Archives of “August 2020” month

rssNikkei 225 closes lower by 1.00% at 22,880.62

Asian equities slip after the retreat from Wall Street

The more downbeat FOMC meeting minutes also adds to further reasons for the decline, with the Hang Seng down by 2.0% and the Shanghai Composite down by 1.0%.

Elsewhere, US futures are down by ~0.6% and that is keeping the risk mood more on the defensive ahead of European morning trade. Treasury yields are a little lower on the day, with 10-year yields down by 2.4 bps to 0.655%.

Meanwhile, major currencies are trading little changed for the most part as tighter ranges continue to play out after the dollar reversal in trading yesterday.

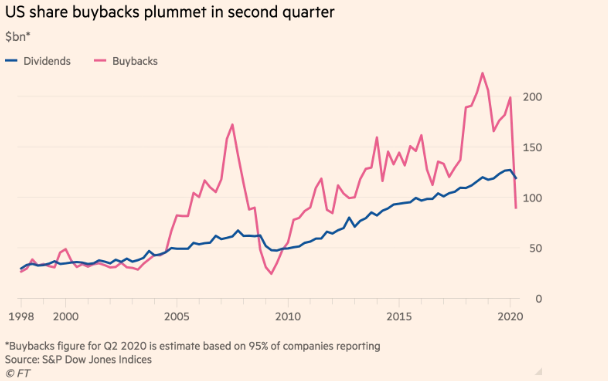

The virus crisis cut US share buybacks by almost half in Q2

But that hasn’t stopped the market from rallying

S&P Dow Jones Indices are showing that provisional figures on total spent on buybacks by companies in the S&P 500 was about $89.7 billion in Q2 2020 – down 46% from the same period last year.

The estimate marks the lowest quarterly total for buybacks by companies in the index since 2012 and the drop would have been much steeper without the aid of tech firms.

Unsurprisingly, the big banks were the notable ones absent from the list with Goldman Sachs, JP Morgan, Morgan Stanley and BofA all having said that they would stop buybacks in March as they contemplate larger provisions.

Meanwhile, the likes of Apple, T-Mobile, Alphabet and Microsoft contributed strongly to buybacks seen in the past quarter.

More on this from the FT here (may be gated).

An interesting point in all of this is what it tells us about the market rally over the past few months. This market has been resilient despite the lack of share buybacks for the most part. Q3 is also likely to be a muted period in terms of buyback activity.

Is the market really seeing light at the end of the tunnel amid the whole virus crisis? Or is cheap money really that powerful? What happens when buybacks start to come back into the picture and inflate valuations once again? Just some things to consider.

Miners are about to become the new growth stocks of this investment cycle.

Don’t be surprised if global stocks top $100 trillion in value soon at this rate.

Implied euro rate against silver from 1400-1850

Benjamin Franklin, Advice to a Young Man on the Choice of a Mistress (1745)

My dear Friend,

I know of no Medicine fit to diminish the violent natural Inclinations you mention; and if I did, I think I should not communicate it to you. Marriage is the proper Remedy. It is the most natural State of Man, and therefore the State in which you are most likely to find solid Happiness. Your Reasons against entering into it at present, appear to me not well-founded. The circumstantial Advantages you have in View by postponing it, are not only uncertain, but they are small in comparison with that of the Thing itself, the being married and settled. It is the Man and Woman united that make the compleat human Being. Separate, she wants his Force of Body and Strength of Reason; he, her Softness, Sensibility and acute Discernment. Together they are more likely to succeed in the World. A single Man has not nearly the Value he would have in that State of Union. He is an incomplete Animal. He resembles the odd Half of a Pair of Scissars. If you get a prudent healthy Wife, your Industry in your Profession, with her good Economy, will be a Fortune sufficient.

But if you will not take this Counsel, and persist in thinking a Commerce with the Sex inevitable, then I repeat my former Advice, that in all your Amours you should prefer old Women to young ones. You call this a Paradox, and demand my Reasons. They are these:

1. Because as they have more Knowledge of the World and their Minds are better stor’d with Observations, their Conversation is more improving and more lastingly agreable.

2. Because when Women cease to be handsome, they study to be good. To maintain their Influence over Men, they supply the Diminution of Beauty by an Augmentation of Utility. They learn to do a 1000 Services small and great, and are the most tender and useful of all Friends when you are sick. Thus they continue amiable. And hence there is hardly such a thing to be found as an old Woman who is not a good Woman.

3. Because there is no hazard of Children, which irregularly produc’d may be attended with much Inconvenience. (more…)

Germany reports 1,707 new coronavirus cases in latest update today

The daily case count continues to rise

This beats yesterday’s count, which was the highest since the end of April.

The 1,707 new cases reported today sees the number of active cases across the country rise to ~14,500 and that is the most since 13 May. Meanwhile, another 10 deaths were reported and that brings the total tally on that front to 9,253 persons.

As the situation develops, just be mindful in case this starts to have more of an impact on the economy – either via restrictions or growing fears of the virus spread itself.

Elsewhere, India reported a record daily jump of 69,672 new coronavirus cases today. That brings the total confirmed cases across the country to over 2.8 million with the number of active cases sitting over 686,000.

For India, while the number of recoveries are encouraging, it is still growing at a slower pace compared to the infections spread.

The billion dollar companies.

FT report: China cautious on hitting back at US companies after Huawei sanctions

The Financial Times writes that despite mounting political pressure to unveil commensurate restrictions on US businesses in China, Beijing has historically been reluctant to retaliate.

Analysts think officials will continue to hold back, as they are reluctant to upset the economic benefits and innovation US companies bring to China.

The US administrations targeting of China’s biggest technology groups incldueds moves against:

- ByteDance

- Tencent

- as well as Huawei

Link to FT is here (may be gated). The FT cite analysts (named in the piece) for the opinions.

If they are right perhaps US-China relations will not chill much further after all.