Stocks, small credit growth

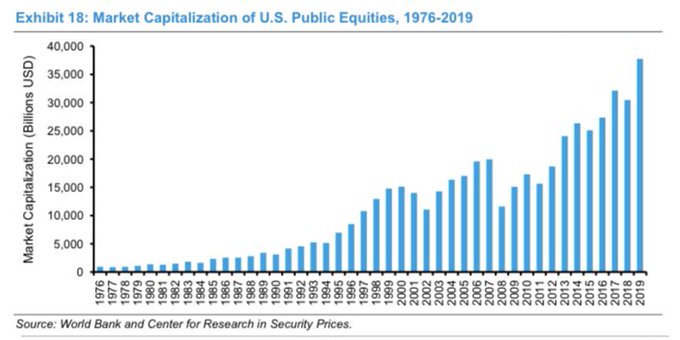

the Federal Reserve is reporting that the 2nd quarter US net worth grew to $118.9 trillion. That is up $7.61 trillion in the 2nd quarter. The household net worth is a record

- Real estate value gained $0.5 trillion

- federal debt rose by record 59% in the 2nd quarter

- biggest drop ever in consumer credit outstanding

- consumer credit fell by 6-6.8%

- mortgage debt rose by 3%

- biggest quarterly gain ever and household net worth

- equity values rose by $5.7 trillion

That’s the good news. The not so good news is that the gains in the 2nd quarter offset Covid 19 related losses in the 1st quarter putting households slightly above end of 2019