Major currencies are generally little changed but the kiwi did get a bit of an early knock amid negative rates talk here before recovering a little in the past few hours.

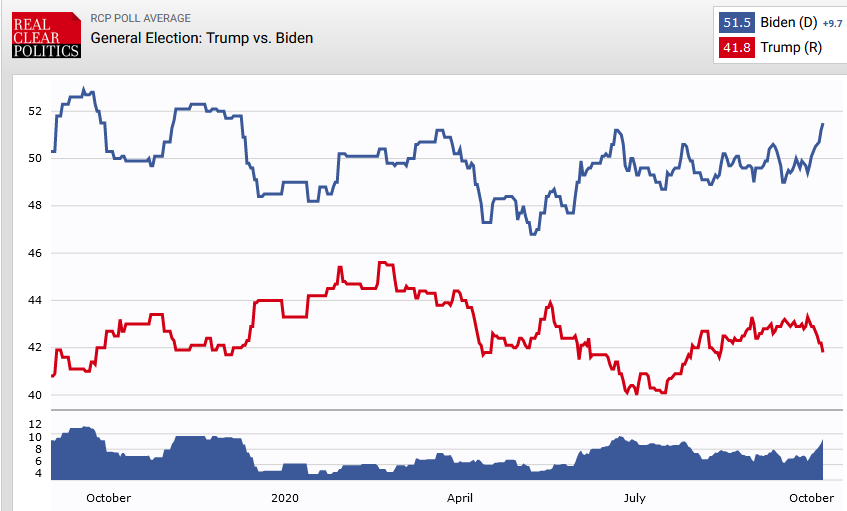

US stocks roared back overnight as the market grew less pessimistic about the halt in stimulus talks. Perhaps the focus on the wider polls and a possible ‘blue wave’ – in which bigger stimulus will follow after – is helping with sentiment somewhat.

US futures are slightly higher once again so that should keep the market in a calmer mood as we look towards European morning trade.

In terms of economic data, once again there isn’t much to really shake things up so look out for Brexit headlines potentially and some central bank talk in Europe today.

0545 GMT – Switzerland September unemployment rate

Prior release can be found here. Much like jobless rate in most countries, it is tough to read too much into the data here as the furlough program is masking the true effects seen in the labour market amid the virus crisis. A minor data point.

0600 GMT – Germany August trade balance data

Prior release can be found here. Both imports and exports are expected to improve further in August, though once again they still remain well below pre-virus levels. The recovery process is a long one so this will partially reflect that narrative.

1130 GMT – ECB releases its account of the September policy meeting

The September meeting statement can be found here. This is generally seen as the minutes to the monetary policy meeting but it shouldn’t reveal much of anything new. That said, there might be some interesting observations if you take this report into consideration. The ECB is still generally in ‘wait and see’ territory but the next steps will be of much importance since euro area inflation is threatening deflationary pressures and the second virus wave may yet derail the economic recovery in the coming months.

That’s all for the session ahead. I will outline the central bank speakers in a separate post later in a bit. I wish you all the best of days to come and good luck with your trading! Stay safe out there.