Major indices all rise

The provisional closes for the European markets are showing solid gains to start the week, led by the German DAX.

- German DAX, +2.9%

- France’s CAC, +2.2%

- UK’s FTSE 100, +2.4%

- Spain’s Ibex, +3.6%

The provisional closes for the European markets are showing solid gains to start the week, led by the German DAX.

Ever wondered about the two main methods of trading stocks and their key differences?

Stock trading or share dealing has been around for centuries and is still the most common way for traders, banks and financial corporations to buy and sell stocks and shares. As far back 1602 the earliest joint-stock company was formed while the first actual stock exchange started trading in 1773 in London. Today, the total market capitalisation of all stocks worldwide is estimated at more than $70 trillion!

What is it?

Share dealing means a trader will buy shares in a company and wait for an increase in the share value, in the hope of making a profit (knowing that the risk of making losses exists too). This relative long-term strategy results in the trader holding stock and so has partial ownership in that company.

Why is it so popular?

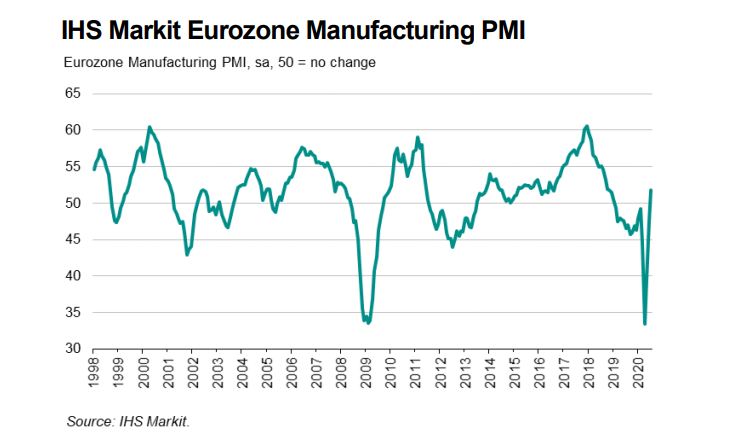

“Eurozone factories reported a very positive start to the third quarter, with production growing at the fastest rate for over two years, fuelled by an encouraging surge in demand. Growth of new orders in fact outpaced production, hinting strongly that August should see further output gains. The order book improvement has also helped restore business confidence about the outlook in July to January’s pre-pandemic peak.

“The job numbers remain a major concern, however, especially as the labour market is likely to be key to determining the economy’s recovery path. Although the rate of job losses eased to the lowest since March, it remained greater than at any time since 2009, reflecting widespread cost-cutting in many firms where profits have been hit hard by the virus outbreak. Increased unemployment, job insecurity, second waves of virus infections and ongoing social distancing measures will inevitably restrain the recovery.

“The next few months numbers will therefore be allimportant in assessing whether the recent uplift in demand can be sustained, helping firms recover lost production and alleviating some of the need for further cost cutting going forward.”

