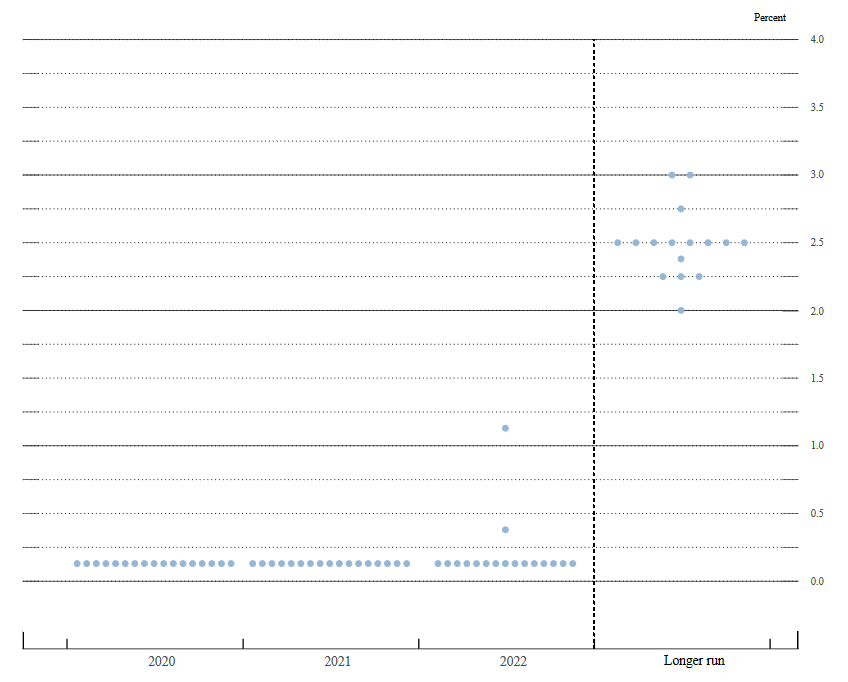

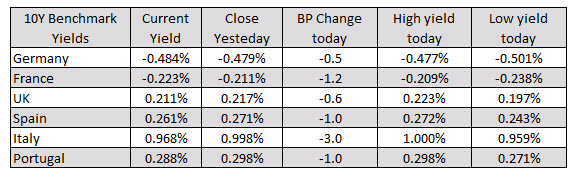

Changes in the dot plot for the Fed funds rate

- The June projections had two dots above zero in 2022.

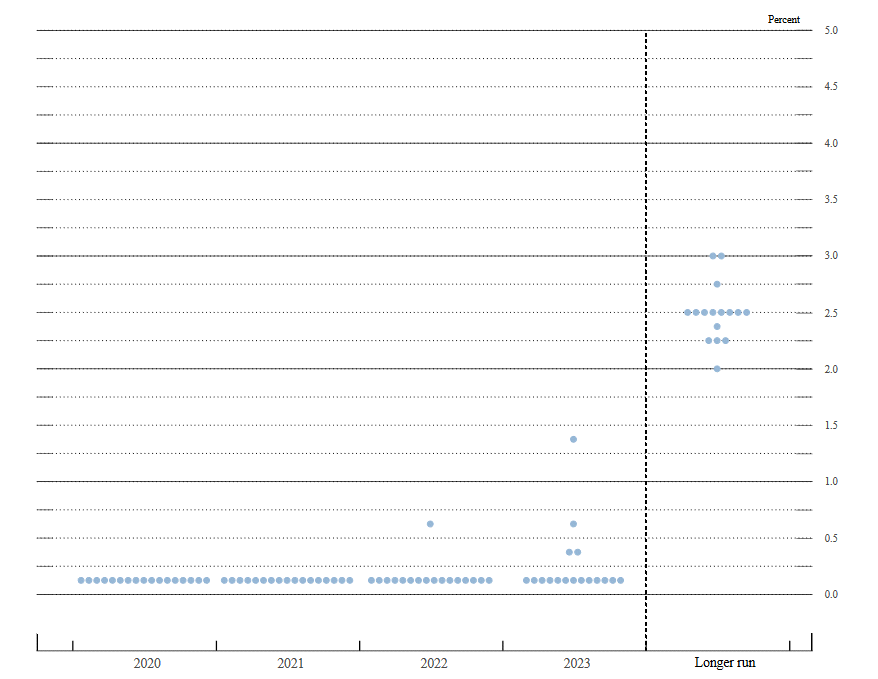

This is the first look at the dot plot for 2023.

