Archives of “July 2020” month

rssThought For A Day

WHO official highlights virus mutation to make it more infectious

Official cites evidence about more-infection strain

The story has been doing the rounds today and WHO expert Van Kerkhove cited it in today’s briefing but he also noted that there’s no evidence that it’s more dangerous (or less).

European equity close: Soft finish to a good week

Closing changes for the main European indexes

- German DAX -0.8%

- UK FTSE 100 -1.5%

- French CAC -1.1%

- Spain IBEX -1.2%

- Italy MIB -1.1%

On the week:

- German DAX +3.5%

- UK FTSE 100 -0.25%

- French CAC +1.65%

- Spain IBEX +3.0%

- Italy MIB +3.0%

The back-and-fill continues everywhere.

Florida coronavirus cases rise 5.6% vs 5.8% seven-day average

Florida coronavirus data published July 3, 2020 (date updated as it’s reported):

- Cases rise vs 10,109 yesterday and 6563 the day before

- Total cases vs 169,106 a day earlier

- Cases up % vs +% seven-day average

- Positivity rate 14.6% vs 15% yesterday

- Deaths 3617 vs 3550 a day ago (highest one-day rise in a month)

- Daily hospitalizations vs record +325 yesterday

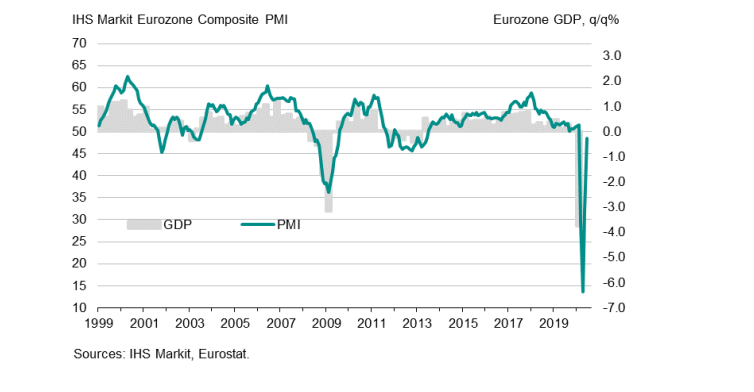

Eurozone June final services PMI 48.3 vs 47.3 prelim

Latest data released by Markit – 3 July 2020

- Composite PMI 48.5 vs 47.5 prelim

The preliminary report can be found here. The revision higher is predicated by the better French and German readings earlier as well, but the story remains very much the same.

The euro area economy shows a modest rebound from May to June, but overall conditions are still subdued – not least with demand (domestic and foreign) remaining weak.

On demand conditions, that may prove to be a drag in the coming quarter. Hence, that will be a key spot to watch in assessing the pace of the recovery in the coming months. In turn, that will be how the market will interpret optimism and economic sentiment in general.

Markit notes that:

“The headline eurozone PMI surged some 17 points in June, a rise beaten over the survey’s 22-year history only by the 18-point gain seen in May. The upturn signals a remarkably swift turnaround in the eurozone economy‘s plight amid the COVID-19 pandemic. Having sunk to an unprecedented low in April amid widespread business closures to fight the virus outbreak, the PMI has risen to a level indicative of GDP contracting at a quarterly rate of just 0.2%, suggestive of strong monthly GDP gains in both May and June.

“An improvement in business sentiment meanwhile adds to hopes that GDP growth will resume in the third quarter.

“However, despite the vigour of the return to work following COVID-19 business closures, we remain cautious as to the strength of any longer-term recovery after the immediate rebound. Companies continued to report weak underlying demand in June. Many remained risk averse, being reticent to commit to spending and hiring due to persistent uncertainty as to the economic outlook, and in particular the likely sustained weakness of demand for many goods and services due to the need to retain many social distancing measures. While confidence in the future has improved, it remains well below levels seen at the start of the year, reflecting how many businesses are far from back to normal.”

China says hasn’t discussed itinerary for Xi’s visit to Japan

Don’t hold your breath on this one

China has postponed a visit from president Xi Jinping to Japan since the start of last month, as Japan has voiced their displeasure over the Hong Kong national security law.

Given that both sides are likely to keep locking heads here, don’t expect the visit from Xi to take place any time soon. If anything else, this can be taken as a gauge of geopolitical relations between the two countries.

Global Times: China may further loosen monetary policy to bolster growth

GT with this from Thursday ICYMI

- According to PBC officials, China is not likely to change its trend of monetary policy easing soon. Monetary policy in the coming months will continue to serve the “Six Priorities” and remain appropriately loose and flexible.