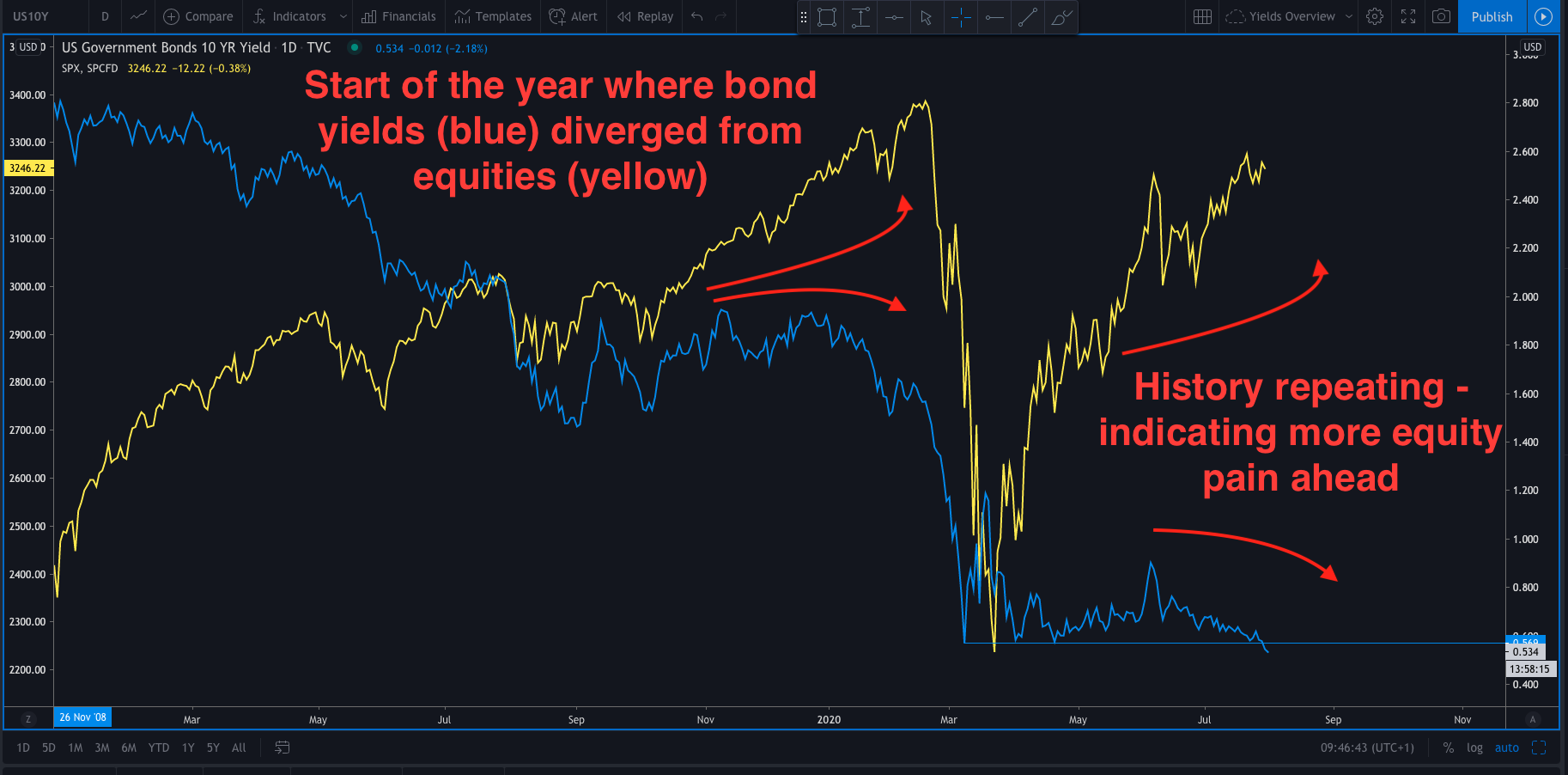

The constant fall in Bond yields is sending out a signal that all is not well in the world. The tail end of last week may have seen some excellent earnings from facebook, apple, amazon and alphabet and that started a fresh equity rally early Friday. However, the fall of Bond yields is saying, ‘look out! There may be trouble ahead. For the uninitiated bond traders tend to take a more long tern macro view. So, when equities rise, but bond yields are falling that is a signal something is wrong.

If you can recall at the start of the year one of the big questions was which market is right? Falling and yields or rising equities? The answer has been, ‘the falling bond yield market’. So, the general rule of thumb is go with the bond yield market. Now, of course this doesn’t mean that a funny divergence can last for weeks and months. However, at the very least it is a warning sign. That warning sign is showing again.

Yields are dropping

The 10Y Gilt yield (UK bond) hit a record low last week. The 10Y Bund (German bond) closed at its lowest level since mid-May on Thursday last week, while the 10 y UST (US bond) was down towards its lowest ever close last week too.

Why are they dropping?

The proverbial tea leaves are being read and a second wave of COVID-19 is being seen ahead. This will mean more monetary and fiscal policy help to get through the pandemic.So, yes the equity market has been rallying on the central bank support. However, the bond market is saying that the next stage of the global economy is fraught with dangers and a ‘V’ shaped recovery is more hope than reality.

Yen unchanged.

I think I am going to have find a cartoon of Xi and Trump engaged in a more violent sport rather than this tame effort.

I think I am going to have find a cartoon of Xi and Trump engaged in a more violent sport rather than this tame effort.