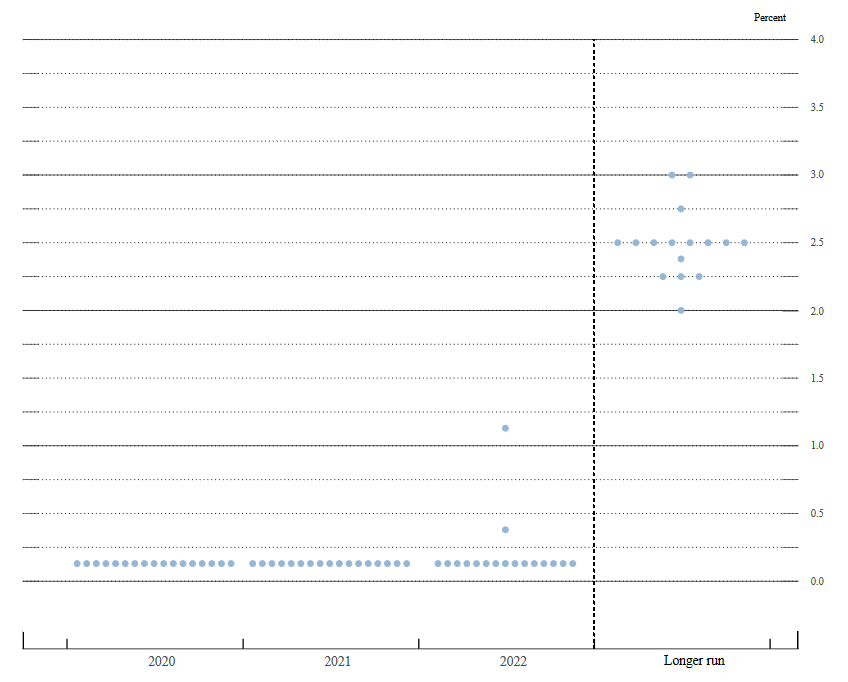

This is the first look at the dot plot for 2023.

Note that one of the dots showing liftoff in 2022 is gone. There are four dots above zero in 2023.

This is the first look at the dot plot for 2023.

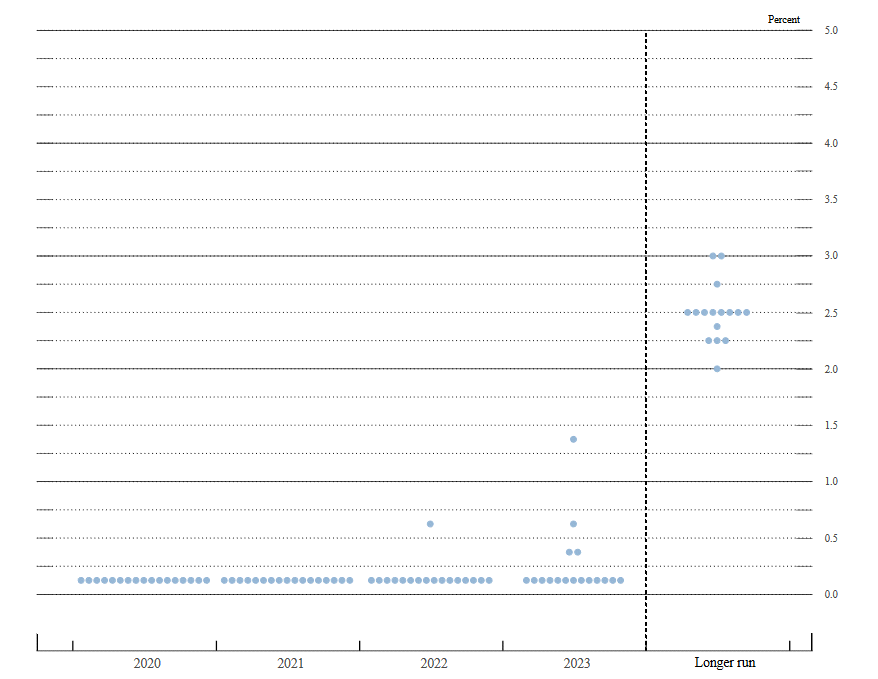

This is the first look at the dot plot for 2023.

Note that one of the dots showing liftoff in 2022 is gone. There are four dots above zero in 2023.

