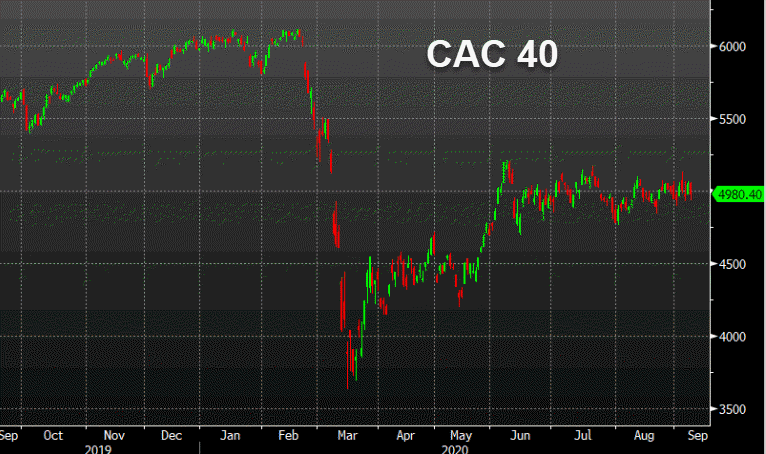

Closing changes for the main European bourses

- UK FTSE 100 -0.2%

- German DAX -0.9%

- French CAC -1.6%

- Spain IBEX -1.4%

- Italy MIB -1.6%

The UK was buffered by the 1% drop in the pound. The good news elsewhere is that stock closed off the lows. The CAC, for instance, had been down by as much as 2.4%.

.jpg)