Archives of “September 3, 2020” day

rssEuropean shares are dragged back down as US stocks tumble

Snatch defeat from the jaws of victory

The European indices were higher at the North American opening. However, the indices could not ignore the liquidation in the US indices and are closing the session lower on the day. The provisional closes are showing:

- German DAX, -1.6%. It was up 1.64% at its highs

- France’s CAC, -0.7%. It was up 1.98% at its highs

- UK’s FTSE 100, -1.6%. It was up 0.93% at the high

- Spain’s Ibex, -0.4%.. It was up 2.33% at its highs

- Italy’s FTSE MIB, -1.8%. It was up 1.42% its highs

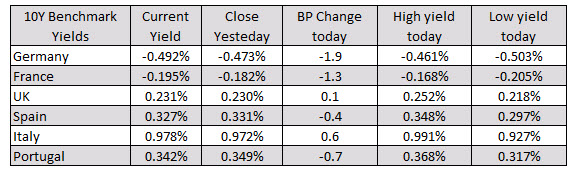

In the 10 year note sector, the benchmark yields are mixed:

In other markets as London/European traders look to exit:

- spot gold is trading down $16.4 or -0.84% $1926.70

- spot silver is trading down $0.89 or -3.24% $26.55

- WTI crude oil futures are down $-1.01 or 2.46% at $40.49

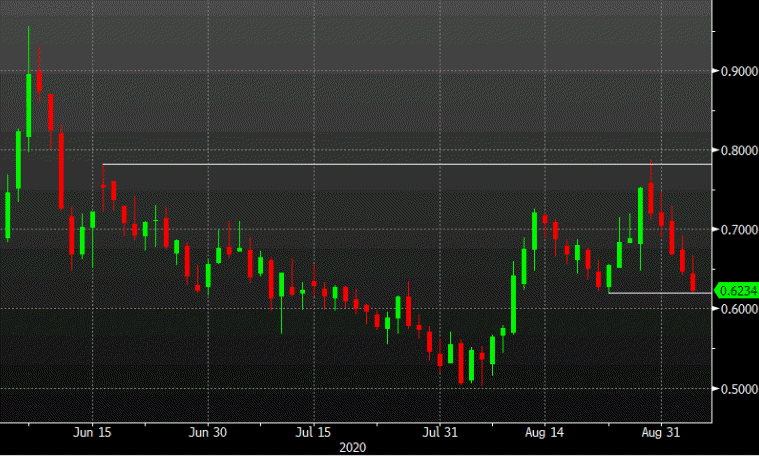

US 10-year yields threaten the late-August low

Treasury yields at session lows

The bond market isn’t exactly freaking out despite the pain in equities (Nasdaq -3.4%) but 10-year yields are approaching an important short-term level.

The Aug 24 low was 0.6201% and it’s at 0.6217% right now. A break could spark a larger flight to safety.

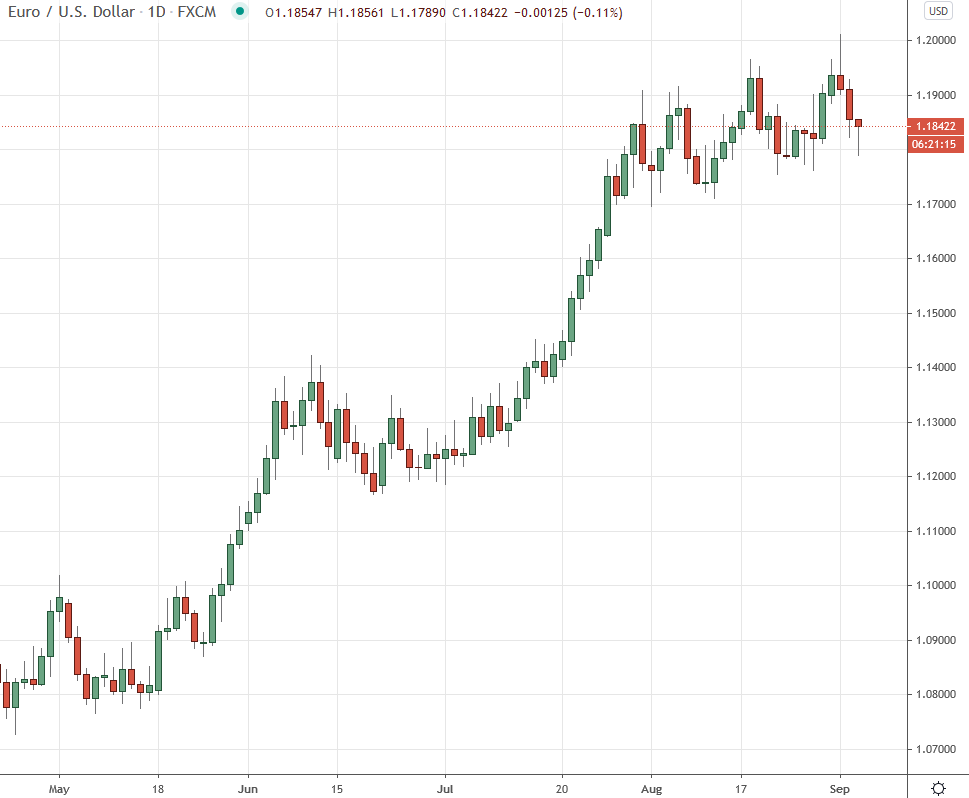

EUR/USD: Weekly close sub-1.1763 would target 1.15 – Citi

Citi on the US

Citi discusses EUR/USD technical outlook and flags scope for further downside.