- PBC governor Yi Gang recently noted that in the second half of 2020, the central bank will use monetary policy to ensure liquidity is at a “reasonably ample” level, with new loans to hit 20 trillion yuan for the full year and total social financing likely to increase to 30 trillion yuan.

- Yi also noted that the financial support offered during the epidemic response period is being phased out, and China should pay attention to the aftermath of the policy and consider the timely withdrawal of policy tools in advance.

Check out the link (above) for more. PBoC have been draining funds in past weeks via OMOs each day, mainly by not injecting more as reverse repos mature.

Elon Musk trolls SEC (and shorts) as Tesla stock surges to new highs

Stock is up 190% In 2020

The price of Tesla continues to soar. Today shares are up around 8.1% to $1210 after the automaker said it delivered about 90,650 vehicles in the second quarter. That handily beat the 72,000 estimate.

The run higher has pushed the price up around 190% for the year (what coronavirus recession?).

It has also led to Musk posting some sophomoric tweets directed at the SEC and short-sellers. I will leave it up to you to figure out the three letter acronym.

Of course, Musk is quite known to push the envelop at times.

Of course, Musk is quite known to push the envelop at times.

US Indices end the session higher but well off the highs for the day

NASDAQ closes at a new record high

Tthe US stocks are ending the session higher, but well off the highs for the day. The major indices got a boost from the much better-than-expected nonfarm payroll report. However gains were limited after Florida reported record coronavirus cases (over 10,000). Late day selling took the prices of the indices closer to the session lows (although still higher on the day). The final numbers are showing:

- S&P index and NASDAQ index close higher for the 4th consecutive day

- NASDAQ index close at a record level and traded to a new intraday record high of 10310.36

- the NASDAQ index is now up 13.76% on the year

- the S&P index within around 2% of the closing level for 2019, before backing off (it is down -3.12% year-to-date)

A look at the final numbers are showing:

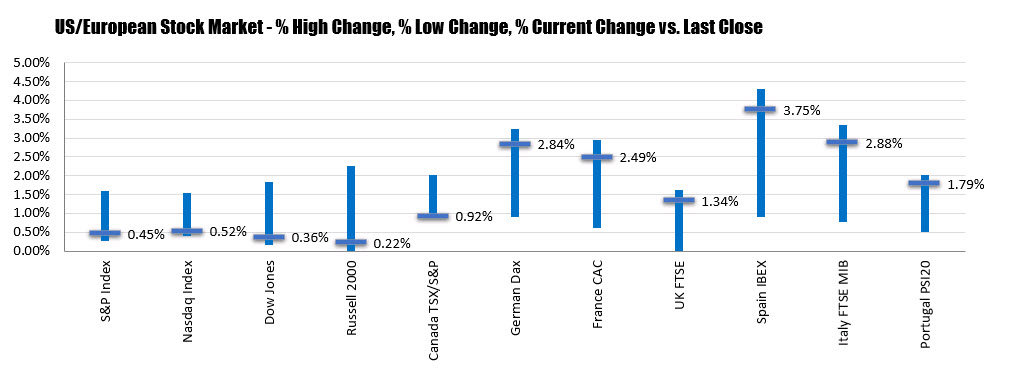

- S&P index up 14.16 points or 0.45% at 3130.02. The high price extended to 3165.81. The low was at 3124.52

- NASDAQ index rose 53 points or 0.52% at 10207.63. It’s high price reached 10310.36, while the low extended to 10194.059

- Dow industrial average close higher by 92.45 points or 0.36% at 25827.42. It’s high price reached all the way up to 26204.41. The low price extended to 25778.12.

The US stock market will be closed tomorrow in observance of 4 July holiday.

In the European equity markets today the major indices close sharply higher with some of the gains reflective of a catch up from yesterday’s afternoon rally in the US. It will be a normal day in the European markets tomorrow (although activity may be more subdued):

- German DAX rose by 347.89 points or 2.84% to 12608.46

- France’s CAC rose 122.44 points or 2.49% to 5049.38

- UK’s FTSE 100 rose by 82.4 points or 1.34% to 6240.36

- Spain’s Ibex rose by 271.20 points or 3.75% 27498.60

- Italy’s FTSE MIB rose by 556 points or 2.88% to 19886.88

Below are the percentage changes including the percentage high and percentage low for the major indices in the US and Europe.