Pres. Trump keeps the pedal to the metal

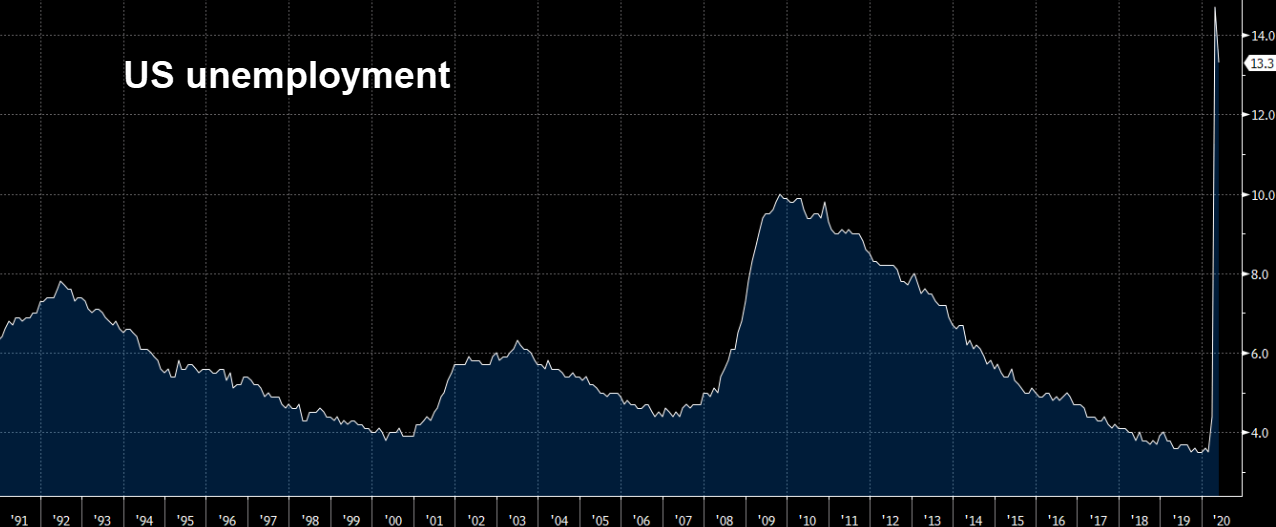

Pres. Trump is trying to keep the pedal to the metal after getting a stronger than expected jobs report earlier in the day, by commenting on the state of the Covid vaccines.

He said:

- Three vaccines looking really good

Earlier this week, Pfizer spoke favorably about a vaccine they were developing.

Other companies who are making inroads toward a vaccine include Moderna and Inovio.

US stocks have come off session highs mainly triggered from the Florida coronavirus numbers. However, we are seeing a modest bounce off the lows. The S&P is trading at 3141.84 off the low at 3130.26. The Nasdaq is up 103 points at 10258. The low reached 10216.35. The old record intraday high reached 10221.85. The price dipped below that old high level on the correction lower, but has since rebounded back above.