Archives of “August 2020” month

rssReminder: Brexit negotiations start up again this week

But don’t expect much before Friday

The coming debt and population problem

Death and taxes

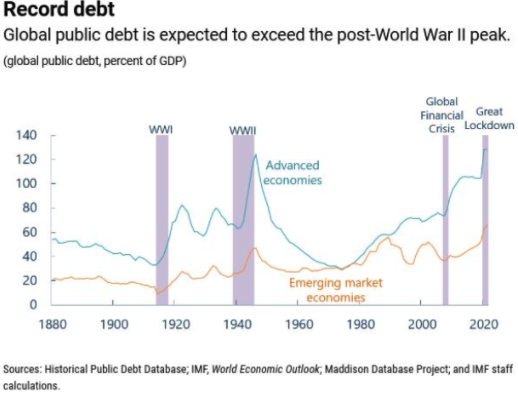

Debt levels are set to rise to unprecedented levels. According to the International Monetary Fund in June the public debt, as a share of GDP in advanced economies, is set to come in at over 130% for this year and next. To put that into perspective that surpasses the debt levels from the second world war.If you look at the chart below you can see that the double whammy of the Global Financial Crisis, followed by the present pandemic is pushing debt to record levels.

The population problem

The general thinking now is that the present crisis is a one in a hundred years kind of event (what if it isn’t) and that future generations will be able to claw back the debt levels over time. However, a publication from the Lancet in the UK suggests that there is a falling population that could fall by 9% at the end of the century. So, this means that there will be a large decline in numbers of working age adults. There are some countries which are projected to be particularly badly hit. Japan, Spain, Portugal, and Thailand are expected to see their populations halve by the end of the century. The countries which are projected to see 25% population declines are also projected to see a higher ration of older to younger people. So, more of this debt is going to be shouldered by fewer as an ageing population raises further spending considerations.

What will happen next?

There will be moves by governments to start to cap this debt problem. It will not be allowed to continue unless we get into worst disasters than we presently are in. The main concern is that of default. As long as willingness to repay remains, then the debt pile can be reduced. The main risk is if the debt becomes too great and the easiest solution is to just walk away…

Japan..

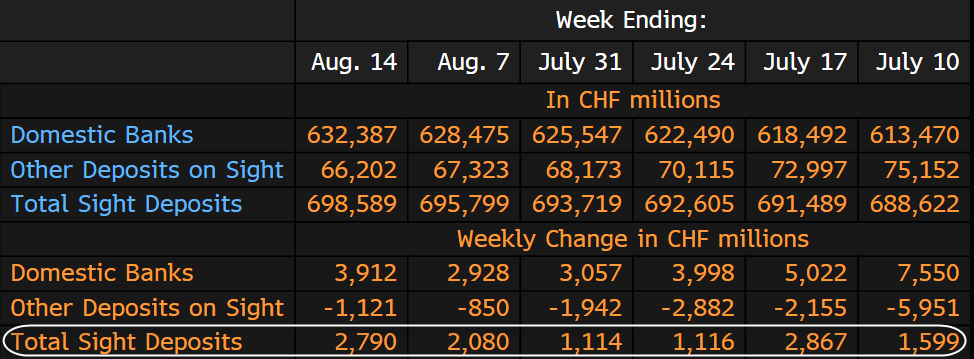

SNB total sight deposits w.e. 14 August CHF 698.6 bn vs CHF 695.8 bn prior

Latest data released by the SNB – 17 August 2020

- Domestic sight deposits CHF 632.4 bn vs CHF 628.5 bn prior

Don’t fight central banks.

For the first time in 42 years, 5 stocks represent more than 20% of the capitalization of the S&P 500.

Nikkei 225 closes lower by 0.83% at 23,096.75

Mixed tones in Asian equities today

Japanese stocks are lower to start the week, as we see a bit more subdued tones outside of the more positive mood in Chinese equities – which owed to the PBOC’s liquidity injection earlier in the day here.

Japan June final industrial production +1.9% vs +2.7% m/m prelim

Daily thread to exchange ideas and to share your thoughts

Heads up for the potential of supportive tweets from Trump on Monday

Axios report the president has been lobbied on a botanical extract hyped as a cure for COVID-19.

- Trump has expressed enthusiasm for the Food and Drug Administration to permit an extract from the oleander plant to be marketed as a dietary supplement or, alternatively, approved as a drug to cure COVID-19, despite lack of proof that it works.

- The experimental botanical extract, oleandrin, was promoted to Trump during an Oval Office meeting in July.