Archives of “September 2020” month

rssOil traders – heads up for the OPEC committee meeting today, Thursday 17 September 2020

This is the OPEC+ Joint Ministerial Monitoring Committee meeting.

Given the weak run for crude prices (past days rally excepted) there is likely to be extra scrutiny on producers not hitting compliance targets.

CAD traders will want to keep an eye out for oil-related headlines from the meeting also.

ps. I don’t have a scheduled time for any comments following the meeting. The meeting is in Vienna so i suspect some time US hours or late Europe.

Bank of England monetary policy decision Thursday 17 September 2020 – likely GBP impact (spoiler – none)

- “With the BoE expected to keep all policy levers on hold, we do not think the September MPC meeting is likely to give sterling much in the way of strong directional cues. All else equal, we expect currency investors to receive mixed set of messages from the BoE”

- “The overall tone may take another step in a dovish direction. At the same time, however, we do not expect the BoE to validate hopes for any further near-term easing on rate cuts or asset purchases. If anything, we see them centering market expectations around our base case scenario of an additional £50 bn of QE alongside the November MPR”

Bank of England announcement is due at 1100 GMT

Preview of the Bank of Japan monetary policy statement due Thursday 17 September 2020

The BOJ is expected to leave policy unchanged at their meeting today.

What time is it? Check this out:

- The Bank of Japan monetary policy statement is due Thursday 17 September 2020

What to expect? There is some speculation the Bank may upgrade their activity outlook on the back of an uptick in business confidence, which has rebounded (a little) from very low levels.

- Policy rates will remain unchanged

- QE buying plans will remain unchanged

Supportive policies are well and truly set in concrete at the BOJ.

Via ScotiaBank, a one-line preview:

- Other than forecast tweaks, this decision should be largely a non-event with no substantive policy changes expected.

Coming up at 0630GMT, Governor Kuroda’s press conference:

France fin min boosts 2020 GDP forecast to -10% from -11%

The latest economic forecasts from the finance ministry:

- 2020 at -10% from -11% prior

- 2021 unchanged at +8.0%

- 2020 deficit to be -10.2% from -11.4%

Overnight :NASDAQ tumbles. Dow higher but gives up most of its gains

Dow is up 396 points at session high

The US stock markets rolled over into the close with the Nasdaq leading the declines. The S&P winning streak of 3 days was snapped. The Dow closed higher but gave up nearly all of its close to 400 point gain at the session highs.

The final numbers are showing:

- S&P index -15.71 points or -0.46% at 3385.49

- NASDAQ index -139.85 points or -1.25% at 11050.40

- Dow up 36.78 points or 0.13% at 28032.38.

The big news today – in stocks that is – was a couple of IPOs.

JFrog was priced at $44 a share and closed at $64.79 after trading as high as $77.

The other was snowflake which was priced at $120 a share and closed at $253.93. It traded as high as $319. Snowflake was the largest ever software IPO.

