alfaazo K Fakir”. It is a complete package of feelings, thoughts, imaginations and some of the real stories that I have seen in the society and surrounding in my poetic way.

I haven’t written any poetries I just have tried to pen down some of the real stories that I have seen in my life and others too, some of them I have felt for me and some in the other people.

Basically, it’s a glimpse of the love that occurs in the face and heart of the people who are in love, were in love or they are just thinking of love.

You may have seen people sad when they broke up, happy when they patch up, lost in the deep and beautiful eyes of their lover, talking senseless in the absence of the paramour, amazed and blessed after meeting , totally lurked in the emotional river after their first kiss, drinking after seeing some bitter phase, etc. This is all that I have also examined in the different people and that I have written in this.

I am not that perfect and mature in this segment as I said, but I am feeling ful. I request you all to shower your love by reading my thoughts and experiences interlaced in the form of poetry.

The earnings season begins next week

Financials led the way

Believe it or not, the earnings season gets underway next week. As is the tradition, financials will predominantly lead the charge. Below is a list of some of the bigger names who will release their earnings next week:

Tuesday:

- Johnson & Johnson

- J.P. Morgan Chase

- Citigroup

- BlackRock

- Delta

Wednesday

- Bank of America

- Wells Fargo

- United

- UnitedHealth group

Thursday

- Morgan Stanley

- Walgreens

- Intuitive Surgical

Friday

- Bank of New York Mellon

- Schlumberger

- JB Hunt

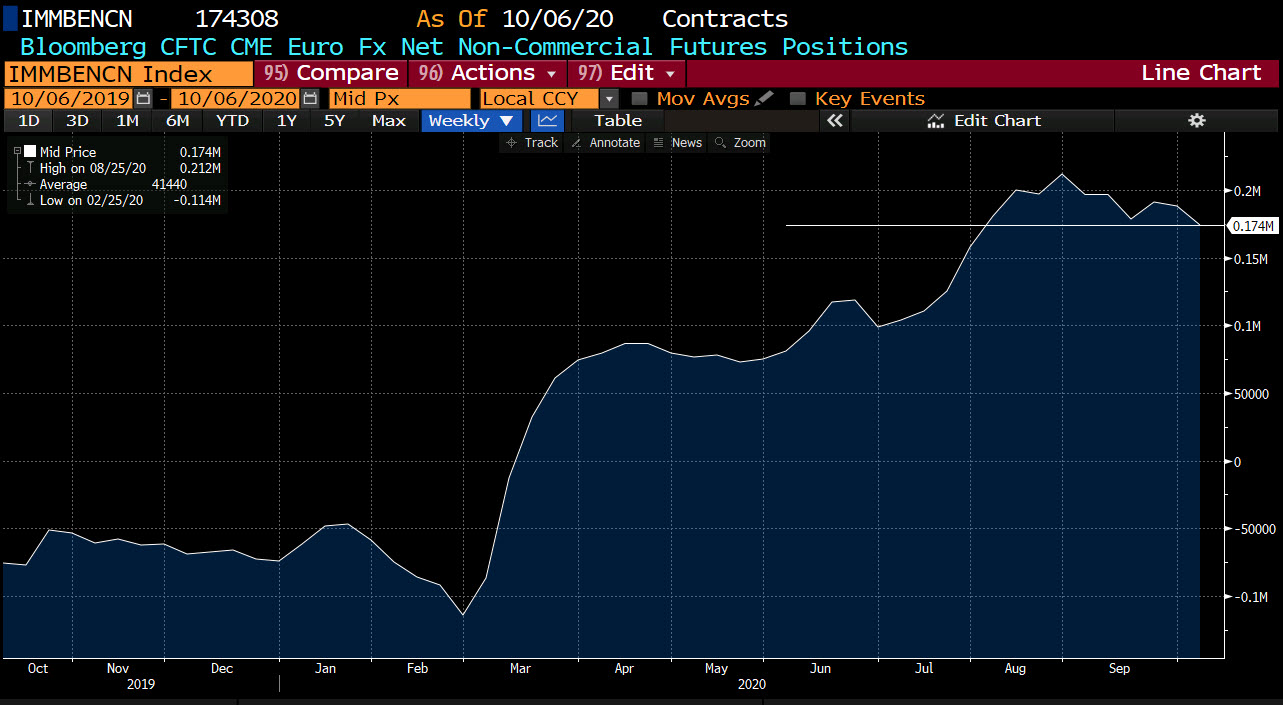

CFTC commitments of traders: EUR longs lowest since end of July

CFTC commitments of traders data for the week ending October 5, 2020

- EUR long 174K vs 188K long last week. Longs trimmed by 14K

- GBP short 11K vs 13k long last week. Shorts trimmed by 2K

- JPY long 21K vs 25K long last week. Longs trimmed by 4K

- CHF long 13K vs 13K long last week. Positioned unchanged

- AUD long 11K vs 9K long last week. Longs increased by 2K

- NZD long 5K vs 3K long last week. Longs increased by 2K

