GBP/USD climbs to a fresh session high of 1.2869

The dollar is slipping further on the session now as we see the likes of EUR/USD approach 1.1730 and USD/JPY fall to a low of 107.25. Adding to that, cable is also extending gains to fresh highs on the session of 1.2869.

That’s the highest level since early March and puts the pair near five-month highs now.

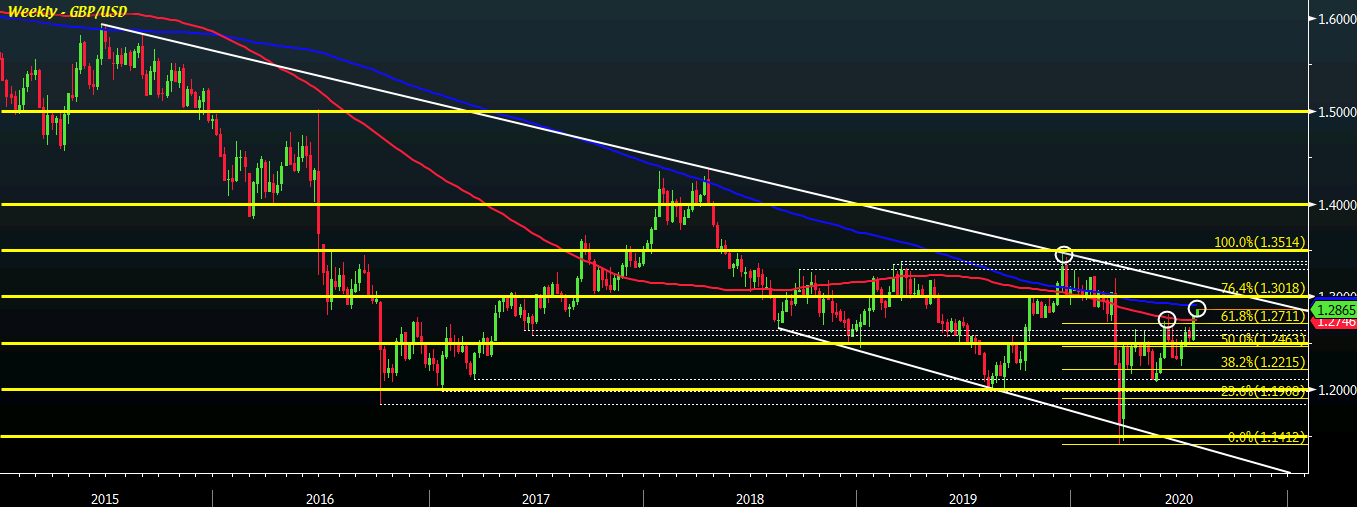

The push above the 200-day moving average from last week now puts a lot of focus back on the bigger picture in cable and that is more clearly outlined by the weekly chart.

On the close last week, buyers managed to push above the 100-week MA (red line) and that hints at more bullish technical momentum but further resistance is seen from the 200-week MA (blue line) @ 1.2907 upon a break of the June high @ 1.2813.

That will be a key level to watch as the dollar continues to weaken, thus underpinning the pair into the closing stages of the month. Further out, the trendline resistance stretching back all the way to 2015 is also a key upside level to be mindful about.

That comes in at 1.3128 for now so baby steps. The 200-week MA will be the first key point of contention before the 1.3000 handle, and then the focus turns to that.

As for sellers, keeping price under the 200-week MA and looking for a push back under the 100-week MA @ 1.2746 will be key. But searching for a break back below 1.2800 will be the first key step for any further potential retracement in the near-term.