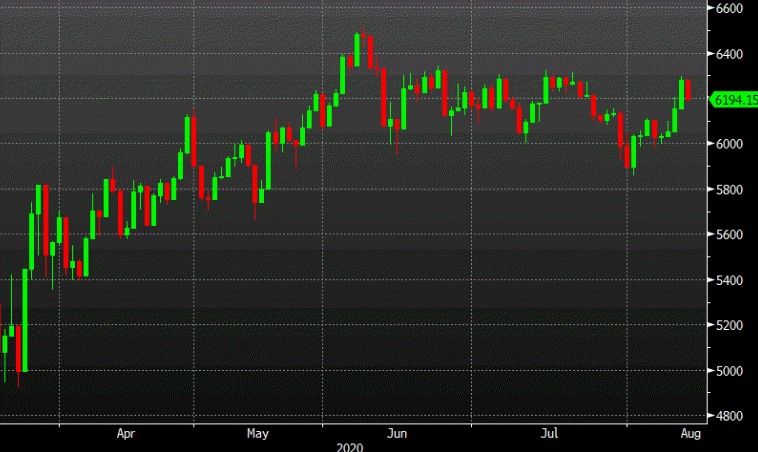

uropean equity closing levels

- UK FTSE 100 -1.4%

- German DAX -0.3%

- Italy MIB -0.35%

- French CAC -0.4%

- Spain IBEX

As the treasury auctions continue at an increasing pace, the US treasury has a announced that they will auction off $25 billion of 20 year bonds next week. That was higher than the 23 billion expected.

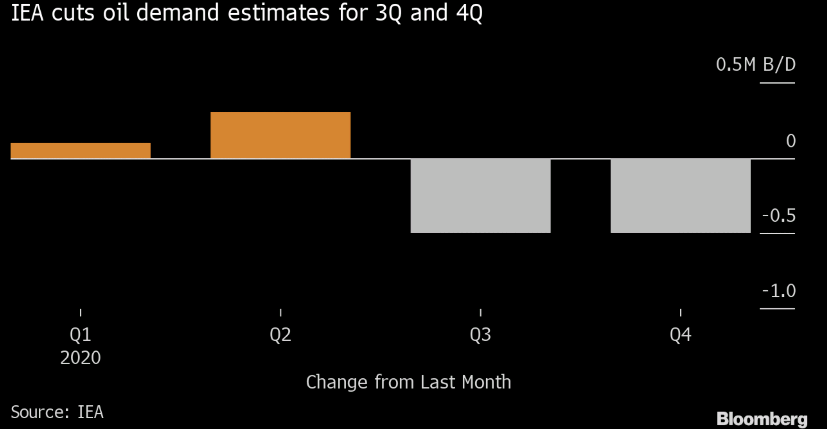

The outlook for jet fuel demand has worsened in recent weeks as the coronavirus has spread more widely. It remains unclear if the new coronavirus cases herald a second wave or are simply a regular fluctuation…

Demand uncertainty, possibility of higher output renders market re-balancing delicate.

