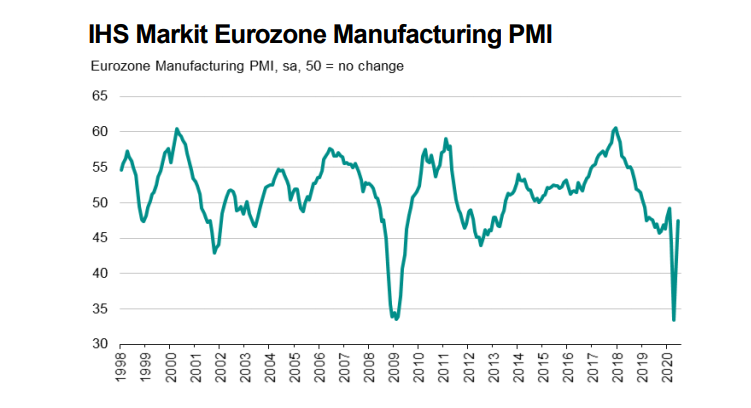

Latest data released by Markit – 1 July 2020

The preliminary release can be found here. The slight revision higher is predicated by the better revisions in the French and German readings earlier as well.

“The final PMI numbers for June add further to signs that the eurozone factories are seeing a strong initial recovery as the economy lifts from COVID-19 lockdowns. The rise in the June survey is indicative of output falling at an annual rate of just 2%*. That compares with a near 30% rate of contraction seen at the height of the lockdowns in April. This remarkable turnaround implies very strong month-on-month gains in the official production numbers for the past two months.

“Expectations for the year ahead have also rebounded sharply as hopes grow that the economy will continue to find its feet again in the coming months.

“However, even with these gains, production and sentiment remain below pre-pandemic peaks, and persistent weak demand combined with ongoing social distancing measures are likely to act as a drag on the recovery. The focus therefore now turns to whether gains seen in the past two months can be built on, or if momentum fades again after this initial rebound.”