“EURUSD peaked the week of 04 Sept 2017 at 1.2092 and entered into a deep correction that took it back to 1.1554 over 9 weeks. That was the deepest correction since the rally began in earnest in April that year. Thereafter it rallied higher to the 1.2555 Feb 2018 peak. Then, as now, weekly momentum was very overbought and started to turn lower,” Citi notes.

“Good support comes in between 1.1754 and 1.1782 and if that gives way then a deeper move towards 1.15 again would look an increased danger. A weekly close this week below 1.1763, if seen, would be a bearish outside week at the trend high and suggest more losses to come,” Citi adds.

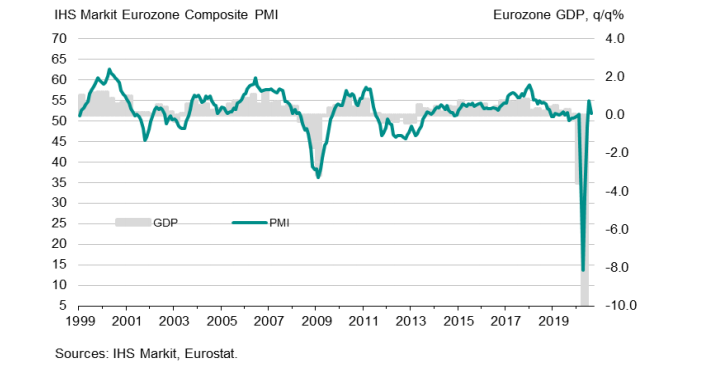

Eurozone August final services PMI 50.5 vs 50.1 prelim

Latest data released by Markit – 3 September 2020

- Composite PMI 51.9 vs 51.6 prelim

The preliminary report can be found here. Some slightly higher revisions but the story is the same as per what we are seeing across all the other national readings today i.e. a loss in momentum in the recovery.

The narrative is that the economic recovery in the region owes much to domestic demand, but that can only do so much as new business is somewhat lacking.

Add that on top of the more subdued labour market conditions, it is keeping the pace of the recovery limited and it remains to be seen how the situation will fare as we look towards the latter stages of the year. Markit notes that:

“Service sector companies across the eurozone saw growth of business activity grind almost to a halt in August, fueling worries that the post-lockdown rebound has started to fade amid ongoing social distancing restrictions linked to COVID-19.

“The near-stalling needs to be viewed in the context of the strong expansion seen in July: business growth had surged to a near two-year high as economies opened up further from the severe COVID-19 lockdowns. However, the latest reading still sends a disappointing signal that the rebound has lost almost all momentum.

“The deterioration was often linked to worries of resurgent COVID-19 infection rates, notably among consumer-facing companies and especially in Spain and Italy, where virus containment measures remained particularly strict.

“The larger size of the services economy means the subdued picture offsets the more upbeat survey of manufacturers in August, suggesting that the overall pace of economic growth has waned midway through the third quarter.

“Although the relative strength of the PMI data in July and August mean the autumn is likely to still see the economy rebound strongly from the collapse witnessed in the spring, the survey highlights how policymakers will need to remain focused firmly on sustaining the recovery as we head further into the year.”

China says will take ‘necessary response’ to new US restrictions on Chinese diplomats

Comments by the Chinese foreign ministry

- New US restrictions are illegal, not legitimate

They are alluding to this movement restriction imposed by the US on Chinese diplomats in the country. If anything else, the escalation in tensions continue to be rather gradual and as mentioned before, the trade deal – or at least the facade of it – is what matters most for the market and both sides aren’t willing to risk that for the time being.

Nikkei 225 closes higher by 0.94% at 23,465.53

A bit of a mixed session for Asian equities

Japanese stocks end the day higher but gains petered out towards the end with US futures slipping a little in the closing stages in Asia. E-minis are down a little by ~0.3% currently, following record gains in Wall Street once again yesterday.

Elsewhere, the Hang Seng is down by 0.7% while the Shanghai Composite is down 0.5% with the latest round of US-China tensions adding to some pessimism on the day.

In the currencies space, the main story is still the pullback in the dollar as the greenback keeps firmer going into European trading. EUR/USD is down to fresh one-week lows around 1.1800 as the ECB begins jawboning the currency ahead of next week’s meeting.

Not even the largest and most sophisticated college funds have been able to beat the US stock market in recent years.

: “The top 5 contributors to the S&P 500 represent 1,113 basis points of performance to date. This is unlike anything we’ve seen before.”

ICYMI – Pompeo announced new restrictions on the movement of Chinese diplomats in the US

US Secretary of State Mike Pompeo with the latest in the slowly escalating tit for tat deteriorating relations with China

- “For years, the Chinese Communist Party has imposed significant barriers on American diplomats working inside the PRC [People’s Republic of China]”

Under the new restrictions

- senior Chinese diplomats will need approval from the State Department to visit American university campuses and meet with local government officials

- Approval will also be required for cultural events for more than 50 attendees happening outside the Chinese embassy or consular posts.

I expect more tit for tat ahead of the US election.