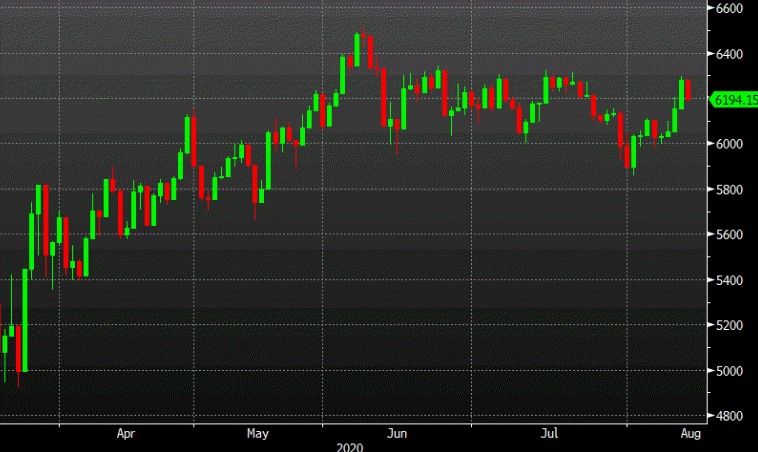

Dow lagged all day

The S&P and NASDAQ both make bonds at all time highs (and all time high closes) but gave up just ahead of the levels and are closing mixed. The the NASDAQ was the only index to hold onto gains today. The Dow industrial average lagged the broader indices all day. The NASDAQ is well off its highs but still close higher on the day for the 2nd consecutive day. The S&P and Dow close lower for the 2nd day in 3 days.

The final numbers are showing:

- S&P index down -6.92 points or -0.20% at 3373.43. The high price reached 3387.24 that was just off the all-time high of 3393.52. The S&P index is up 4.42% on the year

- NASDAQ index closed up 30.265 points or 0.27% at 11042.50. It’s high price reached 11124.85. It’s a low extended to 11007.50. The all-time high price from last week comes in at 11126.04. The NASDAQ index is up 23.07% on the year

- Dow industrial average closed down -80.12 points or -0.29% at 27896.73. It’s high price reached 27986.10. It’s low price extended to 27789.78. The Dow remains -2.25% below the year-end the level

Some winners today included:

- Zoom, +4.44%

- Tesla, +4.16%

- First solar, +3.06%

- Square, +2.98%

- Chipotle, +2.95%

- Chewy, +2.78%

- Papa John’s, +2.58%

- Beyond Meat, +2.54%

- Apple, +1.76%

- Slack, +1.4%

- Nike, +1.23%

Big losers today included

- Cisco, -11.2% (guidance disappointed the market)

- Micron, -4.83%

- Tencent, -4.12%

- Exxon Mobil, -2.43%

- Schlumberger, -2.36%

- Qualcomm, -1.99%

- Walgreens Boots -1.96%

- Goldman Sachs, -1.81%

- United Airlines, -1.68%

- Bank of America -1.44%

- Caterpillar -1.36%

- IBM -1.36%

- Intel -1.28%