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

The COVID-19 pandemic is causing tremendous human and economic hardship across the United States and around the world. Economic activity and employment have picked up in recent months but remain well below their levels at the beginning of the year. Weaker demand and significantly lower oil prices are holding down consumer price inflation. Overall financial conditions have improved in recent months, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy will depend significantly on the course of the virus. The ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer-term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In addition, over coming months the Federal Reserve will increase its holdings of Treasury securities and agency mortgage-backed securities at least at the current pace to sustain smooth market functioning and help foster accommodative financial conditions, thereby supporting the flow of credit to households and businesses. (more…)

Crude Oil -8,315 Light Distillates +445 Middle Distillates +3,981 Heavy & Residues -614 Total Distillates +3,812 Total (Crude + Distillates) -4,502 #OOTT

The European major stock indices are close for the day. The results are mixed. The provisional closes are showing:

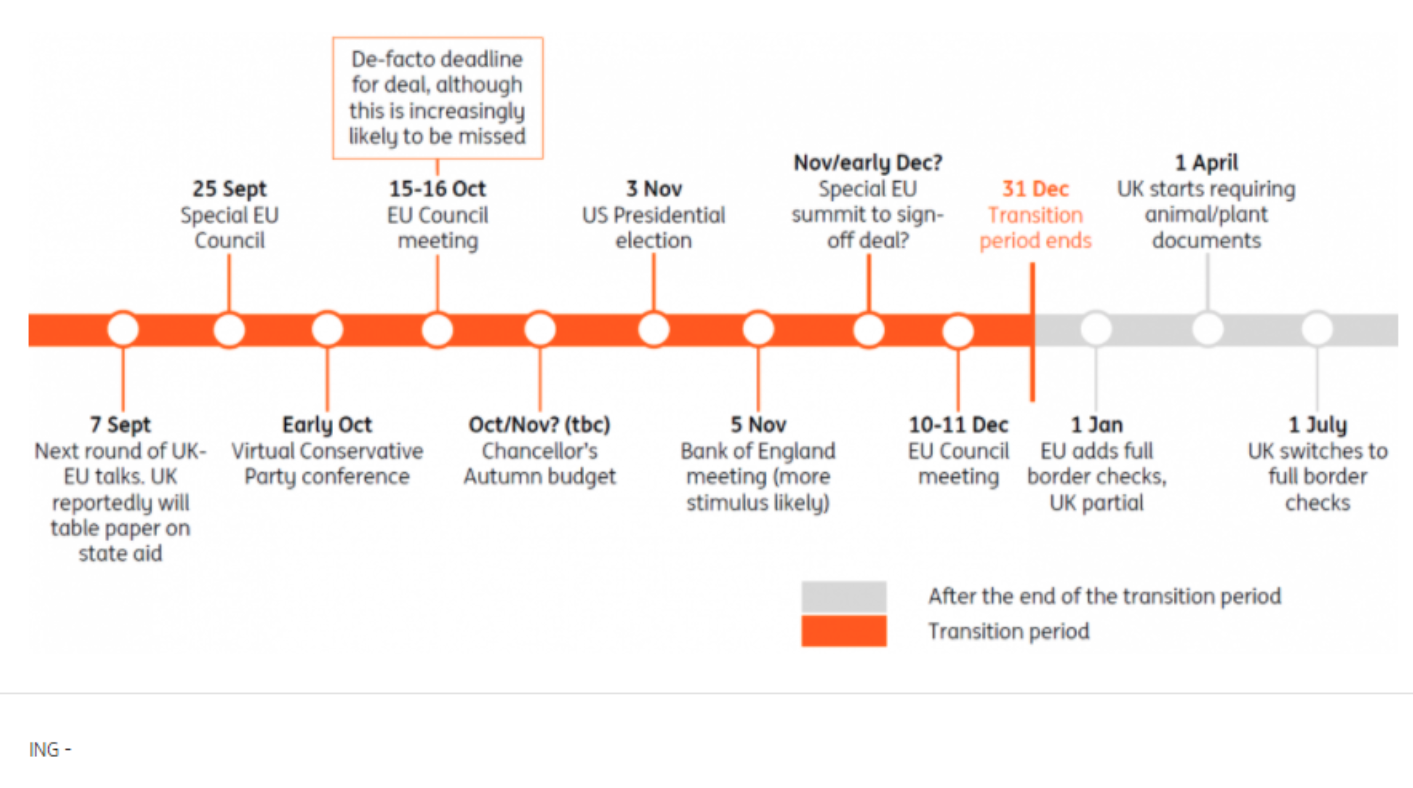

Next date in focus is the special EU Council meeting on September 25. Bearish pressure mounts for the GBP.

Next date in focus is the special EU Council meeting on September 25. Bearish pressure mounts for the GBP.

This is the case whether you are trading for a fund, your family or even a personal account. Furthermore, whether people realise it or not, managing risk is going to be one of the single most important factors in your success or otherwise as a forex trader.

You can’t trade if you have no capital left. Many traders have over leveraged, lost all their capital and then never traded again. In contrast, the proper use of leverage will prevent you from destroying your account and preserve your capital as a trader.

Sometimes people say it is just about greed or fear. However, often times it is simply ignorance as to how leverage works.