Archives of “September 2020” month

rss: “The top 5 contributors to the S&P 500 represent 1,113 basis points of performance to date. This is unlike anything we’ve seen before.”

ICYMI – Pompeo announced new restrictions on the movement of Chinese diplomats in the US

US Secretary of State Mike Pompeo with the latest in the slowly escalating tit for tat deteriorating relations with China

- “For years, the Chinese Communist Party has imposed significant barriers on American diplomats working inside the PRC [People’s Republic of China]”

Under the new restrictions

- senior Chinese diplomats will need approval from the State Department to visit American university campuses and meet with local government officials

- Approval will also be required for cultural events for more than 50 attendees happening outside the Chinese embassy or consular posts.

I expect more tit for tat ahead of the US election.

China has “called on the US to … stop official interaction with Taiwan in all forms”

China’s Ministry of Foreign Affairs has made the .. request(?) as Taiwan and the US deepen ties:

- US furthered tech discussions with Taiwan

- Taiwan’s President says will lift a ban on American beef and pork imports

Hua Chunying, spokeswoman for China’s Ministry of Foreign Affairs, said this week:

- “We called on the US to … stop official interaction with Taiwan in all forms,”

Taiwan … when one China is just not enough …

- People’s Republic of China (PRC) is the big green one

- Republic of China (ROC), commonly known as “Taiwan”

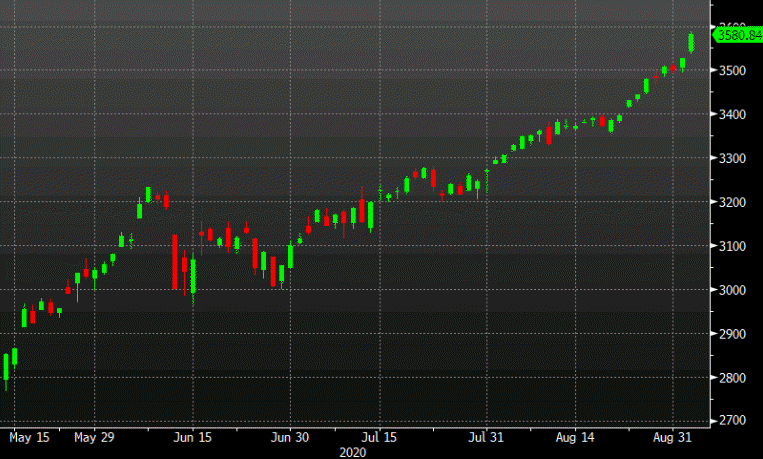

Tesla and Apple dips can’t derail the stock market runaway train

This market is breathtaking

The magical, non-stop rally in stocks continues. The bottom line is this: the pandemic will end in 2021 but easy money policies from central banks and governments won’t.

That, and 1.5% margin loans are fueling a remarkable run in stock markets. What’s especially incredible is how few dips there are. There was a hiccup today that looked like it could turn into more but even big drops on the Tesla an Apple charts couldn’t slow the momentum. New records abound.

- S&P 500 up 54 points to 3580 (+1.5%)

- Nasdaq up 116 points to 12056 (+1.0%)

- DJIA up 454 points to 29100 (+1.6%)

There hasn’t been a truly bad day since June.

Thought For A Day

European shares end the day with gains

German DAX up over 2%

The major European stock indices are closing the day with gains. The market is being led by the German DAX which rose over 2%.

- German DAX, +2.07%

- France’s CAC, +1.8%

- UK’s FTSE, +1.35%

- Spain’s Ibex, +0.26%

- Italy’s FTSE MIB, +1.09%

Eurostoxx futures +0.7% in early European trading

Optimistic tones observed in early trades

- German DAX futures +0.9%

- UK FTSE futures +0.9%

- Spanish IBEX futures +0.6%

European indices ended yesterday more mixed in another somewhat disappointing session, but the late gains seen in US stocks is giving risk buyers another shot in trading today.

This sets up a firmer open for equities later but that isn’t quite translating into much for the major currencies space as the focus remains on the dollar, as it meets some key technical crossroads going into the session ahead.

Nikkei 225 closes higher by 0.47% at 23,247.15

Asian equities mostly advance after Wall Street gains yesterday

Japanese stocks end the day with modest gains, as US equities pushed higher once again in trading yesterday – setting up a more positive mood today. Chinese stocks are looking more flat but the Hang Seng is up slightly by 0.2% currently.

Elsewhere, US futures are pointing to more optimism with S&P 500 futures up by 0.4% while Nasdaq futures are up by 0.6% as we look towards European trading.

In the major currencies space, there is some mild weakness in the franc as USD/CHF rebounds further after testing five-year lows near 0.9000 yesterday.

Besides that, the kiwi is also keeping a slight advance after RBNZ governor Orr said that he wasn’t concerned about the currency with NZD/USD looking to firmly break away from its 31 December high @ 0.6556.