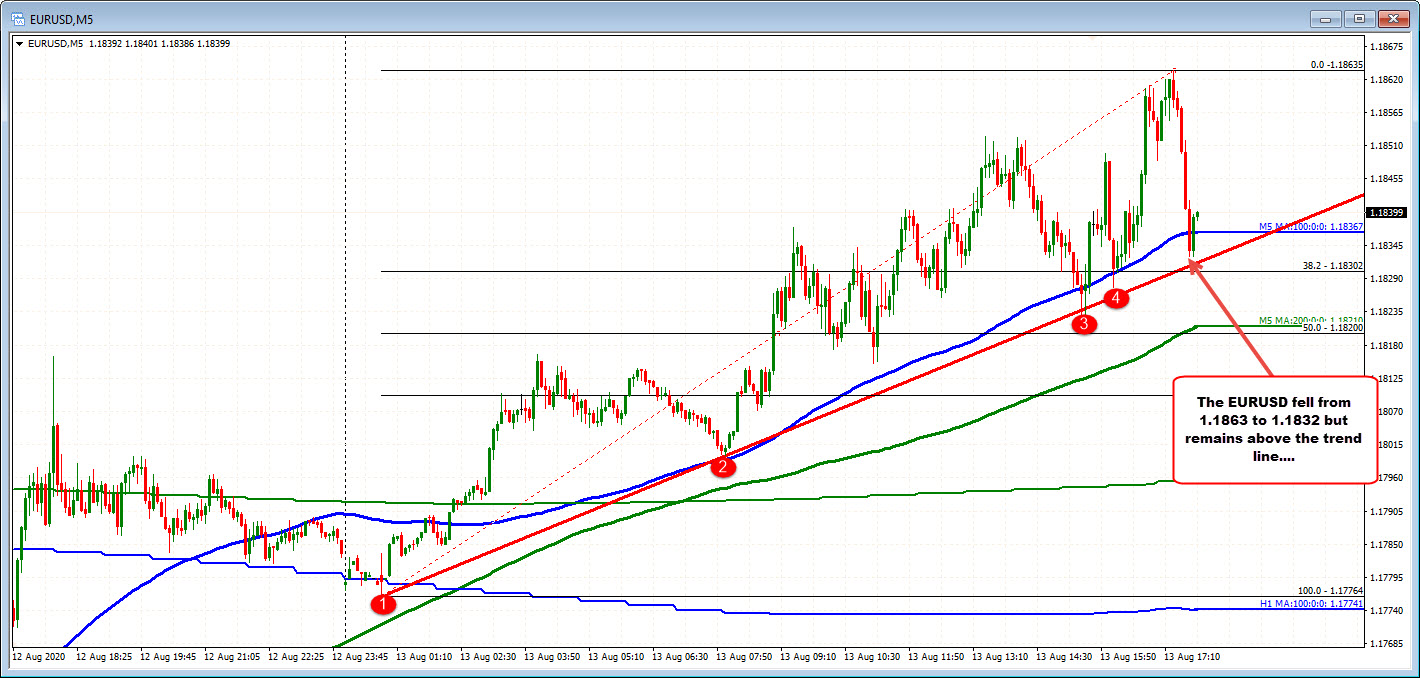

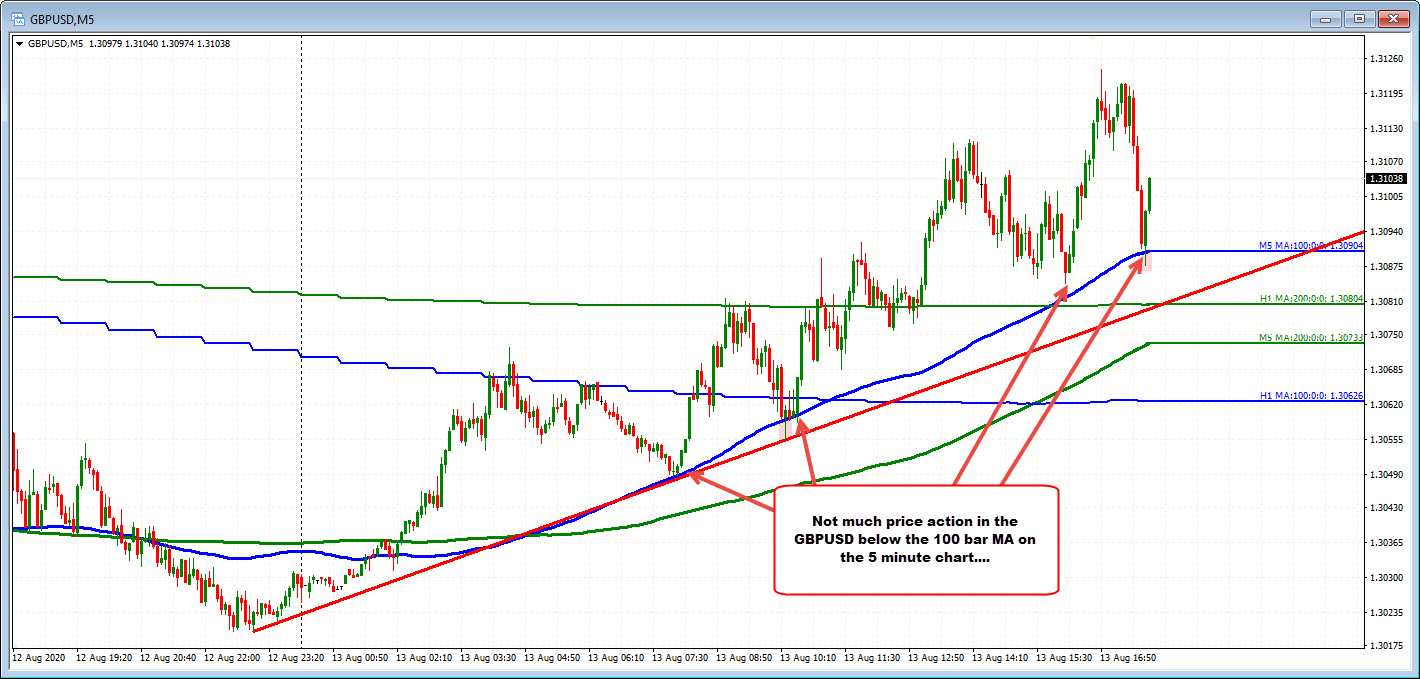

One of the key trading maxims in the FX world is pairing strength against weakness.If you need a refresher on that concept please do check that out here. So, yesterday we had the RBNZ rate meeting which has given us a weak NZD bias. Going into the event a client was asking me what I was going to do before the RBNZ rate meeting. The answer was simple, wait. Waiting to for the central bank to show its hand. The RBNZ has now done that and that is what gives us a bearish bias.

Reasons for the RBNZ’s weakness

The RBNZ has launched a set of bearish policies extending its asset purchases programme and showing openness to negative interest rates. They