- CAD short 18k vs 19K short last week. Shorts trimmed by 1K

- prior report

The EURUSD longs were trimmed to 174K from 188K last week. It is the 2nd consecutive decline in the position and in doing so, took the net speculative position to the lowest long since the end of July.

Having said that, the position remains the largest speculative position of the major currencies by far. The JPY is the next highest at 21K long. The largest short position remains the CAD at -18K.

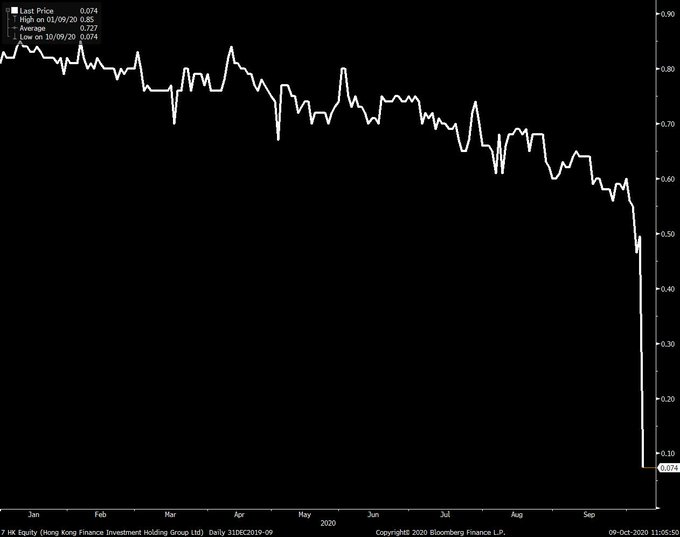

Shares of Hong Kong Finance Investment just fell 90

Stocks close at the highest level since September 2. Dow closes positive for the year

Indices close near the highs for the day

The US stock markets are closed for the day. All 3 major indices close higher on the day led by the NASDAQ index.

Highlights for the day include

- Dow’s close positive for 2020

- Major indices close at the highest level since September 2

- Dow enjoys its best week in 2 months

- NASDAQ leads the charge higher today, this week

- S&P NASDAQ best weeks in more than 3 months

- Major indices close higher for the 3rd consecutive day

- S&P closed at 3% below the all-time high

The final numbers are showing:

- S&P index rose 30.30 points or 0.8% the 3477.13

- NASDAQ index rose 158.96 points or 1.39% at 11579.94

- Dow industrial average closed up 161.39 points or 0.57% at 28586.90

For the week, each of the indices enjoy gains of over 3.25% led by the NASDAQ index:

- S&P index rose 3.84%

- NASDAQ index rose 4.56%

- Dow industrial average increase by 3.27%

Year-to-date the NASDAQ still outperforms by a substantial amount:

- S&P index up 7.63%

- NASDAQ index up 29.06%

- Dow industrial average up 0.17%

Thought For A Day

McConnell: Doesn’t know if there will be a deal or not

He said earlier today, there would most likely not be a deal before the election

He says:

- Does know if there will be a deal or not

- Deal must include liability protections

- 1st priority is the Supreme Court nomination

Meanwhile political is reporting that senior officials are saying that White House, Congress to work on the deal through the weekend.

The GOP is at $1.8T. The Dems are at $2.2T.