Archives of “September 23, 2020” day

rssJP Morgan highlight a tailwind for equities … next week

JPM looking at month-end flows as a bullkiush factor next week.

Citing past research showing:

- rebalances from fixed-weight asset allocation portfolios, along with the reversion of option rolling-driven expiry week momentum, tended to cause the market to mean-revert into month-and quarter-end.

JPM say that

- equities have underperformed bonds month-to-date (but outperformed quarter-to-date) (by -5%)

- a large majority of these portfolios rebalance on a monthly rather than quarterly frequency …. historically, the monthly rebalance effect is over 5x stronger than the quarterly rebalance effect. Thus, the equity buying by monthly rebalancing portfolios (due to equity underperformance MTD) much more than fully offsets the selling by quarterly rebalancing portfolios, meaning these portfolios are expected to be net buyers of equities into month/quarter-end.

And thus:

- we would expect rebalances by these fixed weight asset allocation portfolios to provide a tailwind to equities next week

More on tougher standards on a COVID-19 vaccine from the FDA, making pre election approval unlikely

The Washington Post has the story on the Food and Drug Administration being expected to introduce a new standard for an emergency authorization of a coronavirus vaccine

Which will make pre-election approval less likely.

Says the article:

- The guidance, which is far more rigorous than what was used for emergency clearance of hydroxychloroquine or convalescent plasma, is an effort to shore up confidence in an agency that made missteps in its handling of those clearances.

Link here for more detail.

Announcement on this expected this week sometime.

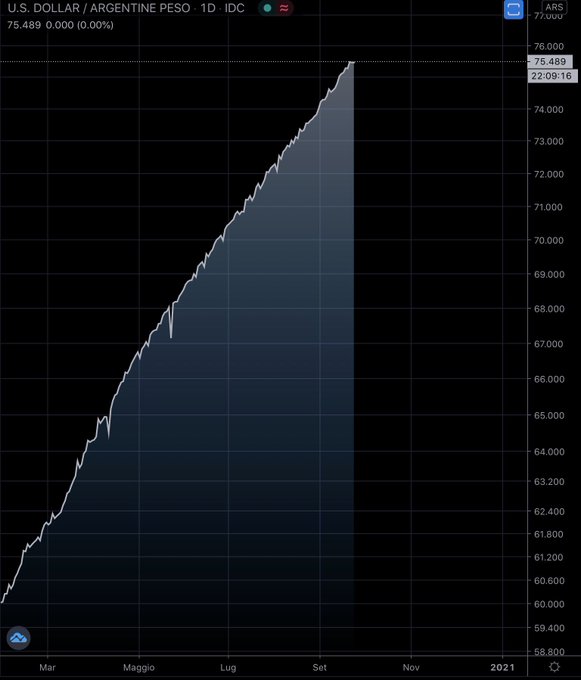

My long term investment only goes up

NASDAQ leads the way to the upside. S&P and NASDAQ break 4-day losing streak

Dow breaks 3 day slide

The S&P and NASDAQ index broke a 4 day losing streak. The Dow industrial average broke its 3 day losing streak as investors liked Feds Powell comments on the economy is resilient, and the expectations at the Fed would remain on hold for a long period of time.

A look at the final numbers are showing:

- S&P index rose 34.49 points or 1.05% to 3315.56. It’s high reached 33 to 0.31. The low extended to 3270.95.

- Nasdaq index rose 184.83 points or 1.71% at 10963.62. Its high reached 10979.64. The low extended to 10737.51

- Dow rose 140.34 points or 0.52% at 27288.04. It’s high reached 27333.09. The low extended to 26989.93.

Thought For A Day