increased their quantitative easing (LSAP) programme to $100bn and extended its length from 12 to 22 months. Furthermore, the RBNZ expressed a preference for a lower or negative OCR and a ‘Funding for Lending Programme’, while leaving all options on the table.

So, we now have a short to medium term NZD bearish bias, look to pair it with currencies as they show strength. Yesterday’s strong AUD employment data make AUDNZD longs appealing on pull backs.

.jpg)

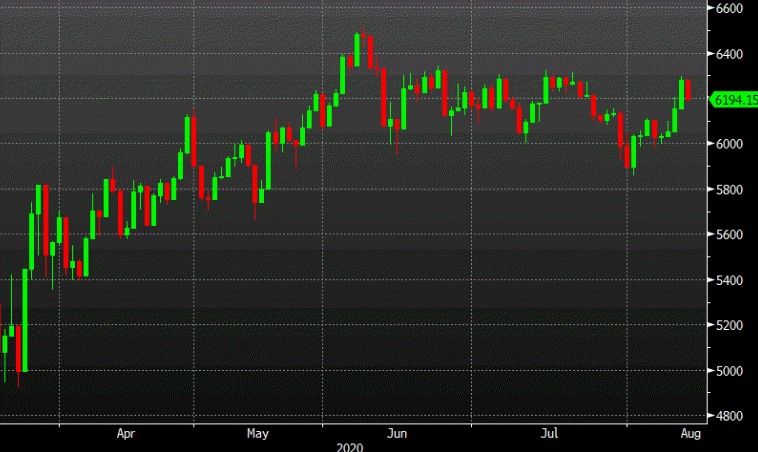

This follows the more positive mood from Wall Street overnight, as the market keeps calmer for the most part to start the new day as well. The Hang Seng is down a little by 0.1% but the Shanghai Composite is up by 0.3% currently.