Archives of “October 31, 2020” day

rssCoronavirus – UK PM Johnson to announce a new lockdown, through to until December 2

As COVID-19 cases in the UK accelerate higher Prime Minister Johnson will soon announce another shutdown. The measures will take effect from Thursday after a vote in the Commons on Wednesday.

The main points, these via various UK media outlets with the info:

- pubs and restaurants to close – takeaway and delivery only

- non-essential retail to close

- manufacturing, construction permitted to continue

- outbound international travel banned, intra-UK travel restrictions (both except for work)

- schools, universities open

- outdoor exercise and recreation permitted

Common Psychological Fallacies on Risk and Probability

- Tendency to overvalue wagers involving a low probability of a high gain and to undervalue wagers involving a relatively high probability of low gain.

- Tendency to interpret the probability of successive independent events as additive rather than multiplicative.

- Belief that after a run of successes, a failure is mathematically inevitable, and vice versa (aka Monte Carlo fallacy).

- Perception that a favorable event has higher probability over an unfavorable event even though their mathematical probability is the same.

- Tendency to overestimate the frequency of occurrence of infrequent events and to underestimate that of comparatively frequent ones after observing a series of randomly generated events.

- Confuse the occurrence of “unusual” events with the occurrence of low-probability events (e.g. getting 13 spades is just as probable as getting any other hand).

THE ECONOMIST GIVES BIDEN A 96% CHANCE OF WINNING

November central bank overview

Major central bank rundown

The central banks are listed below with their current state of play. The link for each central bank is included under the title of the bank and the next scheduled meeting is in the title too.

Reserve Bank of Australia, Governor Phillip Lowe,0.25%, meets 03 November

Going into their latest October meeting some analysts had been anticipating a potential RBA cut. As it turned out the RBA kept rates on hold, but they signalled that they would continue to consider how additional monetary easing could support jobs:

“The Board views addressing the high rate of unemployment as an important national priority. It will maintain highly accommodative policy settings as long as is required and will not increase the cash rate target until progress is being made towards full employment and it is confident that inflation will be sustainably within the 2-3 per cent target band. The Board continues to consider how additional monetary easing could support jobs as the economy opens up further”

You can read the full statement here. This opened up the potential for a rate cut ahead and at the time of writing the OiS markets now price in a 84% chance of a rate cut for November’s meeting. The RBA watcher McCrann also moved to expecting a ‘rate cut’ plus on Cup Day. So, a rate cut I snow the base case for this week.

Of other note is that Australia’s Government announced an aggressive stimulus package on October 06. There is now a large fiscal deficit plan in place to support the country and, according to analysts, there will be few ‘losers’ in stocks. This will help the ASX200 catch up with its Asian peers since a rebound started in March of this year. Australian shares will also be helped by a weaker AUD and as bond yields drift lower towards zero after the Reserve Bank of Australia kept open a rate cut ahead after yesterday’s RBA meeting. SO, stocks have been hit on the latest lockdowns but medium term buyers should be rewarded if they stay the course.

Remember that the Australian economy is closely tied to China’s economy. Approximately 30% of Australia’s GDP comes from its trade with China. Therefore, expect the AUD to be pushed or pulled along with the US-China trade sentiment. If Trump wins the US election then that should drag AUD lower as trade tensions between US and China will ramp up. There is also a very strong correlation between the S&P500 and the value of the AUD. A falling S&P500 tends to weaken the AUD and vice versa, so keep an eye on the latest US stock moves as well in deciding the next path for AUD

China official PMIs for October: Manufacturing 51.4 (vs expected 51.3) Services 56.2 (expected 56.0)

The manufacturing PMI fell from September but not by as much as expected (central median estimate).

Manufacturing 51.4

- expected 51.3, prior 51.5

Non-manufacturing 56.2

- expected 56.0, prior 55.9

Composite 55.3

- prior 55.1

Official Purchasing Manager’s Index (PMI) from China’s National Bureau of Statistics.

- All remain above 50 and in expansion.