Thought For A Day

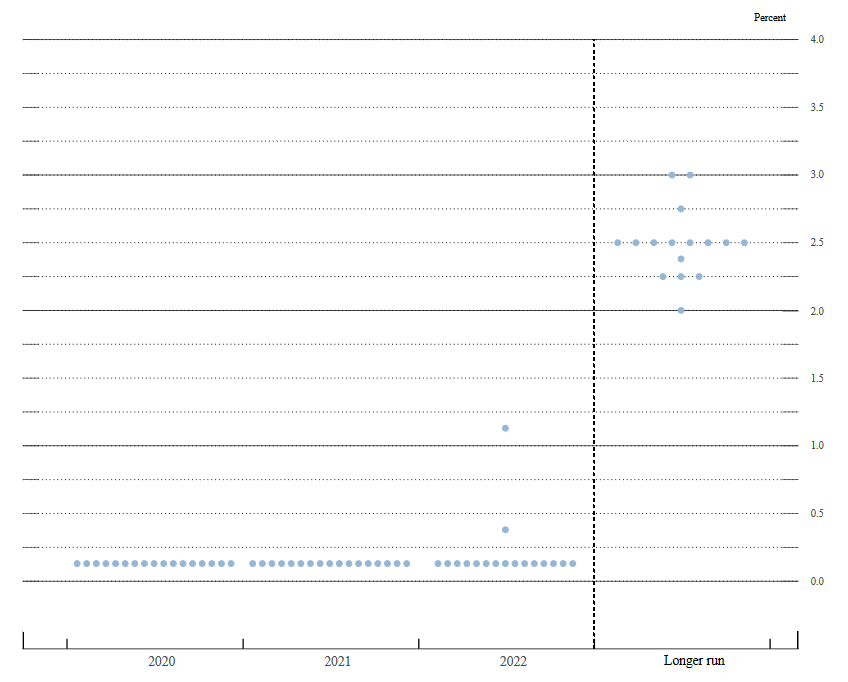

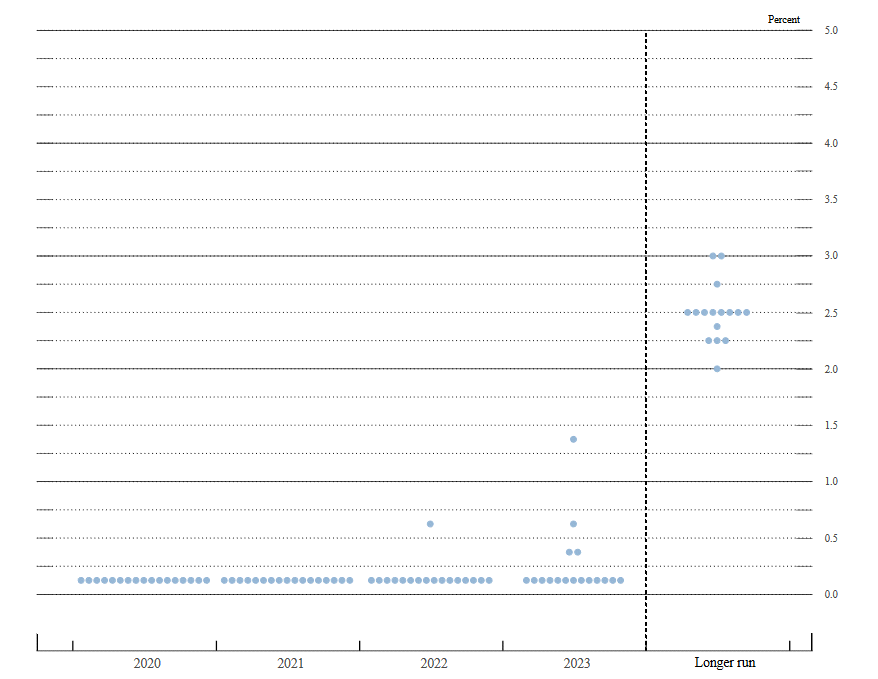

2023 Fed fund dot plot shows four dots above zero, median unchanged

Changes in the dot plot for the Fed funds rate

- The June projections had two dots above zero in 2022.

This is the first look at the dot plot for 2023.

This is the first look at the dot plot for 2023.

Note that one of the dots showing liftoff in 2022 is gone. There are four dots above zero in 2023.

FOMC statement says it would be prepared to adjust if risks emerge that would impede goals

Highlights of the September 16, 2020 FOMC statement:

- Statement adopts nod to average inflation target

- Fed funds rate held in 0.00-0.25% range, as expected

- Overall financial conditions have improved in recent months

- Economic activity and employment have picked up in recent months but remain well below their levels at the beginning of the year

- Repeats that virus poses ‘ considerable risks’ over the medium term

The FOMC statement from the September 2020

The full statement from the FOMC September 2020 meeting

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

The COVID-19 pandemic is causing tremendous human and economic hardship across the United States and around the world. Economic activity and employment have picked up in recent months but remain well below their levels at the beginning of the year. Weaker demand and significantly lower oil prices are holding down consumer price inflation. Overall financial conditions have improved in recent months, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy will depend significantly on the course of the virus. The ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer-term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In addition, over coming months the Federal Reserve will increase its holdings of Treasury securities and agency mortgage-backed securities at least at the current pace to sustain smooth market functioning and help foster accommodative financial conditions, thereby supporting the flow of credit to households and businesses. (more…)