China’s economy is still struggling out of the pandemic response earlier in the year, but the data from the country is improving quicker than elsewhere around the globe (China did come out of the harsh lockdowns earlier than other countries, having gone in first, and so far have avoided the large second-waves being seen presently in Europe and the US).

China’s services sector had been slower to recover but accelerated in Q3.

I can’t see this data having too much impact when FX markets open again on Monday, but join me then and we’ll soon find out!

Spot what’s wrong with this #Tesla

US 10-year yields rise to the highest since June

Treasury yields break the high

US 10-year yields are now up 4.4 bps on the day to 0.8670%. It’s highly unusual to see US stocks down 2-3% and Treasury yields higher.

There are two possible explanations:

- Month end flows

- Treasuries sensing a Biden win

Flows are flows so we will get an answer to that on Monday but a Biden win and blue sweep is a consensus call for higher yields because of larger deficits and more stimulus spending, which is inflationary. I think that’s a possibility here if only because the rout in stocks is so heavily skewed towards tech.

At some point both markets will need to agree but we’re probably going to be waiting until after the vote.

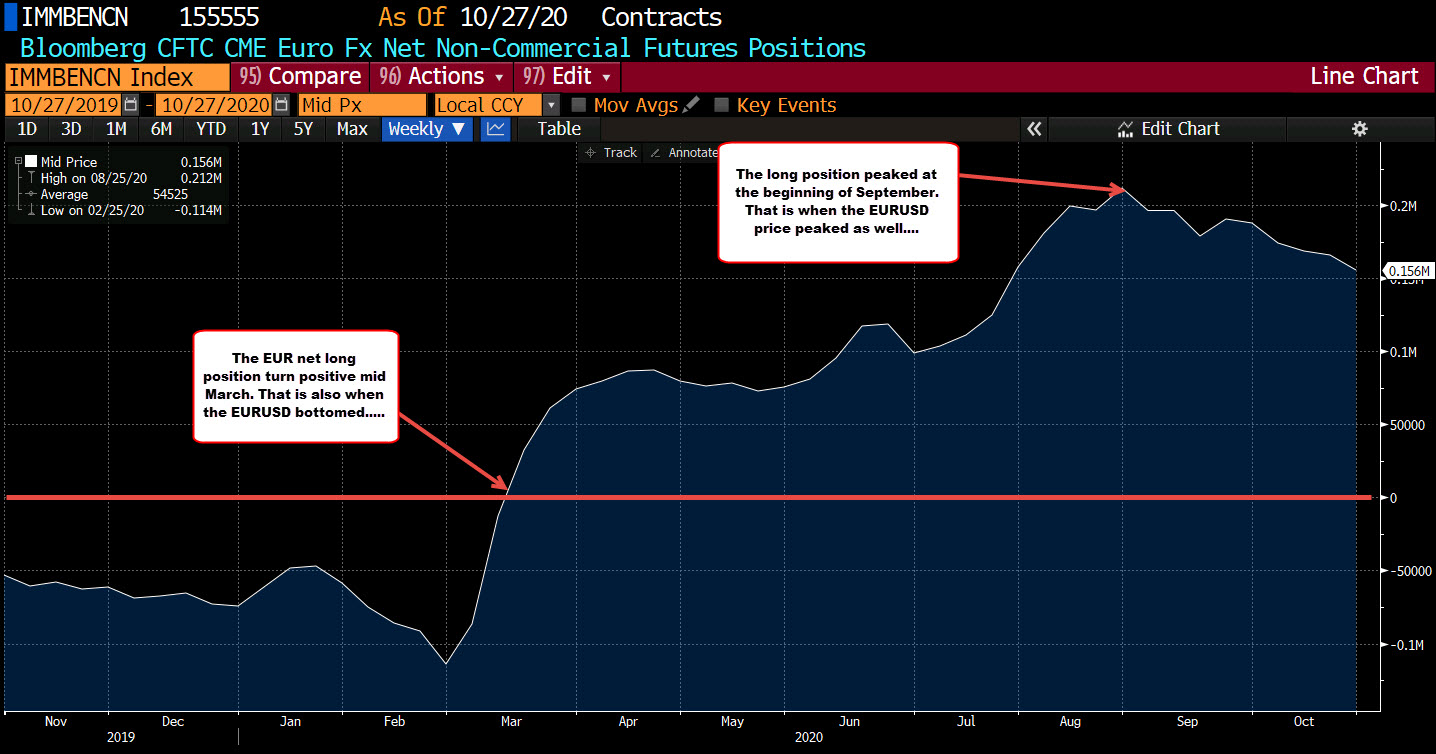

CFTC commitments of traders: EUR longs remain the major position in currencies

Forex futures positioning for the week ending October 27, 2020.

- EUR long 156K vs 166K long last week. Longs trimmed by 10K

- GBP short 7K vs 2K short last week. Shorts increased by 5K

- JPY long 18K vs 14K long last week. Longs increased by 4K

- CHF long 15K vs 14K long last week. Longs increased by 1K

- AUD long 9K vs 7K long last week. Longs increased by 2K

- NZD long 7K vs 6K long last week. Longs increased by 1K

- CAD short 18k vs 19K short last week. Shorts trimmed by 1K

- Prior report

Net positions remained relatively modest with the exception of the long in the EUR. Although still large at 156k, that position is down from a record long level of 212K from the 1st week of September.

The EUR position turn positive in the middle of March. The price peaked on September 1 which corresponded with the largest long position as well. Send the position as 100 lower along with the price of the EUR. So in reality, the net position has been congruent with the markets movements.

The next largest position is long 18K JPY and short 18K in the CAD.

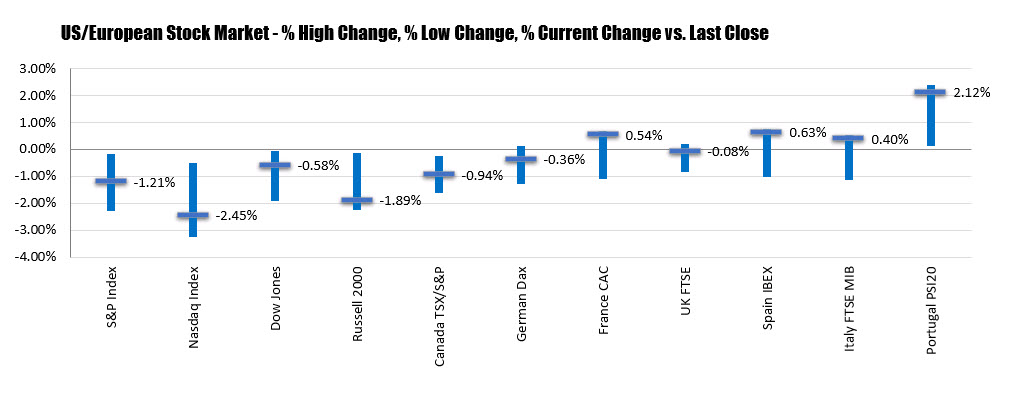

US indices close lower but rebound into the close eases the pain

NASDAQ index leads the way to the downside

The major indices are closing lower on the day but did rebounded into the close which eased some of the downside pain.

- Dow close that is lowest level since July 31

- Amazon, Apple close over 5% lower. Apple closes 20% below its all-time high

- Twitter plunged 21%

- Facebook fell -6.3%

- Major indices post the 2nd straight monthly declines

- Dow has it’s worst month since March

- NASDAQ closes nearly 10% below its all-time high

- S&P closes just 1.21% from the 2019 close

- S&P closes 9% from all time high

The final numbers are showing:

- S&P index fell -40.15 points or -1.21% at 3269.96

- NASDAQ index fell -274 points or -2.45% at 10911.59

- Dow industrial average fell 157.51 points or -0.59% at 26501.68

Looking at the ranges and changes for the major indices in North America and Europe, Portugal led the way to the upside. Other gainers were the France’s CAC, Spain’s Ibex, and Italy’s FTSE MIB. The NASDAQ index was the biggest loser for the day.

For the week,